Recent Developments at PVR Hanoi

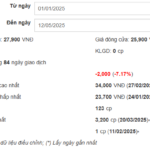

On May 13th, PVR Hanoi Joint Stock Investment Company (UpCOM: PVR) announced that Ms. Tran Thi Tham, spouse of Chairman Bui Van Phu, registered to sell her entire holding of nearly 12.5 million PVR shares, representing 24.05% of the company’s charter capital.

The purpose of this transaction is portfolio restructuring. The trading period is from May 15th to June 13th, and the transaction method will be by agreement and order matching.

Following this, on May 21st, Mr. Bui Van Phu, Chairman of PVR Hanoi Joint Stock Company, also registered to sell his entire holding of over 2.72 million PVR shares, equivalent to 5.23% of the charter capital. The expected trading period is from May 23rd to June 2nd, with the same stated reason for the transaction.

Previously, from August 15th to September 10, 2024, Ms. Tran Thi Tham had registered to sell a similar volume of shares but was unable to complete the transaction due to a lack of liquidity in the stock.

If both transactions are successful, the couple will have divested a total of nearly 15.2 million shares, representing 29.28% of PVR Hanoi’s capital. Based on the PVR share price of VND 1,000/share on May 21st, the estimated total divestment value is over VND 15 billion.

It is important to note that PVR shares are currently restricted from trading due to a temporary halt in business operations.

The capital divestment comes amidst PVR’s business stagnation and cessation of operations until the end of 2025.

Mr. Phu attributed this decision to a lack of financial resources to sustain operations and stated that the company needs to reorganize its personnel and seek new business directions to overcome the current challenges.

In late October 2023, the company’s bank accounts were frozen due to a court decision related to a dispute with Vietnam Oil and Gas Installation Corporation (PVX). All employees have since left the company, and current operations are limited to the Board of Directors, the General Director, and the Chief Accountant, who work two days a week on administrative tasks and exploring new business options.

Chairman Bui Van Phu has expressed the company’s difficulties in obtaining loans, and the leadership has indicated that they need time to explore solutions such as finding investment partners, business cooperation, project transfers, or capital divestment.

The minutes of the 2025 Annual General Meeting of Shareholders revealed that the company’s investment projects have made little progress. The luxury international tourism project in Tan Vien has been revoked, and the CT10-11 Van Phu project (Hanoi Time Tower) remains halted due to a lack of capital and customers’ reluctance to make payments due to delays.

Hanoi Time Tower Project.

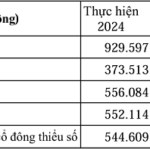

In the first quarter of 2025, due to the cessation of business operations, PVR Hanoi recorded no revenue from its core activities, while incurring financial expenses of nearly VND 322 million and management expenses of VND 60.6 million, resulting in a net loss of VND 383 million.

A Stock Surges Nearly 80%, Chairman Looks to Offload Majority Stake, Expected to Pocket Billions

“Should the proposed transaction find fruition, the Chairman’s personal holdings would diminish to a mere 784,000 shares. This shift translates to a negligible ownership stake of a scant 0.35%.”

The Strategic Capital Retreat: Biwase Members Plan Massive Divestment from Vwaco

Biwase Installation – Electricity Joint Stock Company (Biwelco) has registered to sell 7.1 million VLW shares of Vinh Long Water Supply Joint Stock Company (Vwaco, UPCoM: VLW) from May 13 to June 6, expecting to reduce its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%).