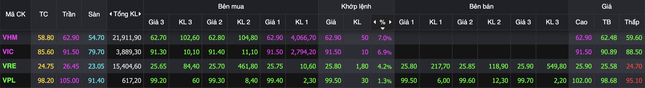

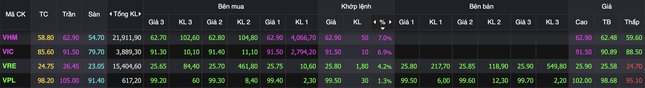

The VN-Index surged by almost 20 points in today’s (May 20) session, with strong contributions from the Vingroup and Techcombank stocks. All four stocks, VIC, VHM, VRE, and VPL, traded higher. VIC, in particular, hit the ceiling price of 91,500 VND per unit, while VHM reached 62,900 VND per share.

According to the latest update from Forbes, Mr. Pham Nhat Vuong’s net worth has hit a record high of $10.2 billion, a milestone achievement.

All four stocks VIC, VHM, VRE, and VPL witnessed price increases.

As of May 20, Mr. Vuong ranks 277th on the list of the world’s richest people. In just over five months, his net worth has increased by more than $6 billion, propelling him over 400 places ahead of notable figures such as Jay Y. Lee, Chairman of Samsung Group, who currently holds $8.8 billion and ranks 353rd.

Mr. Pham Nhat Vuong’s current net worth is equivalent to the combined wealth of the top eight entrepreneurs in the Vietnamese stock market.

The rally in the VN-Index was further bolstered by a group of banking stocks. MBB, MSB, HDB, ACB, EIB, TPB, STB, CTG, and others witnessed price increases. TCB led the pack with a 4.8% gain. Techcombank recently announced a resolution by its board of directors regarding a plan to increase charter capital in 2025 through an employee stock ownership plan (ESOP) share issuance, with a total value of nearly VND 214 billion.

The bank will issue nearly 21.4 million ESOP shares at a par value of VND 10,000 per share. Of these, over 14.8 million shares will be allocated to domestic employees, and nearly 6.6 million shares will be offered to foreign employees. The issuance volume accounts for about 0.3% of the total circulating shares. If this plan is realized, the bank’s charter capital will increase from VND 70,649 billion to approximately VND 70,862 billion.

At the close of the trading session, the VN-Index climbed 18.86 points (1.45%) to 1,315.15, while the HNX-Index gained 0.46 points (0.21%) to reach 217.7. In contrast, the UPCoM-Index dipped by 0.02 points (0.02%) to 95.69. Trading liquidity slightly improved, with the value of shares traded on HoSE exceeding VND 22,600 billion. Foreign investors continued to offload Vietnamese stocks, with a net sell value of VND 564 billion, focusing on VHM, FPT, SHB, and HCM.

The VinGroup Stock Rally: How High Can the VN-Index Soar?

Since the beginning of the year, the “Vingroup family” of stocks has surged by several tens of percent, and in some cases, even multiplied. This remarkable performance has significantly contributed to the VN-Index.

Technical Analysis for May 22: Short-Term Tug-of-War

The VN-Index and HNX-Index exhibited a contrasting performance amidst weakening ADX indications, hinting at a potential sideways trend with interspersed gains and losses in upcoming sessions.