This week, 51 enterprises announced a dividend lock-in, with 46 companies paying cash dividends, 1 enterprise paying stock dividends, 2 enterprises issuing additional shares, and 2 enterprises paying mixed dividends.

Selling when the stock price rises

Mr. Pham Van Trong, a member of the Board of Management of Mobile World Investment Joint Stock Company (stock code: MWG) and General Director of Bach Hoa Xanh chain, registered to sell 200,000 MWG shares to reduce ownership to 0.21% of charter capital. The transaction is expected to be executed from May 20 to June 18.

Regarding stock price movements, MWG shares have recently experienced a strong uptrend. Accordingly, from April 9 to May 15, MWG shares increased by 39%, from VND 46,250 to VND 64,300 per share.

Notably, Mobile World has just approved the plan to issue conditional share purchase rights at its subsidiary, Bach Hoa Xanh Technology and Investment Joint Stock Company (the owner of the Bach Hoa Xanh chain), to key managers of Bach Hoa Xanh Investment to create a breakthrough, recognize contributions, and strengthen alignment with Bach Hoa Xanh’s long-term development goals.

General Director of the Bach Hoa Xanh chain registers to sell 200,000 MWG shares.

In the first quarter of this year, Bach Hoa Xanh recorded revenue of over VND 11,000 billion, up 20% over the same period last year. In the first three months, 232 new Bach Hoa Xanh stores were opened, bringing the total number of stores to 2,002.

The average revenue per Bach Hoa Xanh store that has been operating stably for at least six months in the Southern region reached VND 2.1 billion per month, with 30% of them having reached the optimal threshold and 70% still having room for growth.

However, as of the end of the first quarter, the Bach Hoa Xanh chain still recorded accumulated losses of nearly VND 6,918 billion. Specifically, the chain recorded losses of over VND 1,733 billion in 2020, over VND 966 billion in 2021, over VND 2,961 billion in 2022, and over VND 1,256 billion in 2023. In 2024, Bach Hoa Xanh’s revenue increased by 30% over the same period to VND 41,000 billion.

For Mobile World, the first quarter of this year recorded net revenue of VND 36,135 billion, up nearly 15% over the same period in 2024. After-tax profit reached VND 1,548 billion, up more than 71% over the previous year. This is the second-highest quarterly profit in MWG’s operating history.

Mr. Doan Chi Thanh, Director of Business Block and son of Mr. Doan Toi – General Director of Nam Viet Joint Stock Company (stock code: ANV) – had an additional 1,362,000 ANV shares sold for debt settlement, reducing ownership to 11.22% of charter capital. The transaction was executed on May 15.

Previously, on April 15, Mr. Thanh had 63,500 shares sold for debt settlement, followed by another 1,640,000 ANV shares sold on May 6 and 1,281,000 ANV shares on May 9. Thus, in the past month, Mr. Thanh had a total of 4,346,500 ANV shares sold for debt settlement.

From April 2 to May 15, the ANV share price decreased by nearly 11%, from VND 16,500 per share to VND 14,700 per share.

Huge dividends

Sai Gon – Mekong Beer Joint Stock Company (stock code: WSB) announced that on May 22, it will finalize the list of shareholders to pay the final 2024 dividend. Accordingly, dividends will be paid in cash at a rate of 30%, meaning that shareholders owning 1 share will receive VND 3,000. The ex-dividend date is May 21, and the expected dividend payment date is June 6.

In late December 2024, Saigon – Mekong Beer paid the first 2024 dividend in cash at a rate of 20%. Thus, the total dividend payout for 2024 of this enterprise is 50%.

Sai Gon – Mekong Beer currently has a charter capital of VND 145 billion, in which Saigon Beer – Alcohol – Beverage Joint Stock Company (Sabeco, stock code: SAB) is the parent company, holding nearly 12.52 million shares (equivalent to 86.32% of charter capital) and will receive about VND 37.56 billion in dividends from WSB.

ACB will increase its charter capital from VND 44,667 billion to VND 51,367 billion.

On May 26, Asia Commercial Joint Stock Bank (stock code: ACB) will finalize the list of shareholders to pay 2024 dividends in cash and shares. Accordingly, ACB will pay dividends in cash at a rate of 10%. The expected dividend payment date is June 5.

The above list of shareholders will also receive dividends in shares at a rate of 100:15, meaning that shareholders owning 100 shares will receive 15 new shares, equivalent to about 670 million ACB shares to be issued additionally. After the issuance, ACB’s charter capital will increase from VND 44,667 billion to VND 51,367 billion.

Drug Joint Stock Company of Hau Giang (stock code: DHG) announced that on May 26, it will finalize the list of shareholders to pay 2024 dividends in cash at a rate of 60%. The payment date is June 18. With more than 130 million circulating shares, Drug Joint Stock Company of Hau Giang will spend over VND 784 billion on dividends for shareholders.

FPT Online Joint Stock Company (stock code: FOC) has just announced the record date for receiving 2024 cash dividends at a rate of 100% – the highest rate since 2021, equivalent to a projected expenditure of nearly VND 185 billion. FPT currently holds 23.86% of FOC’s capital and will receive more than VND 44 billion in dividends, while FPT Telecom (stock code: FOX) owns 56.51% of FOC’s capital and will receive nearly VND 105 billion in dividends.

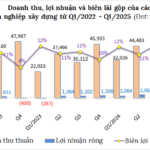

The Construction Industry’s Profit Polarization: Weak Firms Stuck in a Spiraling Loss Crisis

The construction industry witnessed a stark contrast in fortunes in Q1 2025, with some businesses surging ahead with exponential profit growth while others remained mired in losses or experienced significant profit declines. A wave of public investment and key infrastructure projects offers a glimmer of hope for a sector-wide recovery in the coming months.

“BMSC Gears Up for Massive Growth: Plans to Issue Over 7.8 Million New Shares to Boost Capital Past VND 2,000 Billion”

“On May 19, BMSC Joint Stock Securities Company (BMSC), trading on the UPCoM exchange under the ticker symbol ‘BMS,’ announced its plan to issue over 7.8 million new shares. This share issuance aims to boost the company’s capital by drawing from its own equity sources, aligning with its strategy to increase its total capital to over VND 2,039 billion.”

“SDA Stock Plunges Following Trading Restriction News”

“Shares of Simco Song Da Joint Stock Company (HNX: SDA) plummeted on May 19th, following an announcement by the Hanoi Stock Exchange. The exchange has decided to impose trading restrictions on the stock starting May 21st due to a delay in submitting its audited financial statements for the year 2024. With this development, traders are left wondering about the future performance of SDA and its ability to rebound from this setback.”