In a recent development, the Board of Directors of TAL resolved on May 19 to contribute VND 576 billion to a new subsidiary, equivalent to 80% of its charter capital. The total charter capital of Taseco Ha Nam is VND 720 billion. The contribution will be sourced from TAL’s business capital.

Mr. Vu Quoc Huy, Deputy General Director of TAL, and Mr. Tran Minh Thang have been authorized to manage this contribution, representing VND 360 billion (50% of the charter capital) and VND 216 billion (30%), respectively. Both individuals will hold voting rights in the 2025 Members’ Council meetings of the subsidiary.

Taseco Ha Nam is the second subsidiary established in 2025, following the CTCP Khu Cong Nghiep Taseco Hai Phong, which was founded in March with a charter capital of VND 300 billion, with TAL contributing VND 210 billion. With an investment of VND 576 billion, Taseco Ha Nam will become one of TAL’s largest investments, second only to Taseco Invest and ICON4.

Taseco Land contributes VND 210 billion to the Hai Phong Industrial Park

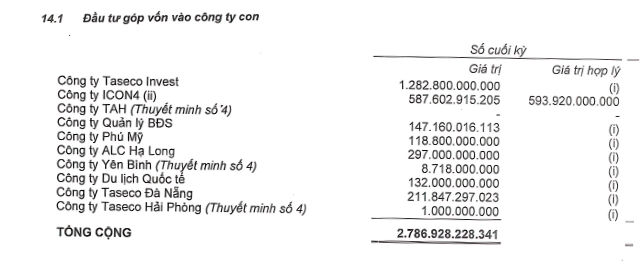

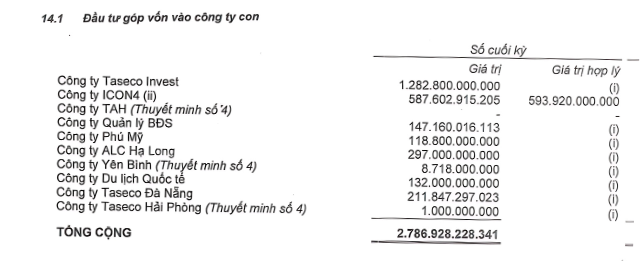

Source: Q1/2025 Consolidated Financial Statements of Taseco Land

|

As of the end of March, TAL’s total investment in its subsidiaries neared VND 2,800 billion, equivalent to approximately 30% of the parent company’s total assets. The decision to contribute capital to Taseco Ha Nam indicates the company’s continued focus on expanding its investments in this region.

While specific details about the projects to be undertaken by the new subsidiary are not yet available, Ha Nam province holds strategic importance in TAL’s investment strategy. In Duy Tien town, the company is developing a new urban area in the south of the administrative center, spanning 115 hectares with a total expected investment of over VND 4,700 billion. The project aims to create a multi-functional urban area offering premium residential, commercial, and service facilities, along with public utilities.

In parallel, TAL is also executing its first industrial real estate project in Ha Nam, the Dong Van III Supporting Industrial Park, located east of the Cau Gie-Ninh Binh Expressway, with a scale of 223 hectares and a total investment of approximately VND 2,400 billion.

Beyond Ha Nam, TAL continues to expand its investment footprint and portfolio. Recently, the company’s Board of Directors approved participation in land auctions in Tu Son City (Bac Ninh) and Thai Nguyen City (Thai Nguyen) to develop new urban areas.

In terms of financial performance, TAL recorded consolidated revenue of nearly VND 376 billion in Q1/2025, a 21% increase from the previous year, mainly driven by a significant jump in real estate transfers, which accounted for VND 324 billion. Net profit after tax doubled to VND 22.3 billion, while interest expenses rose sharply to nearly VND 39 billion.

| Taseco Land’s low profit in early 2025 |

For the full year 2025, TAL targets consolidated revenue of VND 4,300 billion and net profit after tax of VND 536 billion. In the first three months, the company achieved 9% of its revenue plan and 4% of its profit target.

Total assets as of the end of March stood at VND 9,560 billion, slightly higher than the beginning of the year. Construction in progress continued to increase for the key project, the Dong Van III Supporting Industrial Park. Meanwhile, inventory decreased the most for the new urban area project in Project No. 4 in Thanh Hoa province, with VND 110 billion.

At the 2025 Annual General Meeting of Shareholders, TAL’s Chairman, Mr. Pham Ngoc Thanh, shared that the Dong Van III Supporting Industrial Park is one of three key projects expected to generate significant revenue for the company this year, along with the new urban area project in Thanh Hoa and the Nguyen Binh project in Nghi Son. The industrial park has almost completed land clearance, and infrastructure development is expected to be finalized by the end of September. The Thanh Hoa project has completed technical infrastructure and residential construction and is in the process of finalizing legal procedures, aiming to contribute nearly VND 1,300 billion in revenue. The Nguyen Binh project is anticipated to bring in approximately VND 445 billion.

– 10:56 22/05/2025

The $300 Million Airport in Vietnam’s Town: A Global Beauty That’s Been Stalled for 3 Years. When Will Construction Begin?

After 3 long years since the groundbreaking ceremony, construction on the highly anticipated airport project, with an investment of 7 trillion VND, is yet to officially commence.

The Ultimate Guide to Investing in Dong Nai’s Transportation Infrastructure: Unveiling the Massive Investment Opportunities

The Ben Thanh – Suoi Tien Metro line to Dong Nai, the Ho Chi Minh City Belt Road 4 section through Dong Nai, the Cat Lai Bridge, the Dong Nai 2 Bridge, and the elevated road along National Highway 51 are key transportation infrastructure projects currently open to investors, as announced by the Dong Nai Department of Construction.

A District in Hai Duong Province Prepares to Reclaim Land from Over 2,500 Households to Develop the Largest-Ever Industrial Park, Almost the Size of Hanoi’s Central District.

The Kim Thanh 2 Industrial Park, located in Kim Thanh District, Hai Duong Province, spans an impressive 509 hectares, almost matching the size of Hanoi’s Hoan Kiem District, which covers 529 hectares. To facilitate the development project, land acquisition from approximately 2,700 households is necessary.

Unlocking Investment Potential: Unraveling the Procedural Knot for My Thuy Port’s Future

With an impressive investment of 15 trillion VND and a scale of 10 wharves, My Thuy Port Area is envisioned to be the new driving force for the economic zone in Southeast Quang Tri. However, after more than 6 years of approval, construction progress remains slow due to challenges in land clearance and permit procedures related to mineral exploitation.