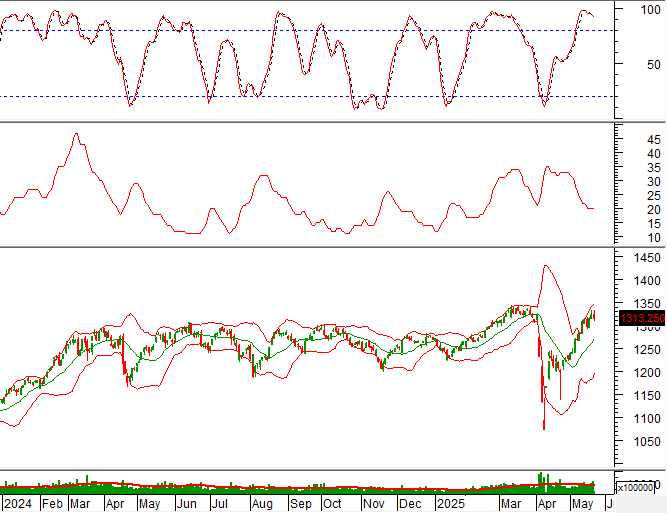

Technical Signals for VN-Index

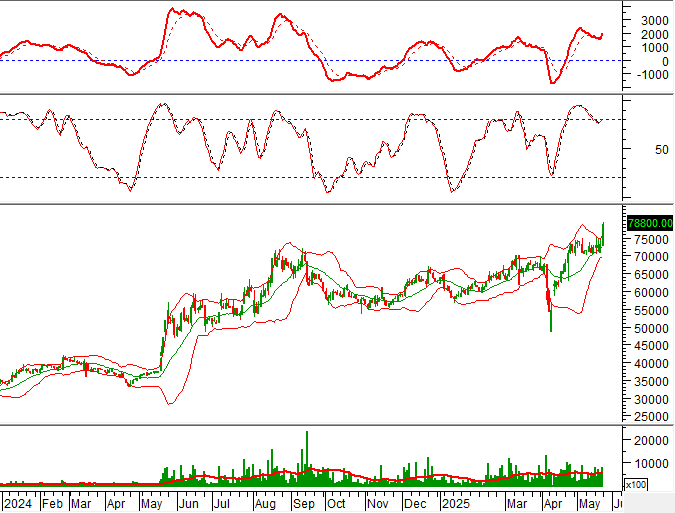

During the trading session on the morning of May 21, 2025, the VN-Index witnessed a decline, forming a Doji candlestick pattern, while trading volume significantly dropped, indicating investors’ cautious sentiment.

Currently, the ADX indicator is moving within the gray zone (20 < adx < 25), suggesting a lack of clear trend direction.

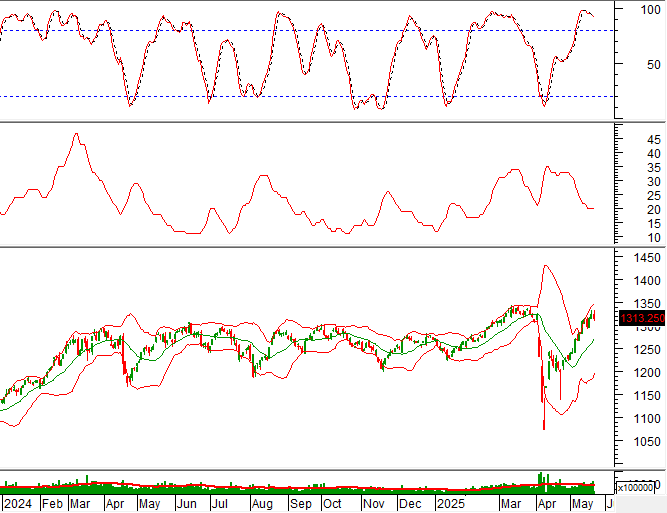

Technical Signals for HNX-Index

On May 21, 2025, the HNX-Index climbed, forming a Doji candlestick pattern, while trading volume substantially decreased, reflecting investors’ cautious approach.

Additionally, a ‘Death Cross’ occurred in the HNX-Index as the SMA 50-day line crossed below the SMA 100-day and SMA 200-day lines, indicating a potential deterioration in the mid-to-long-term outlook.

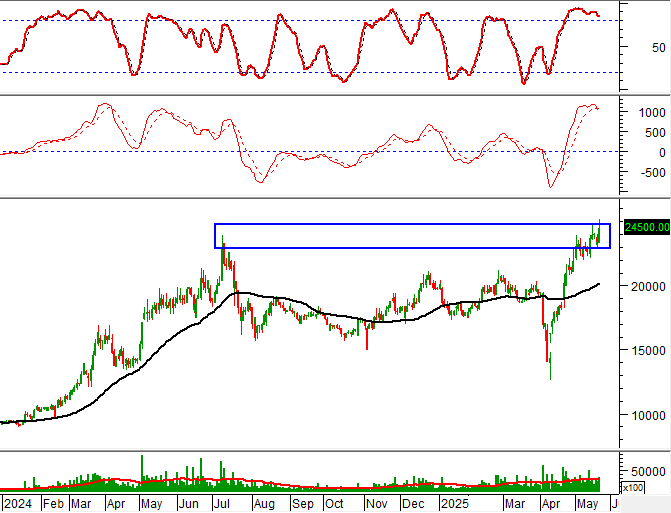

DDV – DAP – VINACHEM JSC

On the morning of May 21, 2025, DDV witnessed an upward price movement, accompanied by above-average trading volume, reflecting investors’ optimism.

At present, the stock price is retesting the previous peak from July 2024 (approximately 23,000-24,500) as the MACD indicator provides a buy signal. Should the stock price successfully breach this resistance level, the short-term upward trajectory may extend in upcoming sessions.

NTP – Nha Thong Tien Phong Plastic JSC

During the morning session on May 21, 2025, NTP surged, forming a White Marubozu candlestick pattern, while trading volume exceeded the 20-session average, indicating active participation from investors.

Furthermore, the stock price rebounded after successfully testing the Middle line of the Bollinger Bands, and the Stochastic Oscillator generated a buy signal, reinforcing the prevailing bullish momentum.

Technical Analysis Team, Vietstock Consulting

– 12:04 23/05/2025

“Top Vietnamese Stocks Soar: Vinhomes, Vietnam Airlines, Novaland, and Gelex Reach New Heights”

The market is witnessing a strong polarization, resulting in a stagnant VN-Index, while individual stocks are experiencing dramatic performances. Some are soaring to new heights, while others are struggling to find their footing.

The VN-Index Surpasses 1,300 Points, But Many Investors Miss Out: What’s Going On?

The VN-Index has seen a promising 4.44% increase since the start of the year, but this masks the reality for a significant number of stocks. Almost 60% of codes on HoSE have lost value, with nearly 300 stocks underperforming the index.