With the upcoming wedding of her nephew, Ms. Lan from Cau Giay, Hanoi, visited a PNJ store on Cau Giay street to purchase a 3-5 tael gold bangle. However, the sales staff informed her that the desired product was out of stock and only the 2-tael variant was available. When Ms. Lan inquired about plain gold rings, she was told that PNJ had run out of stock of those items for several months and was not taking any orders.

The PNJ staff suggested that Ms. Lan consider the 2-tael gold bangle and mentioned that due to the unavailability of plain gold rings and gold bars, many customers had opted to purchase bangles for storage, resulting in limited supply for this particular product.

Ms. Lan was surprised to find that a prominent gold and jewelry brand like PNJ faced shortages in their supply of gold bars and plain gold jewelry. However, this development had been anticipated by analysts, who predicted that PNJ would increasingly face challenges, including significant pressure on their gold input supply. As a result, the company has prioritized gold materials for producing jewelry with higher profit margins and lower gold content rather than focusing on gold bar sales or products with higher gold purity.

First Sign of the Adjustment Cycle?

PNJ, the only listed company in the gold and jewelry industry, boasts a strong brand and the largest business network in Vietnam, with 429 stores covering 58 out of 63 provinces as of the first quarter of 2025. The company plans to expand by opening 12 to 25 new stores this year. However, the number of stores remained unchanged in the first quarter compared to the end of last year, despite it typically being a peak business season.

Although retail jewelry sales, PNJ’s main segment, grew by more than 6% year-on-year in the first quarter, reaching VND 6,677 billion, the growth rate has slowed compared to the 10% increase in the fourth quarter of 2024. This indicates that consumer demand has not shown significant improvement. On the other hand, wholesale revenue increased by 22.3% year-on-year as the market increasingly emphasizes transparency and traceability of products.

