Vietnam’s stock market just experienced a lackluster trading session. Many Bluechip stocks unexpectedly faced strong selling pressure in the afternoon session, causing a lack of support for the VN-Index. At the close on May 22, the VN-Index fell 9.21 points to 1,313.84. Liquidity surged with the matched order value on HoSE reaching VND 25,026 billion.

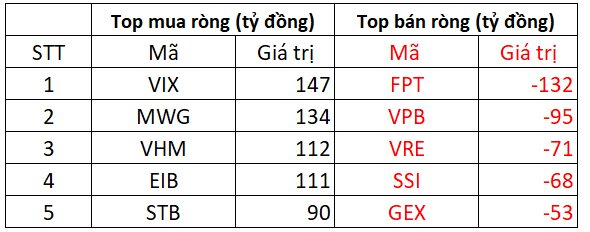

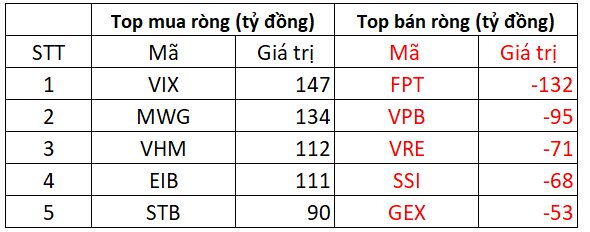

Foreign trading was a positive factor, with a net buy of nearly VND 69 billion today. Specifically:

On HoSE, foreign investors net bought approximately VND 114 billion

In the buying side, securities stock VIX was the most net bought in the market with a value of up to VND 147 billion. Following were MWG, VHM, and EIB, with net buys of VND 134 billion, 112 billion, and 111 billion, respectively. In addition, foreign investors also net bought STB stock with VND 90 billion.

In contrast, FPT stock faced strong net selling pressure of VND 132 billion by foreign investors, while VPB and VRE were net sold from VND 71-95 billion. Following were SSI and GEX, which were also in the top net sold list today.

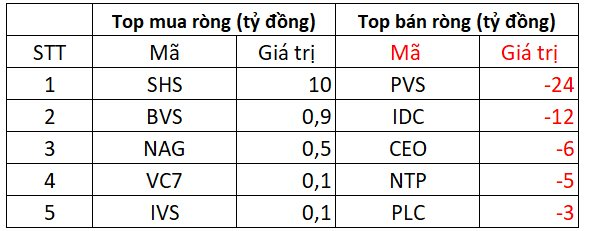

On HNX, foreign investors net sold about VND 51 billion

On the buying side, SHS stock was net bought for VND 10 billion. Following were BVS, NAG, VC7, and IVS, which were also net bought in today’s session with values ranging from a few tens of millions to a few hundred million VND.

On the opposite side, IDC and PVS stocks faced the strongest net selling pressure with values of VND 12-24 billion, while NTP, CEO, and PLC were net sold at around VND 3-6 billion each.

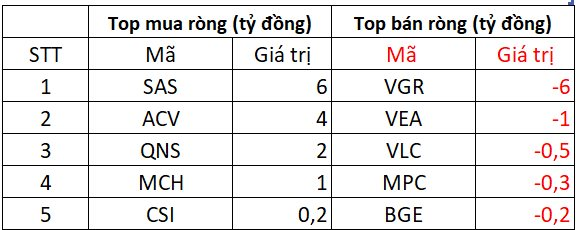

On UPCOM, foreign investors net bought nearly VND 6 billion

In terms of net bought value, SAS and ACV stocks led with VND 4-6 billion each, followed by QNS and MCH, which were also slightly net bought by a few billion VND.

Conversely, VGR stock faced net selling pressure of VND 6 billion, while VEA was net sold for VND 1 billion. Other stocks like VLC, MPC, and BGE were also net sold but with negligible values.

The VN-Index Plunges by 9 Points as Proprietary Traders Sell-Off

Today’s liquidity across the three exchanges reached 28 trillion dong, indicating that money is still pouring in confidently at current price levels. The VIPs net sold 357.8 billion dong, and they net sold 412.6 billion dong in matching orders alone.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.

The Art of Market Manipulation: VN-Index’s Dangerous Dance with Blue Chips

The robust upward momentum witnessed right after the morning session opened today propelled the VN-Index into the March peak zone. However, this rally was solely driven by large-cap stocks. As these heavyweight stocks started to lose steam, the index gave back almost all of its gains, ending the day with a marginal increase of less than 1 point, despite being up nearly 16.5 points earlier.