According to data from the Vietnam Aviation Authority, the total number of passenger trips in the first quarter reached over 20.7 million, a 9.2% increase compared to the same period last year. Notably, the international market continued to lead the growth with 11.7 million passengers, a 12.3% increase, while the domestic market served over 9 million passengers, a 5.4% increase.

In parallel, cargo transportation also witnessed a breakthrough with 329,000 tons, a 12.4% increase compared to 2024. The international market remained dominant, contributing 269,000 tons (a 14.8% increase), while the domestic market accounted for more than 60,000 tons (a 2.8% increase).

Significantly, compared to pre-COVID-19 levels, Vietnam’s air transport industry has not only fully recovered but also achieved exceptional growth in both the international (11% increase) and domestic (5.8% increase) markets.

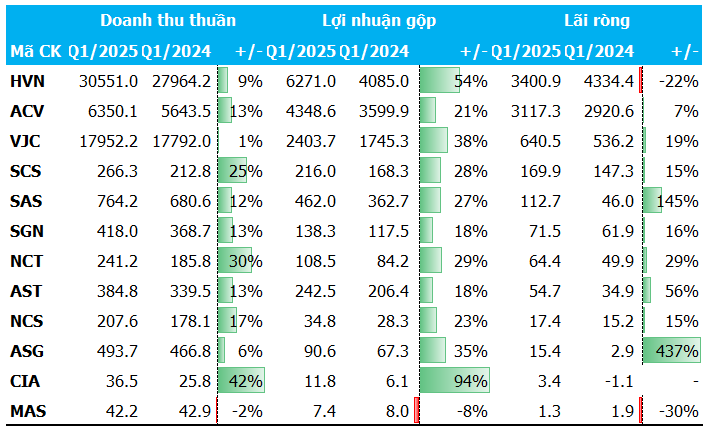

Financial Results of Aviation Companies in Q1 2025

Unit: Billion VND

Source: VietstockFinance

|

In this context, 11 out of 12 listed companies in the aviation industry reported revenue growth compared to the same period, with a record number of international tourists visiting Vietnam. In terms of profit growth, auxiliary service businesses remained the brightest stars in the industry.

Vietnam Airlines No Longer Relies on Other Income for Profits

Vietnam Airlines Corporation (HOSE: HVN) recorded a gross revenue of 30,551 billion VND in Q1/2025, a 9% increase year-on-year. Notably, the national carrier’s gross profit surged by 54% to 6,271 billion VND.

Although net profit decreased by 22% to 3,400 billion VND, it is noteworthy that this profit was mainly derived from core business operations, a significant difference from the same period last year when the company recognized other income of over 3,600 billion VND.

According to explanations from Vietnam Airlines, these positive results were mainly due to lower fuel prices compared to the previous year and the boom in the international market, particularly in India, the Middle East, and Northeast Asia.

Meanwhile, Vietjet Air (HOSE: VJC), a direct competitor of Vietnam Airlines, achieved modest 1% growth in gross revenue, reaching 17,952 billion VND. However, it impressed with a 38% increase in gross profit to over 2,400 billion VND and a 19% rise in net profit to over 640 billion VND.

Windfall Profits for Airport and Auxiliary Services

The airport giant, ACV, reaffirmed its leading position with a gross revenue of 6,350 billion VND, a 13% increase compared to Q1/2024. Net profit increased by 7% to 3,117 billion VND, nearing its historical peak.

The shining stars in the industry’s first-quarter performance were the auxiliary service businesses, which achieved outstanding profit growth.

In the field of air cargo transportation, Saigon Cargo Service Joint Stock Company (HOSE: SCS) witnessed a 25% increase in revenue to 266.3 billion VND and a 15% rise in net profit to 169.9 billion VND compared to the previous year.

Similarly, Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) also achieved positive results, with a 30% increase in gross revenue to 241 billion VND and a 29% surge in net profit to 64.4 billion VND.

The airport duty-free and retail services segment also profited significantly in Q1/2025. SASCO (UPCoM: SAS), led by the “luxury king” Johnathan Hanh Nguyen, experienced strong growth, with a 12% increase in gross revenue to 764 billion VND and a remarkable 145% jump in net profit to nearly 113 billion VND compared to the previous year. These results reflect the robust recovery of international tourism, especially among high-spending travelers.

Likewise, Taseco (HOSE: AST) reported a 13% increase in gross revenue to 385 billion VND and a significant 56% surge in net profit to nearly 55 billion VND.

The ground handling segment also yielded positive outcomes. In Q1/2025, Saigon Ground Services Joint Stock Company (HOSE: SGN) maintained its growth momentum from the previous quarter, with a 13% increase in gross revenue to 418 billion VND and a 16% rise in net profit to nearly 72 billion VND.

However, the company faced a significant challenge in April when Vietjet – one of its major clients – decided to handle ground operations independently at Tan Son Nhat Airport.

– 09:00 23/05/2025

The $500 Million Inter-Port Traffic Contract for Long Thanh Airport is Delayed.

The $4.8 billion Intra-Airport Transportation Package project at Long Thanh Airport is facing delays due to a shortage of machinery, labor, and challenging construction conditions. With a massive scope and tight deadlines, this project demands exceptional efficiency and expertise to get back on track.

“Vietnam Airlines and FPT: Forging Ahead with Next-Gen Aviation Technology”

Vietnam Airlines and FPT have joined forces, signing a comprehensive strategic cooperation agreement with a shared vision of digital transformation. This partnership aims to enhance operational capabilities and optimize the customer experience through innovative solutions. With FPT’s expertise in technology and Vietnam Airlines’ commitment to excellence, this collaboration is set to revolutionize the industry, taking both companies to new heights.