According to the Vietnam Real Estate Brokers Association (VARS), Vietnam’s economy in Q1 2025 was stable, with inflation under control and the country’s large economic balances ensured.

In this favorable context, the Vietnamese real estate market has made its first moves to activate a new cycle. Although there hasn’t been a “boom” across the board, supply and liquidity in the market have shown a clear recovery in some segments, especially compared to the stagnant period of 2023.

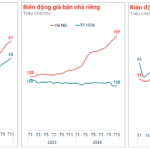

VARS data shows that in Q1 2025, the supply of housing in Vietnam reached 27,000 products, up 33% compared to the same period last year. Of these, 14,500 were new offerings, only about half of the previous quarter, but tripled compared to Q1 2024. The rest were existing inventory.

The overall absorption rate of the market reached 45%, equivalent to 12,273 transactions, half of the previous quarter but double the same period last year. The absorption rate increased by 15 percentage points compared to the same period last year but decreased by 20 percentage points compared to 2024. The absorption pace remained stable as supply improved and prices remained largely unchanged.

The apartment segment continued to lead the market, contributing up to 72% of transactions. Meanwhile, the absorption rate of newly opened low-rise projects achieved approximately 52%.

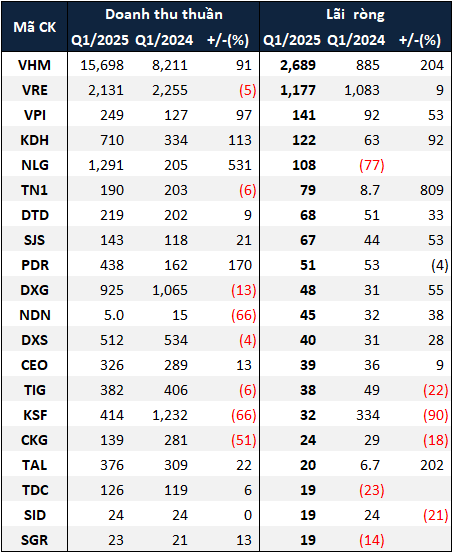

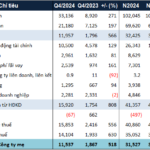

Along with the market’s positive performance, data from VietstockFinance shows that the revenue and net profit of 82 real estate enterprises in management and real estate development on the stock market (HOSE, HNX, and UPCoM) in Q1 2025 increased by 36% and 68% over the same period, reaching more than VND 29,700 billion and VND 4,400 billion, respectively.

Vin duo leads the market in profits

The top contributors to the industry’s profits were the duo of Vinhomes Joint Stock Company (HOSE: VHM) and Vincom Retail Joint Stock Company (HOSE: VRE) with nearly VND 2,700 billion and almost VND 1,200 billion, respectively. This performance is triple and a 9% increase compared to the same period last year.

VHM stated that the handover of units at Vinhomes Royal Island and Vinhomes Ocean Park 2-3 projects continued to be the main driver of their business results this period.

Q1 2025 sales and unhanded over sales by the end of the quarter reached VND 35,000 billion and VND 120,000 billion, respectively, more than double and a 7% increase over the same period last year. This impressive performance was mainly due to positive business results from large-scale urban projects, especially Vinhomes Wonder City in western Hanoi, which was launched in mid-March 2025. This lays a solid foundation to boost the company’s revenue and profits in the following quarters.

Regarding VRE, although real estate transfer revenue decreased due to the handover of only 9 shophouses in the quarter (compared to 45 in the same period last year), leasing and service revenue increased by 5%, exceeding VND 2,000 billion. In addition, financial revenue (mainly from interest income) also increased by nearly 44%, to over VND 625 billion, contributing to profit growth.

|

Top 20 Real Estate Enterprises with the Highest Net Profit in Q1/2025 (in VND billion)

Source: VietstockFinance

|

Although more modest compared to the two Vin companies, three other real estate enterprises also achieved positive results in the first quarter, with net profits exceeding VND 100 billion.

