|

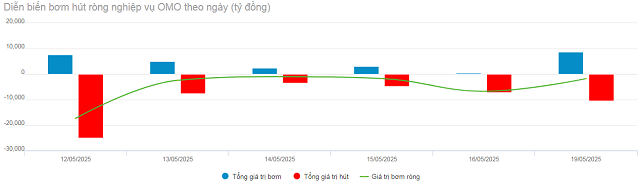

Net OMO pumping evolution last week (05/12-05/19/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, the trend of net liquidity withdrawal persisted with modest new issuances on the term deposit channel (27.044 billion VND), while there were term deposit contracts maturing at an interest rate of 4% (58,361 billion VND). By week-end, the outstanding volume on the term deposit channel stood at 58,748 billion VND.

|

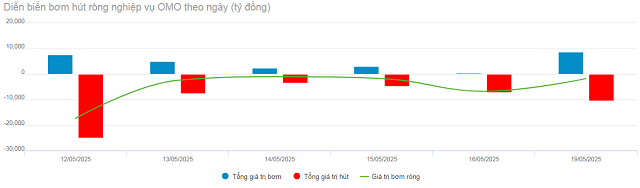

Evolution of overnight interbank interest rates since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

The overnight interbank interest rate at the end of the week of 05/16 decreased to 3.78% (down 31 basis points compared to the previous week) and the average trading value slightly decreased to VND 461 thousand billion/day.

|

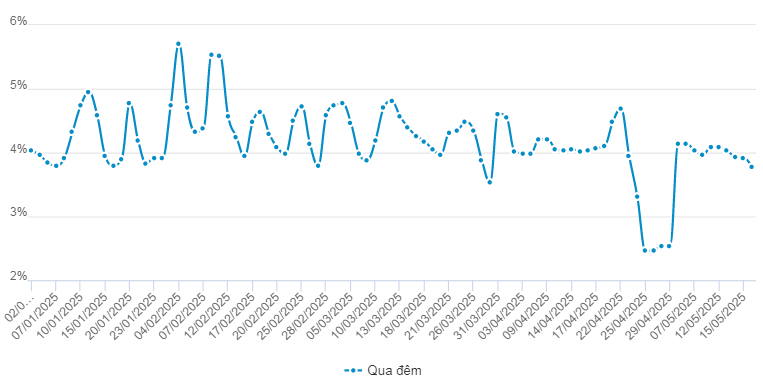

DXY evolution from the beginning of 2025 to 05/20

Source: marketwatch

|

In the international market, USD-Index (DXY) in the week of 05/12-05/16 continued to increase by 0.56 points to 100.98, marking the fourth consecutive week of increase.

USD price maintained its upward trajectory in the international market after the US and China reached an agreement on tariffs – easing trade tensions and improving investor sentiment in the global financial market, thereby contributing to the strengthening of the greenback.

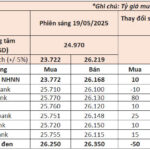

In the domestic market, the exchange rate listed at Vietcombank ended the session on 05/16 at 25,720-26,110 VND/USD (buy-sell), down 30 VND in both directions compared to the previous week. This is the third consecutive week of decline for the exchange rate at this bank, with a total decrease of 85 VND/USD. This development reflects a favorable foreign exchange supply and demand situation in the domestic market.

– 10:28 05/20/2025

“Dollar and Yuan Rise: A Slight Uptick in Currency Exchange Rates on May 23rd”

As of 8:30 a.m. on May 23, Vietcombank maintained its USD exchange rate at 23,790-26,150 VND/USD (buy-sell), unchanged from the previous day’s opening rate.

“May 19: State Bank Raises USD Exchange Rate, Free Market Dollar Continues to Fall”

As of May 19th, the USD exchange rate at banks trended upward as the State Bank increased the central exchange rate by 10 VND. In contrast, the free-market USD rate dropped by 50 VND, trading at 26,250 – 26,350 VND/USD.

The Vietnamese Dong’s Turbulent Times: A Brighter Future Ahead

The forex market has been under significant pressure since the US announced countervailing duties in early April, despite a global easing of the US dollar’s strength. Nonetheless, experts assess that the Vietnamese Dong will show positive signs by year-end, with a ‘not-so-bad’ trade deal on the table.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)