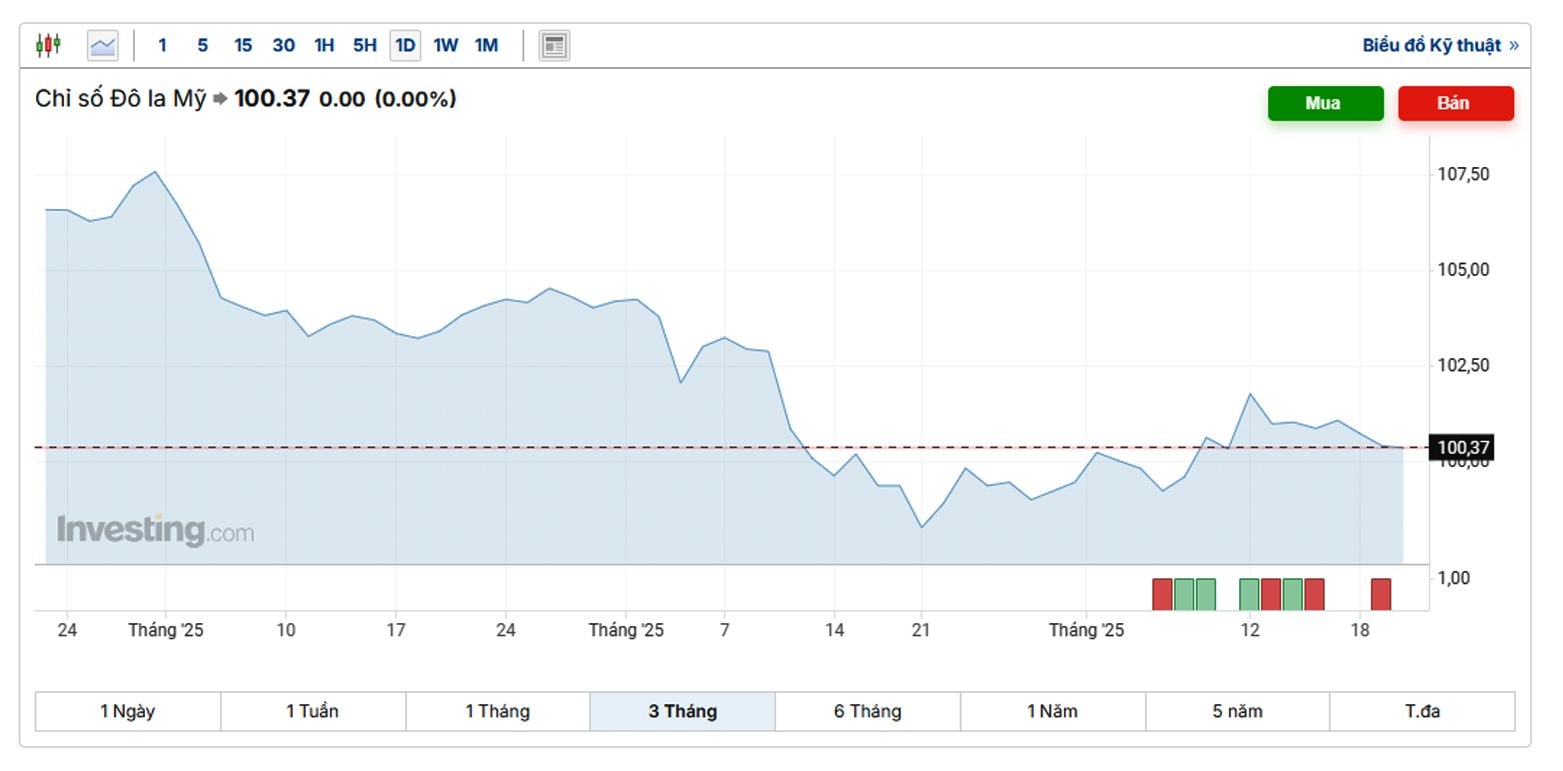

Market observations indicate that the US Dollar Index (DXY) — a measure of the US dollar’s strength — experienced a significant downward trend throughout the month amid tariff tensions. On April 2nd, President Trump declared a “National Day of Freedom” with the imposition of large-scale retaliatory tariffs on multiple trading partners, including a 145% increase on imports from China. However, he decided to postpone these tariffs for 90 days.

Adding to the pressure on the US dollar, President Trump repeatedly criticized and exerted pressure on the Federal Reserve, going as far as to consider removing the Fed Chair. In this context, the DXY hit a three-year low of 98.3 points on April 21st, a 10.2% decrease compared to the beginning of the year.