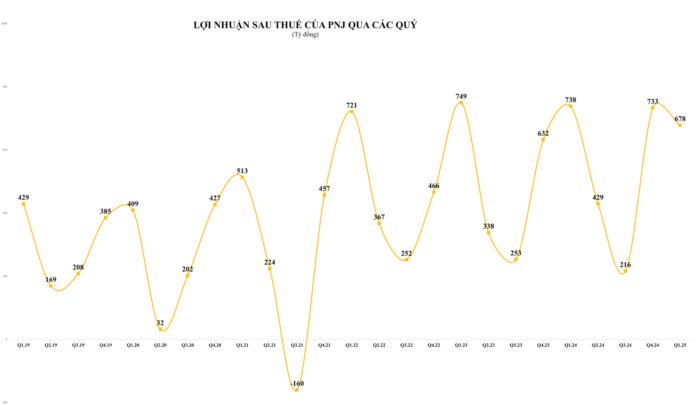

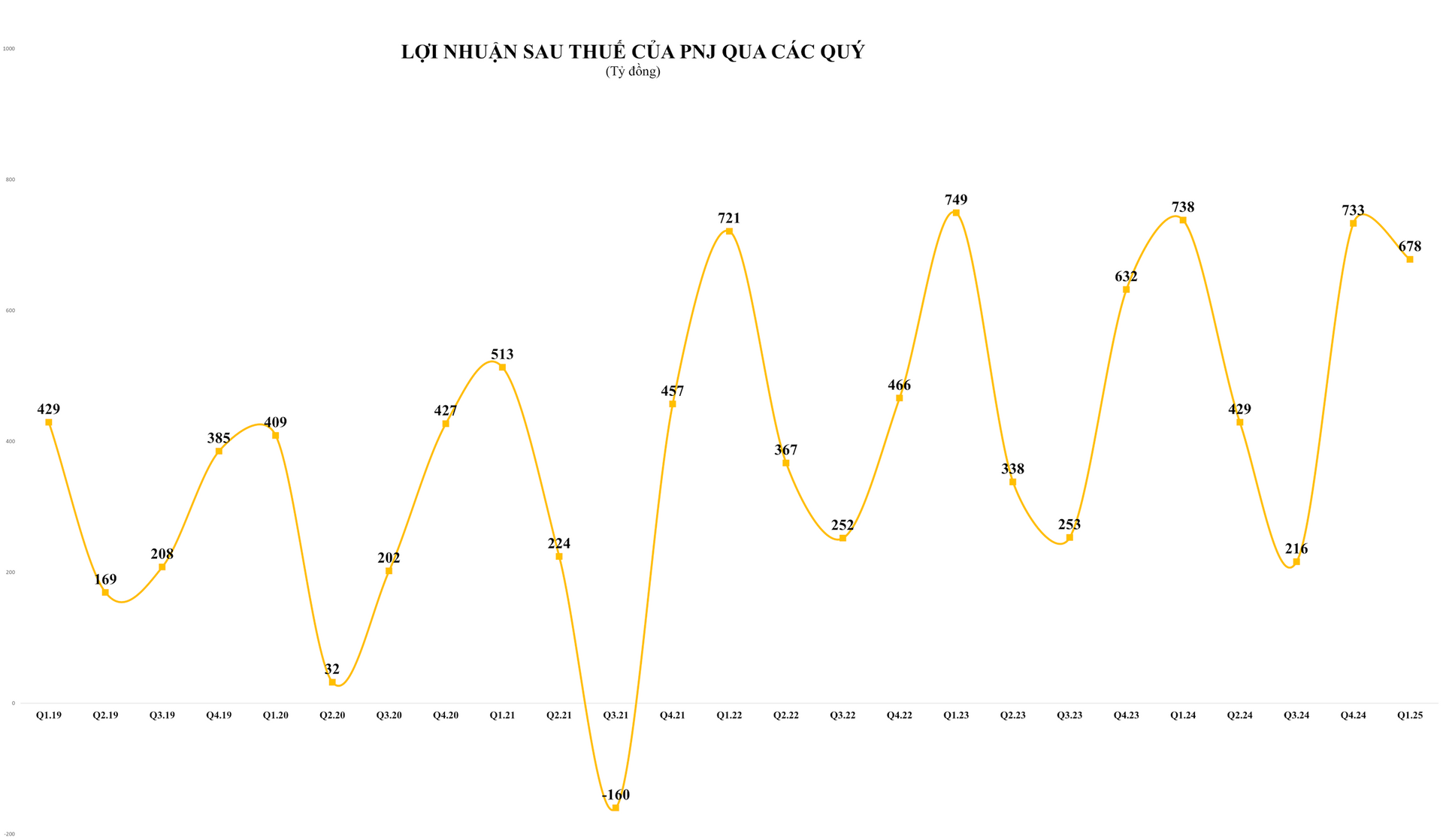

The decrease in both revenue and profit in the first quarter partly reflects the first sign of the adjustment cycle for this “growth star” in the jewelry retail industry. While PNJ achieved record revenue and profit in 2024, analysts predicted a significant drop in gold bar sales for the company in 2025. Additionally, PNJ faces challenges, notably input cost pressures, weak market conditions for output, and changing consumer behavior with gold prices consistently remaining at high levels.

In April, when gold prices surged past VND 120 million/tael and even reached VND 124 million/tael, PNJ announced that they had no plain gold rings or SJC gold bars available for sale, except for their strength—jewelry. Currently, PNJ’s website no longer offers gold bars or plain gold rings. Similarly, PNJ stores have been out of stock of these products for a long time.

