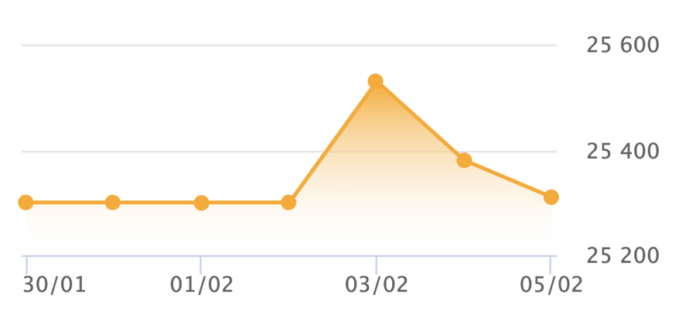

On February 5, the State Bank of Vietnam continued to increase the central exchange rate by 35 VND against the dollar compared to February 4, to 24,395 VND/USD. With a +/-5% fluctuation band, today’s ceiling rate is 25,615 VND/USD and the floor rate is 23,175 VND/USD. The reference exchange rate at the State Bank of Vietnam remains unchanged at 23,400 – 25,450 VND/USD (buying – selling).

In the morning session of February 5, commercial banks’ exchange rates cooled down after two consecutive sessions of sharp increases.

Specifically, at the beginning of the session on February 5, Vietcombank listed the USD exchange rate at 25,010 – 25,370 VND/USD (buying – selling), down 110 VND in both buying and selling rates compared to the previous morning. At 14:30 on February 5, Vietcombank continued to reduce its buying price by another 30 VND to 24,980 VND/USD, while the selling price decreased by 60 VND to 25,310 VND/USD.

At the beginning of the trading session on February 5, BIDV also decreased its exchange rate by 115 VND to 24,930 – 25,290 VND/USD (buying – selling). At 14:30 on February 5, BIDV increased its buying and selling rates compared to the opening, to 24,985 – 25,345 VND/USD. BIDV’s exchange rates decreased by 55 VND in both directions compared to the previous session’s close.

In the interbank market, exchange rates closely followed the movements of the Dollar Index (DXY) and declined for the second consecutive session. On February 5, interbank rates fluctuated around 25,170 VND/USD, a decrease of 100 VND compared to the previous session’s close.

On February 5, the overnight interbank lending rate for VND decreased sharply by 0.27-0.99 percentage points compared to the previous session’s close. Specifically, the overnight rate was 4.51%, 1-week was 4.71%, 2-week was 4.84%, and 1-month was 5.01%.

Compared to the previous day, the interbank lending rate for USD on February 5 increased slightly by 0.01 percentage points for the overnight term. The 1-week term remained unchanged, while terms from 2 weeks onwards decreased slightly by 0.01-0.02 percentage points. The overnight rate was 4.38%, 1-week was 4.44%, 2-week was 4.49%, and 1-month was 4.56%.

The trade tensions between the US and other major economies have been influencing the sentiment of domestic and foreign markets at the beginning of this year.

Over two days, on February 4 and 5 (Vietnam time), the DXY decreased by nearly 0.5% (currently fluctuating around 107.9 points) after President Donald Trump unexpectedly delayed the imposition of tariffs on imports from Canada and Mexico for 30 days.

However, the US is still imposing an additional 10% tariff on imports from China, which took effect yesterday. The trade tensions between the US and China are the factors that the market is closely monitoring in the near future, as it is too early to assess the next moves of the two countries. Yesterday, China announced an increase of tariffs by 15% on coal and liquefied gas, and 10% on crude oil and agricultural machinery imports from the US as a first retaliatory move to the recent tariff hikes from the US.

China’s decision to increase tariffs on a small proportion of imports from the US is considered a cautious response given the slowdown in the world’s second-largest economy and the prolonged crisis in the real estate market. According to data from the General Administration of Customs of China, the country’s exports to the US are three times higher than its imports, which means China has fewer options to retaliate with tariffs compared to the US.

In 2024-2025, exchange rates faced significant pressure due to global economic and political uncertainties. In 2024, to stabilize the exchange rate, the State Bank of Vietnam intervened by selling foreign currencies during periods when the market rates reached the ceiling of the fluctuation band.

According to statistics from Rong Viet Securities Company (VDSC), the State Bank’s foreign currency sales can be divided into two phases. Phase 1 was from April to July 2024, with a volume of approximately $6.5 billion. Phase 2 was less intense, from September to December 2024, with a volume of about $2.8 billion. In total, the State Bank sold about $9.4 billion in 2024.

VDSC estimated that foreign reserves at the end of 2024 were about $80 billion, equivalent to 2.5 months of imports, lower than the level recorded at the end of 2023, which was 3.3 months of imports.

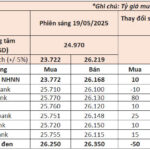

“May 19: State Bank Raises USD Exchange Rate, Free Market Dollar Continues to Fall”

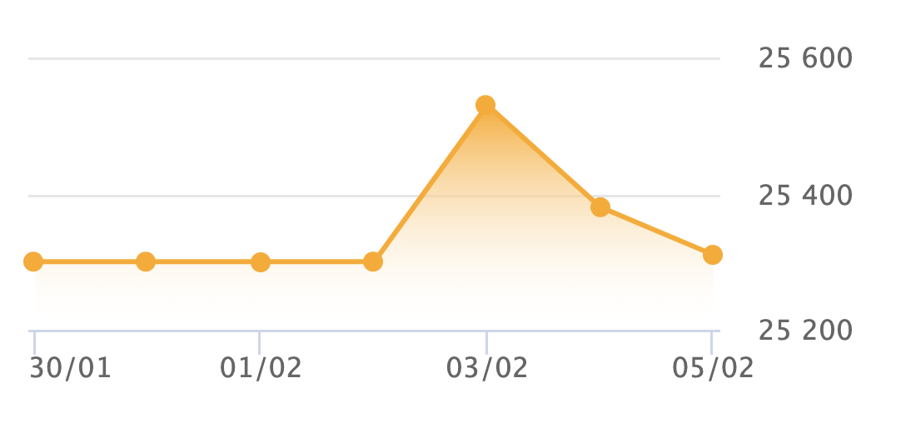

As of May 19th, the USD exchange rate at banks trended upward as the State Bank increased the central exchange rate by 10 VND. In contrast, the free-market USD rate dropped by 50 VND, trading at 26,250 – 26,350 VND/USD.

The Vietnamese Dong’s Turbulent Times: A Brighter Future Ahead

The forex market has been under significant pressure since the US announced countervailing duties in early April, despite a global easing of the US dollar’s strength. Nonetheless, experts assess that the Vietnamese Dong will show positive signs by year-end, with a ‘not-so-bad’ trade deal on the table.