US economic data also revealed a second consecutive month of decline in the manufacturing sector, with the ISM PMI falling to 48.7 in April due to supply chain disruptions caused by new tariff policies. Inflation eased slightly, with the PCE price index for March 2025 rising 2.3% year-over-year, down from 2.7% in February 2025. Meanwhile, consumer spending recorded its fastest growth in more than two years as households rushed to make purchases before the new tariffs took effect. Faced with numerous uncertainties and a bleak economic outlook, the US consumer sentiment index dropped to its second-lowest level since 1952. Consequently, the US dollar depreciated by 4.8% from the end of March 2025, closing April at 99.2 points, a 9.3% decrease year-to-date.

The DXY saw a slight recovery after the US and China reached initial tariff agreements (on April 12th, DXY stood at 101.77), but it retreated to 100.37 on May 20th amid news of Moody’s downgrade of the US credit rating from Aaa to Aa1 and weak economic data.

Analysts from UOB Bank forecast a continued weakening of the US dollar against other major currencies, pushing the DXY below the 100-point mark towards 96.9 points in Q1 2026. UOB’s latest predictions also indicate that the EUR/USD and GBP/USD exchange rates will further appreciate to 1.17 and 1.39, respectively, in Q1 2026. Regarding the AUD, the bank suggests that its V-shaped recovery may have been overextended, limiting its gains to around 0.66 in Q1 2026. The JPY, on the other hand, is expected to gradually strengthen as the Bank of Japan (BOJ) adopts a milder interest rate hike path, reaching 140 USD/JPY in Q1 2026. The USD/CNY is projected to stand at 7.32 in Q3 2025, while the USD/SGD, USD/MYR, USD/THB, and USD/IDR are expected to be 1.32, 4.38, 33.5, and 16,800, respectively.

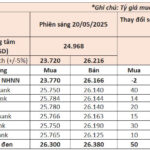

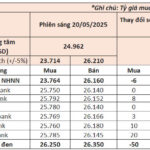

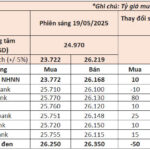

Regarding the VND, UOB experts consider it a special case in the region’s currencies’ strong recovery in April, as the VND depreciated by 1.6% that month to 25,990 VND/USD. The market may have reacted to the negative economic impact on Vietnam after the US announced tariffs of up to 46% on Vietnamese goods — the second-highest rate globally, after China. The manufacturing PMI also dropped sharply to 45.6 points, a two-year low, indicating manufacturers’ cautious sentiment amid concerns about Vietnamese products losing their price competitiveness in the US export market. “If a trade agreement with the US is not reached, we expect the VND to remain in a weak range against the USD,” UOB analysts forecast.

A recent report by Vietcombank Securities (VCBS) assesses that in the context of uncertainties and concerns about Vietnam facing high retaliatory tariffs, the exchange rate may fluctuate more in the short term. In the coming time, export activities (especially to the US market) could slow down or even suffer losses, as there is no final decision on tariffs yet.

However, if Vietnam continues to demonstrate its stable foundation, it will remain an ideal destination for investment and business operations. VCBS experts believe that “although the exchange rate may face short-term pressure, the foreign exchange market is still expected to show positive developments, instead of experiencing rapid and strong upward pressure as in the recent period.”

Sharing the same view, analysts from Military Bank Securities (MBS) acknowledge the pressures on the VND but also highlight several positive factors. They anticipate the USD/VND exchange rate to fluctuate within the range of 25,500–26,000 VND/USD in 2025, as the new administration’s fiscal easing plans, combined with tighter immigration policies, relatively high interest rates, and a relatively high level of protectionism in the US, are expected to support the strengthening of the US dollar this year. Additionally, unpredictable tariff policies from the US are likely to create challenges for Vietnam’s exports and FDI attraction, potentially impacting foreign reserve levels.

“However, so far, internal factors are still showing positive results, such as trade surplus (~$3.79 billion in the first four months of 2025), FDI disbursement ($6.74 billion, +7.3% over the same period), and the recovery of international tourism (+23.8% over the same period in the first four months of 2025). This is expected to continue supporting the VND,” MBS analysts stated.

According to experts from Rong Viet Securities (VDSC), unlike the past pattern of capital flowing into USD assets as a “safe haven” during times of uncertainty or rising global economic recession risks, President Trump’s tariff policies have caused investors to question the US dollar’s safe-haven role. This external factor bodes well for the USD/VND exchange rate.

“However, the uncertainty about the tariff scenario that Vietnam will face after the negotiations is unfavorable for the exchange rate outlook, as it raises concerns about export prospects and foreign investment inflows. In the short term, the State Bank of Vietnam has room to control the depreciation of the VND within the allowable band of 3-5% in 2025,” VDSC analysts predicted.

The Greenback Slides in Vietnam

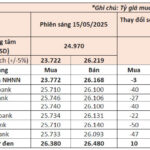

The US dollar witnessed a surprising decline at commercial banks, hovering just above the 26,000 VND mark.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)