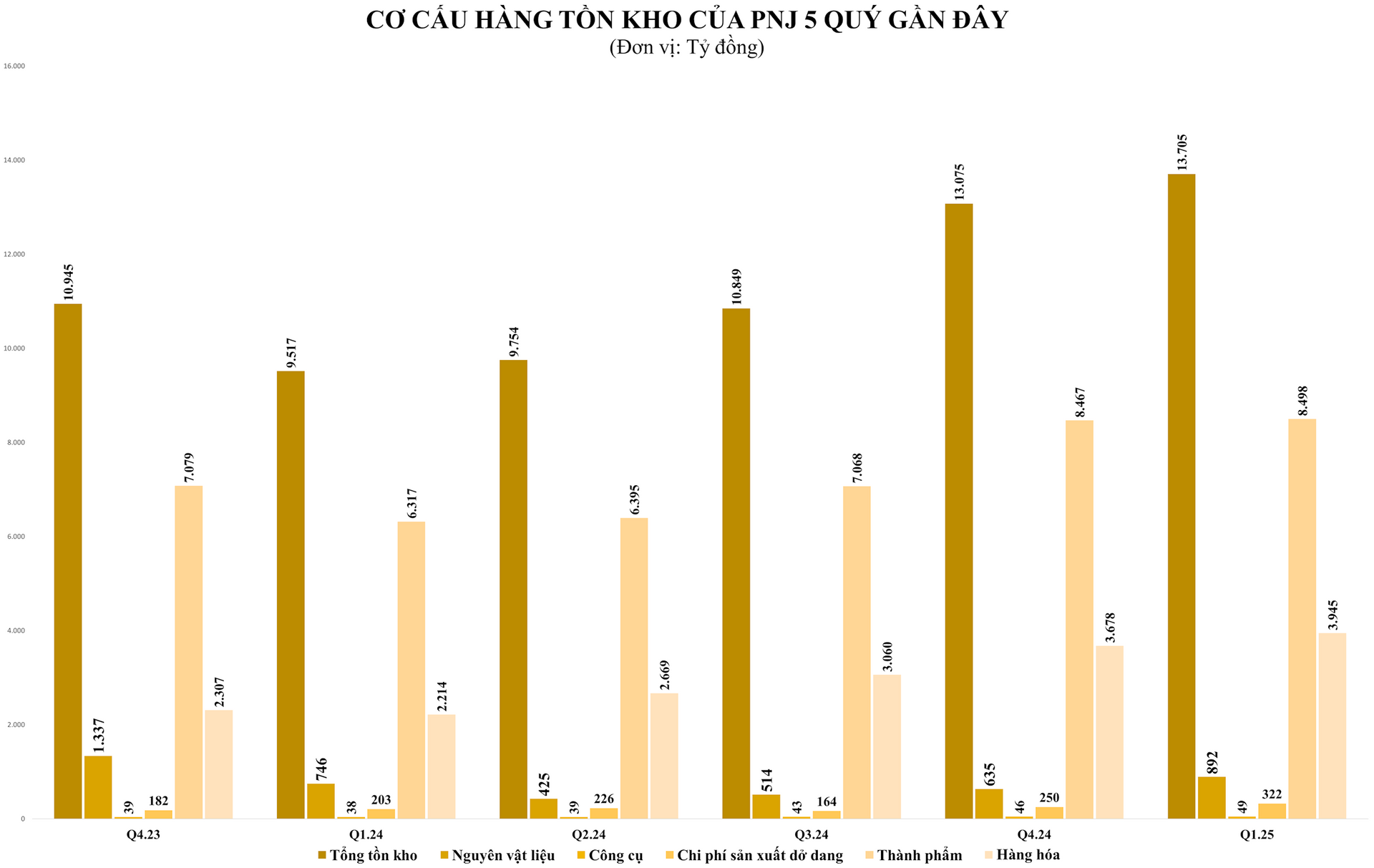

Despite the shortage of high-purity gold products, PNJ’s inventory remains high. As of the first quarter of 2025, the company’s inventory value was VND 13,706 billion, a 4.8% increase from the end of 2024 (up 19% year-on-year in 2024 to VND 13,075 billion). Finished goods accounted for VND 8,498 billion, slightly higher than the beginning of the period.

PNJ’s recent quarterly financial reports indicate that their finished goods inventory has been on the rise since the end of last year, coinciding with the jewelry segment facing more significant challenges in output due to weak market demand as high gold prices and a general slowdown in retail consumption dampen jewelry purchases.

PNJ’s inventory has been increasing since the third quarter of 2024

On the input side, PNJ is increasing its gold material reserves to cater to jewelry production. PNJ’s leadership affirmed at the beginning of the year that the company would prioritize gold materials for jewelry manufacturing over gold bar sales. They plan to increase recycled jewelry, buyback programs, and jewelry imports to compensate for the shortage of raw materials.

However, while PNJ offers to buy back gold at around 80% of the purchase price, peer-to-peer gold jewelry exchange groups have emerged, offering more flexible prices. Sellers can often get better deals and faster transactions with fewer formalities in these groups, despite potential risks regarding quality and authenticity. The flexibility and immediate financial benefits have attracted some consumers away from established brands like PNJ.

Consequently, PNJ faces not only competitive pressures on selling prices and input costs but also the challenge of reviewing its after-sales policies and product liquidity mechanisms, which are crucial for retaining customers.

Output Challenges and Changing Consumer Behavior

In addition to the challenges in sourcing raw materials, high gold prices have dampened demand for jewelry, particularly in the mid-range segment. According to VNDIRECT Securities Corporation, if gold prices remain high in the coming quarters, PNJ may face more significant pressure in maintaining profit margins and stimulating consumer demand.

Gold prices have consistently reached new highs this year, increasing production costs for PNJ and, subsequently, retail prices. As a result, consumers are becoming more cautious about spending on gold jewelry. Instead, they prioritize hoarding 24k (9999 or 999) gold to preserve value or opt for savings, negatively impacting PNJ’s jewelry sales growth prospects.

PNJ’s crafting cost for a 2-tael gold bangle is approximately VND 1,050,000.

In contrast, the crafting cost for a 2-tael gold bangle at a small private gold shop ranges from VND 420,000 to VND 450,000.

Moreover, PNJ’s jewelry crafting costs are considered higher than the market average. According to surveys, PNJ’s product prices are often hundreds of thousands to millions of dong higher than those of private brands and crafting units, depending on the segment. For instance, for a 24K gold wedding bangle with a similar design, PNJ’s crafting cost is approximately VND 1,050,000 (similar to DOJI), while other units charge between VND 420,000 and VND 450,000.

