Global gold prices rose for the third consecutive session on Wednesday (May 21) in US markets and continued to surge past the $3,300/oz mark during the Asian session on Thursday (May 22). A weaker US dollar and safe-haven demands fueled by economic and geopolitical concerns drove this rally in gold prices.

As of 8:45 a.m. Vietnam time, spot gold in the Asian market surged by $26.7/oz compared to the previous close in New York, or up 0.81%, trading at $3,342.2/oz, according to Kitco data.

At this level, after converting the rate based on Vietcombank’s selling exchange rate, the domestic gold price is equivalent to about VND 105.3 million/tael, up VND 1.6 million/tael compared to yesterday morning. In just two days, the world gold price has increased by VND 4 million/tael.

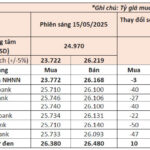

At the same time, Vietcombank listed the buying rate for the US dollar at VND 25,760 and the selling rate at VND 26,150, an increase of VND 10 for both rates compared to the previous day.

On Wednesday’s close in New York, spot gold reached $3,315.5/oz, up $22.2/oz or nearly 0.7% from the previous session’s close.

The US dollar weakened significantly, with the Dollar Index settling at 99.56, down 0.6% from the previous session’s 100.12.

Not only the US dollar but other American assets such as stocks and bonds also witnessed a sell-off during this session.

The decline in bond prices pushed the yield on the 30-year US Treasury bond to 5.09%, the highest since October 2023. The yield on the 10-year bond rose to 4.59%.

Long-dated US Treasuries came under pressure due to concerns over the massive US budget deficit, which could widen further if the bill to extend President Donald Trump’s 2017 tax cut program is passed. Lawmakers in Congress have reached a consensus on deductions for state and local taxes and are expected to approve the bill in the coming days.

Concerns about the US government’s budget deficit and debt have heightened in recent days, following a downgrade of the country’s credit rating by Moody’s. Trump’s tax cut plan has further exacerbated these concerns.

Geopolitical news also weighed on risky assets like stocks while boosting safe-haven demand for gold. Peace negotiations between Russia and Ukraine remained stagnant, while in the Middle East, there were reports that Israel might be preparing to strike Iran’s nuclear facilities even as the Trump administration is engaged in negotiations with Iran over its uranium enrichment program.

However, analysts believe that the trade negotiations remain the primary focus for investors, and as long as there is no clear outcome, gold prices will continue to fluctuate.

“Gold prices seem to be hovering in the middle of the recent high and low, awaiting news on trade deals,” said Daniel Pavilonis, a strategist at RJO Futures, in a Reuters report.

Gold prices skyrocketed past $3,500/oz in April after Trump announced retaliatory tariffs. In May, following the US-China trade truce, gold dipped below the $3,100/oz level.

“We expect the recent gold price dip to spur buying interest as macroeconomic and geopolitical uncertainties remain,” noted a report by ANZ.

SPDR Gold Trust, the world’s largest gold ETF, sold 1.7 tons of gold on Wednesday, reducing its holdings to 919.9 tons. While the fund has been net buying in the first two sessions of the week, net selling has been the predominant trend over the past month.

The Growth Investment Guru’s Fund Becomes Major Stakeholder in PNJ.

PNJ, or Phu Nhuan Jewelry Joint Stock Company, has a new major shareholder in the form of T. Rowe Price Associates, Inc., a prominent American investment fund. This development comes on the heels of Dragon Capital’s exit from the list of major shareholders, marking a significant shift in the company’s investor landscape.