Van Phu – INVEST Investment Joint Stock Company (HOSE: VPI) earned VND 141 billion, up 53% over the same period last year. VPI stated that in Q1 2025, in addition to revenue from leasing Oakwood Residence Hanoi serviced apartments, the company also recognized revenue from the Terra Bac Giang project and some other services.

Khang Dien House Trading Joint Stock Company (HOSE: KDH) posted a net profit of VND 122 billion, up 92%. At the 2025 Annual General Meeting of Shareholders, KDH CEO Vuong Van Minh said that the company’s profit in 2025 was mainly due to The Privia project, which handed over about 60% of the units in 2024, and the rest will be handed over this year, recognizing revenue and profits. It is known that in early March 2025, Khang Phuc Housing Trading Services Co., Ltd. – a subsidiary of KDH – held a ceremony to hand over the first pink books to residents at The Privia project.

The third enterprise with a net profit of over VND 100 billion was Nam Long Investment Joint Stock Company (HOSE: NLG) with VND 108 billion. This result was mainly due to the handover of 153 apartments at the Akari project, with revenue of VND 582 billion, 70 land plots, and 305 social houses at the EhomeS project in Can Tho, with a total revenue of VND 559 billion.

In addition, NLG shared that presales in the first four months of 2025 reached VND 2,576 billion, nearly double the same period in 2024, mainly from the Southgate project. The amount of sold inventory in existing subdivisions, such as The Aqua and Park Village, reflects the strong recovery of real estate in the western region.

Akari City project developed by NLG

|

Mixed Performance

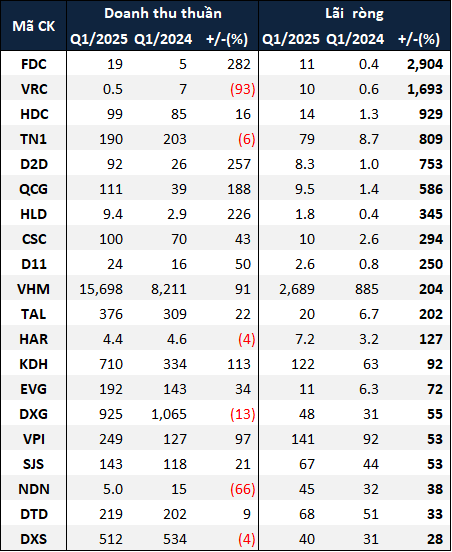

While some enterprises did not achieve impressive profits, many still experienced significant profit growth in the first three months of 2025.

Leading in terms of growth was Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company (HOSE: FDC), with a net profit of VND 11 billion, 30 times higher than the same period last year. This remarkable performance was due to rental income from the Fideco office building at 28 Phung Khac Khoan, District 1, Ho Chi Minh City. In the same period last year, this office building was still under construction.

Fideco office building as of the end of June 2024 – Photo: Thuong Ngoc

|

Thanks to other income of more than VND 14 billion from compensation for the 52G project, the net profit of VRC Real Estate and Investment Joint Stock Company (HOSE: VRC) was nearly 18 times higher than the same period, reaching VND 10 billion. In contrast, its net revenue decreased by 93% to less than VND 500 million.

|

Top 20 Real Estate Enterprises with Increased Profit in Q1/2025 (in VND billion)

Source: VietstockFinance

|

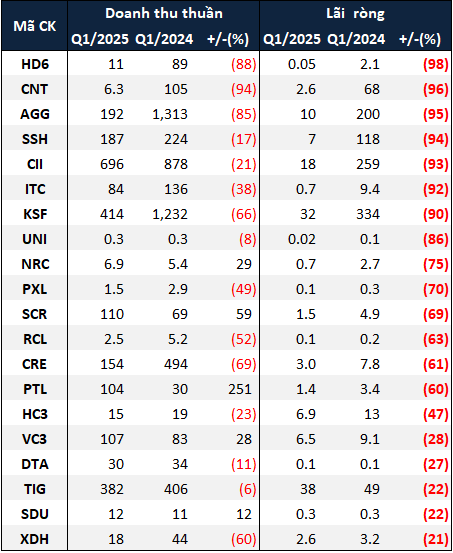

On the other hand, many enterprises recorded a decrease in net profit in Q1 2025.