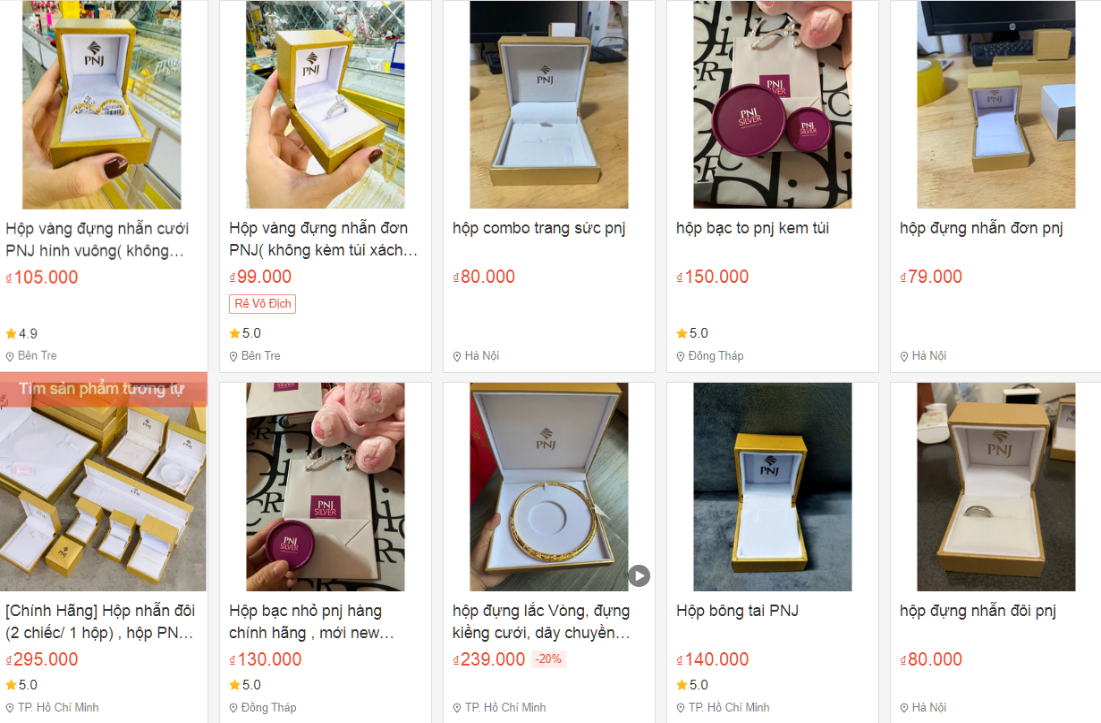

The high gold prices, coupled with expensive crafting costs, have driven consumers to seek alternative options. For instance, those planning a wedding might opt to rent gold jewelry for a fraction (10-20%) of the actual product value instead of spending tens of millions of dong on purchasing it. Consequently, the trend of renting gold jewelry, especially wedding jewelry, has gained popularity recently. Additionally, Facebook groups for buying and selling “PNJ wedding gift boxes” at prices ranging from VND 100,000 to VND 300,000 have become more active.

PNJ jewelry box being sold on an e-commerce platform. (Screenshot)

In reality, PNJ’s leadership has recognized the “double whammy” of challenges on both the supply and demand sides and has planned to continuously reinvent itself while proactively responding to market fluctuations to sustain revenue and profit.

However, given the multiple pressures, it will be challenging for PNJ to maintain its growth trajectory in 2025. Therefore, the company has set more conservative targets for this year, with a 17% decrease in revenue compared to 2024, amounting to VND 31,607 billion, and a 7% decline in after-tax profit to VND 1,960 billion.

According to PNJ’s management, amid these challenges, the company views this period as a market transition that will favor businesses with professional foundations, transparency, and excellent service quality. They expect the 2024-2025 period to be a consolidation phase, similar to 2019-2021, when PNJ’s performance plateaued for two years before surging to the VND 30,000 billion revenue mark and VND 2,000 billion profit level.

As PNJ undergoes a transformation in its business operations and market psychology shifts towards defensive assets, a subtle “swap” among major foreign institutional shareholders is taking place in the stock market. On the one hand, Dragon Capital and Sprucegrove Investment Management have reduced their stakes, while on the other hand, T.Rowe Price Associates, Inc. has increased its holdings in the company.

The Market on May 23: Oil, Natural Gas, Gold, Copper, and Coffee Prices All Decline

As of May 24, 2025, the commodities market witnessed a broad decline with oil, natural gas, gold, and coffee prices all trending downward. The drop was significant enough to push the value of certain commodities to multi-week lows: copper hit its lowest point in three weeks, lead touched a two-week trough, and Indian rice futures plunged to their weakest level in nearly two years.

Gold Prices Falter as the US Dollar Rallies and SPDR Gold Trust Adds Four Tons

Recent reports suggest that gold prices have found a strong support level at the $3,300 per ounce mark and are poised to reach the $4,000 per ounce milestone this year.