The dairy industry witnessed a challenging first quarter with a nearly 30% drop in profits.

The combined revenue of five dairy companies listed on HOSE, HNX, and UPCoM exchanges, including VNM, HNM, IDP, MCM, and QNS, amounted to over VND 17.8 trillion in Q1 2025, a 6% decrease year-on-year. However, their profit declined by nearly 30%, reaching VND 2.1 trillion.

Vinamilk (HOSE: VNM), the prominent Vietnamese dairy company, reported a revenue of VND 12.9 trillion, an 8.3% drop. Their net profit fell to VND 1.56 trillion, the lowest in many years.

The company attributed these results to challenging business conditions in the first quarter. Operating, advertising, and market research expenses increased for this industry leader. Vinamilk’s selling expenses as a percentage of revenue rose to 24.5% in Q1 2025, the highest in recent years, indicating the mounting costs of maintaining market share.

International Dairy Products Joint Stock Company (IDP) experienced a sharp decline in profit due to surging selling expenses.

One of the most surprising performances came from International Dairy Products Joint Stock Company (UPCoM: IDP), the company behind the Kun dairy brand. Despite a 15.6% increase in revenue to nearly VND 1.8 trillion, their profit halved to VND 106 billion, the lowest since 2021.

IDP attributed this to a significant rise in operating and marketing expenses. Specifically, their selling expenses surged from VND 307 billion to VND 512 billion, squeezing profits. In Q1 2025, IDP’s selling expenses as a percentage of revenue reached 27.9%, a notable increase compared to the previous years’ average of around 19%.

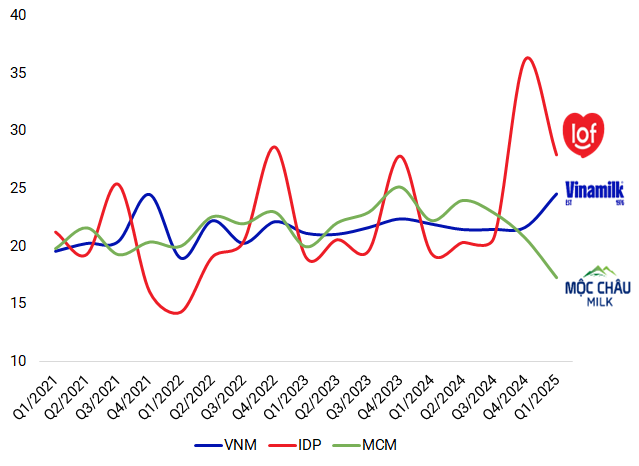

|

Both Vinamilk and IDP experienced high selling expenses as a percentage of revenue in Q1 2025

Source: Author’s compilation

|

Mộc Châu Milk (HOSE: MCM) witnessed a decline in revenue to its lowest level since 2019.

Mộc Châu Milk (HOSE: MCM) exemplified the industry’s shrinking revenue trend. Their Q1 revenue reached VND 591 billion, a 5.5% decrease, the lowest since 2019. Net profit fell to nearly VND 48 billion, nearing a four-year low.

However, a positive note was their reduced selling expenses, which fell from VND 118 billion in the previous year to VND 83 billion, preventing a steeper profit decline. MCM’s selling expenses as a percentage of revenue stood at 17.3%, the lowest in many years.

QNS’s dairy segment couldn’t offset profit decline despite positive performance

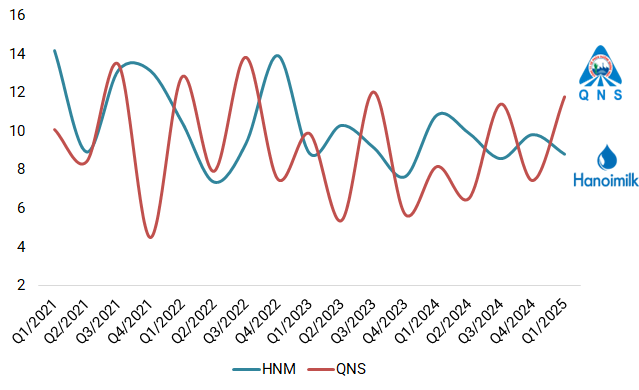

Quang Ngai Sugar Joint Stock Company (UPCoM: QNS) has two main business segments: sugar and dairy, contributing almost equally to their revenue. Despite a 20% increase in sugar production in Q1, their revenue decreased by 10% to VND 2.27 trillion due to weak demand and slightly lower domestic sugar prices. Net profit fell to VND 391 billion, the lowest in two years.