Although Saigon Thuong Tin Real Estate Joint Stock Company (HOSE: SCR) saw a 59% increase in net revenue, its net profit for the quarter decreased by 69%, to VND 1.5 billion. The increase in revenue was mainly due to commercial and warehouse leasing activities, which brought in nearly VND 69 billion in revenue, 2.5 times higher than the same period. However, management expenses increased fivefold to more than VND 24 billion due to a provision of more than VND 4 billion for doubtful debts in Q1 2025, while VND 13 billion was reversed in the same period last year.

|

Top 20 Real Estate Enterprises with Decreased Profit in Q1/2025 (in VND billion)

Source: VietstockFinance

|

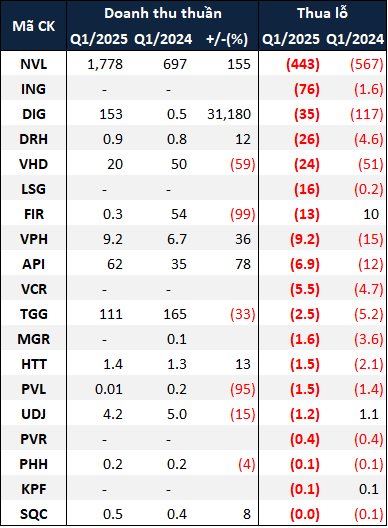

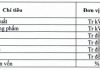

19 Enterprises Reported Losses

Statistics show that 19 enterprises reported net losses in the first quarter of 2025. Many of these enterprises had zero net revenue.

|

19 Real Estate Enterprises Reporting Losses in Q1/2025 (in VND billion)

Source: VietstockFinance

|

The heaviest loss was reported by No Va Real Estate Investment Group Joint Stock Company (HOSE: NVL) at VND 443 billion. Net revenue from real estate transfers exceeded VND 1,634 billion, 3.3 times higher than the same period, thanks to handovers at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City. However, during the period, NVL incurred other losses of nearly VND 262 billion due to a decrease in penalties for contract violations compared to the same period last year (VND 3 billion in Q1 2025 compared to nearly VND 331 billion in Q1 2024).

Another notable enterprise with a net loss of VND 35 billion was the Construction Development Investment Corporation (HOSE: DIG). This result was quite unexpected, as at the 2025 Annual General Meeting of Shareholders, DIG Chairman Nguyen Hung Cuong stated that the company expected a profit of about VND 10 billion in Q1 2025 and estimated that it would complete its record profit target of VND 718 billion for the full year in the middle of the year, instead of the third or fourth quarter.

– 08:06 23/05/2025

Royal Island Vinhomes Marina – Elevating the Royal Island City

The recently launched luxury marina, Vinhomes Royal Island, is a shining example of refined living, elevating the standard of upscale lifestyle in Vu Yen Island. This new development not only offers an enhanced upscale lifestyle but also presents a vibrant opportunity for investors and businesses. It further boosts aquatic tourism and significantly contributes to the improvement of Haiphong’s water transport infrastructure and its neighboring areas.

The Pearl of Vu Yen Island: Profitable Promise in the Heart of a Billion-Dollar Metropolis

As commercial real estate investments surge, Vinhomes Royal Island, a resort-style urban development in the heart of Hai Phong, is attracting investors’ attention. The shophouse offerings are the centerpiece of this project, boasting prime locations, spacious road frontage, and a superior business ecosystem.

The New Crown Jewel of Haiphong: A Multi-Billion Dollar Project by Vingroup

“The land area allocated to Vingroup has undergone a strategic revision, with a refined focus on essential facets. A reduction in land designated for transportation purposes, including urban railways and external communications – specifically the ring road 3, marks a shift in vision. This evolution in allocation strategy paves the way for a redefined future, where every inch of land serves a purpose, and every purpose is served with excellence.”

“VHM Achieves Target of 35 Trillion VND Net Profit in 2024”

In 2024, Vinhomes Joint Stock Company (HOSE: VHM) recorded impressive figures with over VND 102 trillion in revenue and VND 31.5 trillion in net profit. The company successfully achieved its target of VND 35 trillion in after-tax profit set at the beginning of the year.