While the market is on the rise, crypto derivatives are taking a different path, and stocks are not holding VIC… Illustration: Tuan Tran

|

Hai Au

Illustration: Tuan Tran

– 7:28 PM, May 24, 2025

Surprising Drop in Liquidity, Stocks Soar.

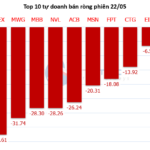

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.

Market Momentum: Sustaining the Uptrend

The VN-Index continued its upward trajectory, retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume maintained above the 20-day average, indicating positive signs of sustained cash flow participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it retests this range. Currently, the MACD indicator has been signaling a buy since late April 2025. If this status quo persists, the short-term outlook for the index remains optimistic.

What are the Strongest Stocks on the VN-Index?

As of late May 2025, the VN-Index has climbed approximately 4.44% since the start of the year, weathering the April slump triggered by tariff headlines. Yet, not all investors’ portfolios are in the green.