According to the company behind the Fami soy milk brand, their dairy segment showed positive growth, with a 10% increase in consumption attributed to marketing campaigns and sales strategies implemented since 2024. However, they faced significant selling expenses, with agent commissions surging tenfold to over VND 60 billion, and display costs rising 58% to VND 44 billion. Consequently, QNS’s selling expenses as a percentage of revenue climbed back up to 11.8%, higher than the two-year average.

Hanoimilk (UPCoM: HNM) stood out with profit growth amidst industry challenges

Amid the dairy industry’s gloomy landscape, Hanoimilk (UPCoM: HNM) was a rare bright spot. Their Q1 2025 revenue rose 46% to VND 192 billion, the third-highest in their operating history. Net profit increased by 33% to VND 8 billion.

However, this growth partly resulted from a low base in Q1 2024. Selling expenses rose by 18% to nearly VND 17 billion, narrowing their profit margin despite higher revenue. Hanoimilk maintained its selling expenses as a percentage of revenue at 8.8%, significantly lower than the industry average.

|

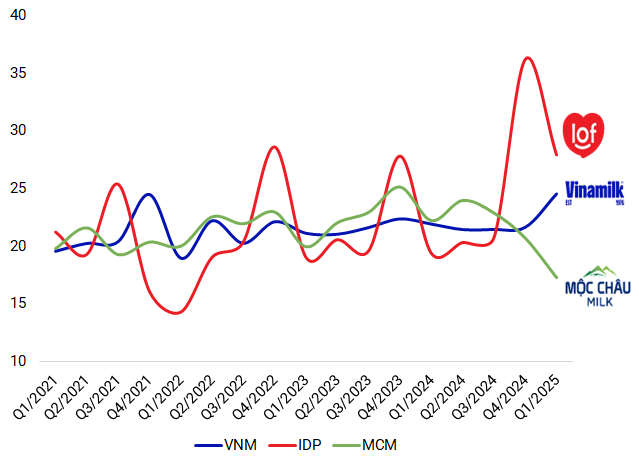

HNM and IDP were the only companies to report revenue growth in Q1

Source: Author’s compilation

|

|

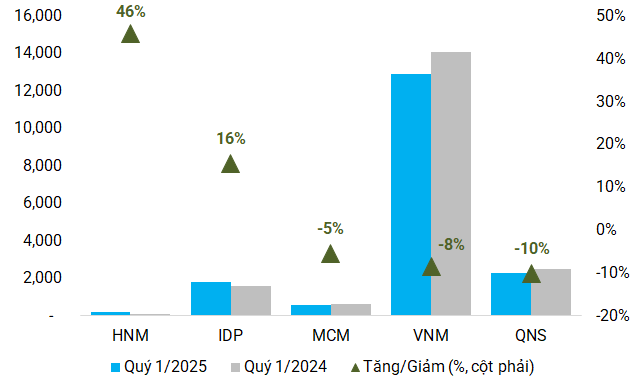

HNM was the lone company to report profit growth

Source: Author’s compilation

|

|

Hanoimilk maintained a low ratio of selling expenses to revenue

Source: Author’s compilation

|

Brighter prospects expected in Q2 2025 for the dairy industry

After a challenging first quarter marked by cost pressures, the dairy industry is anticipated to witness positive developments in Q2 2025, especially for leading companies like Vinamilk.

During an investor meeting on May 6th, Mr.

Mr. Liêm expressed optimism about achieving positive growth in both revenue and profit in Q2, barring any unforeseen circumstances. While raw material prices are expected to increase this year, Vinamilk’s management believes this trend may stabilize in the second half as many commodities have already adjusted their prices in the first half.

– 09:00 22/05/2025

“Nurturing Vietnam’s Future Leaders: Vinamilk Empowers Young Dreams”

The 10th ‘Good Children Following Uncle Ho’s Steps’ Congress in Hanoi was a resounding success, bringing together 500 exemplary young delegates from across the nation. This event, leading up to the 135th birthday celebration of President Ho Chi Minh, was a testament to the values and spirit of Vietnam’s beloved leader.

Captivating Cash Flows of Vinamilk, BAF

Vinamilk’s domestic sales for April witnessed a remarkable surge, surpassing the corresponding period of the previous year by over 10% and exhibiting an impressive 40% increase compared to the monthly average of the first quarter. Meanwhile, BAF boasted record-breaking performance in April, with a staggering turnover of VND 450 billion, marking the highest monthly revenue.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)