The Vietnamese stock market closed positively on May 21 despite facing profit-taking pressure during the session. The VN-Index briefly dipped to the reference level but quickly regained upward momentum thanks to strong buying interest in large-cap stocks. At the close, the VN-Index gained 7.9 points to 1,323.05. Trading liquidity improved, with the matched order value on HoSE reaching VND23.23 trillion.

Foreign trading was a bright spot, with net buying returning to the market today, totaling VND454 billion. Specifically:

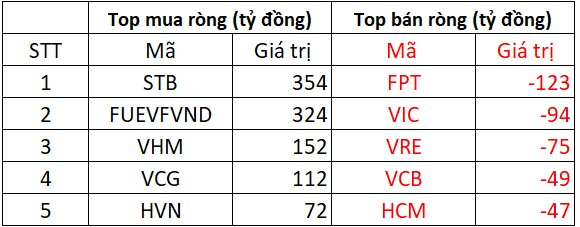

On HoSE, foreign investors net bought approximately VND480 billion

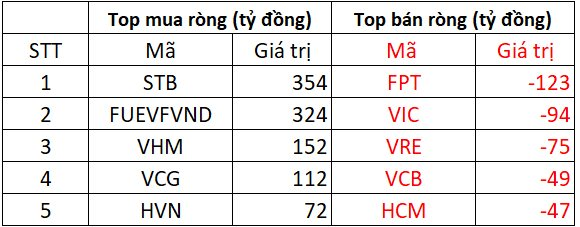

In the buying side, STB bank stocks witnessed the strongest net buying in the market, with a value of up to VND354 billion. Following closely, FUEVFVND ETF certificates also received net buying of up to VND324 billion. Additionally, VHM and VCG stocks were net bought at around VND112-152 billion, while HVN stocks were net bought for VND72 billion.

On the opposite side, FPT stocks experienced the heaviest net selling by foreign investors, amounting to VND123 billion. VIC and VRE stocks also faced net selling totaling VND169 billion. Subsequently, VCB and HCM stocks were among the top net sold tickers today.

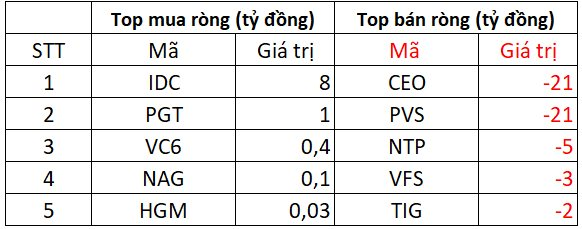

On HNX, foreign investors net sold about VND51 billion

On the buying side, IDC stocks were net bought for VND8 billion, followed by PGT with VND1 billion. Subsequently, VC6, NAG, and HGM stocks also witnessed net buying in today’s session, ranging from several tens of millions to several hundred million VND.

Conversely, CEO and PVS stocks faced the strongest net selling, both recording VND21 billion in net outflow. NTP, VFS, and TIG stocks experienced net selling of around VND2-5 billion each.

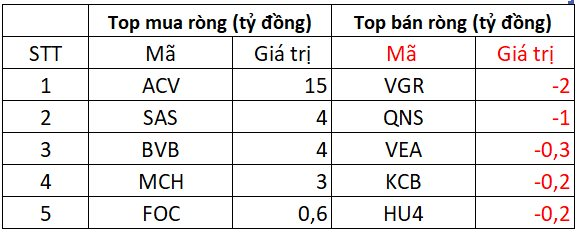

On UPCOM, foreign investors net bought nearly VND25 billion

In terms of net buying, ACV stocks attracted VND15 billion in net buying per ticker. Subsequently, SAS, BVB, and MCH stocks also witnessed slight net buying of a few billion VND.

On the opposite side, VGR stocks experienced net selling of VND2 billion, while QNS stocks faced net outflows of VND1 billion. Other tickers, such as VEA, KCB, and HU4, were also slightly net sold.

The VN-Index Surpasses 1,300 Points, But Many Investors Miss Out: What’s Going On?

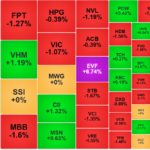

The VN-Index has seen a promising 4.44% increase since the start of the year, but this masks the reality for a significant number of stocks. Almost 60% of codes on HoSE have lost value, with nearly 300 stocks underperforming the index.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.