The construction project of Terminal 3 at Tan Son Nhat International Airport, with a total investment of nearly VND 11,000 billion, was undertaken by the Vietnam Airports Corporation (ACV). Package 12 – Construction and Installation of Terminal Equipment – was the most valuable package.

Package 12 was bid out by ACV in April 2023, and the winning bid was announced in August 2023.

A consortium of six contractors won the bid, including Hanoi Construction Corporation (Hancorp), Construction Corporation No. 1 (CC1), Corporation 319 (Ministry of Defense), Truong Son Construction Corporation, RICONS Construction Investment Joint Stock Company, and Luu Nguyen Construction Company Limited.

Gap in the stone pavement at Terminal 3, Tan Son Nhat Airport. Photo: Tuan Kiet

|

The winning bid amount was VND 9,034 billion, VND 22 billion lower than the package value. The contract duration is 600 days from the date of site handover by ACV.

The completion time includes holidays, Tet holidays, but excludes cases of force majeure.

The construction project of Terminal 3 at Tan Son Nhat Airport consists of three main items: passenger terminal, multi-storey car park combined with non-aviation services, and the viaduct in front of the terminal. The capital source is from ACV’s equity capital (70%) and commercial loans (30%).

On April 19, ACV inaugurated the construction project of Terminal 3, two months ahead of schedule.

As the main contractor of Package 12, Hancorp has won several other large packages from ACV, such as Package 11 (construction of piles and basement of Terminal 3) and Package 5.6 (construction of piles at Long Thanh Airport project).

In addition to aviation infrastructure, Hancorp has also participated in key projects such as the headquarters of the Ministry of Public Security, the National Convention Center, the Central Pediatric Hospital, and the Hanoi Opera House…

Hancorp – The ‘giant’ under the Ministry of Construction, how is its business doing?

Hanoi Construction Corporation – Joint Stock Company is an enterprise directly under the Ministry of Construction and was equitized in 2014. Hancorp’s shares are traded on UPCoM under the code HAN.

In addition to the parent company, Hanoi Construction Corporation – Joint Stock Company currently has seven subsidiaries: Hanoi Construction Joint Stock Company No. 1, Tay Ho Construction Investment and Development Joint Stock Company, Hancorp Equipment and Construction Materials Joint Stock Company, Hancorp 3 Limited Liability One Member Company, Hantech Limited Liability One Member Company, Hanoi Hancorp Commercial Investment Joint Stock Company and Hancorp Urban Services Joint Stock Company.

As of March 31, Hancorp’s chartered capital was over VND 1,410 billion, of which the Ministry of Construction held 98.83%.

Workers are injecting silicone to fill the gap. Photo: Tuan Kiet |

According to the consolidated financial statements for the first quarter of 2025, as of March 31, Hancorp’s total assets reached VND 6,059 billion, a decrease of nearly 6% compared to the beginning of the year.

In terms of business results, Hancorp’s net revenue in the first quarter of 2025 reached VND 866 billion, an increase of over 60% compared to the same period last year. After-tax profit reached over VND 43 billion.

Recently, the Finance Inspection Department of the Ministry of Finance has issued inspection conclusions on Hancorp’s finance in 2023.

By the end of 2023, Hancorp’s parent company had invested in 37 enterprises, with a total amount of over VND 992 billion.

Of these, only 23 companies made profits in the 2023 financial year, and 5 companies had accumulated losses, although some were identified as “project companies with planned losses.”

The Finance Inspection Department pointed out that some of Hancorp’s investments before equitization were ineffective as of the end of the 2023 financial year.

Notably, the parent company of Hancorp invested in four land lots in the Bãi Nổ population expansion area, Cổ Loa commune, Đông Anh district, Hanoi. These land lots only have a principle decision on land use, and the two parties signed a transfer contract but have not yet been granted land use rights and construction permits.

The Finance Inspectorate requested Hancorp to divest from the four land lots invested but unable to implement the project because these land lots belong to the planning of the Cổ Loa Relic Conservation Area.

At the same time, Hancorp must organize the review and evaluation of financial investments in inefficient businesses and develop specific solutions to overcome financial difficulties.

The Inspectorate also requested Hancorp to review all financial investments in weak businesses, develop handling plans, restructure its investment portfolio, and divest from units with prolonged losses to preserve and develop state capital.

Hong Khanh

– 06:15 24/05/2025

“Unanimous Shareholder Approval: ACV’s 96% Dividend Payout in Stock”

“As per the plans, ACV will allocate VND 7.13 trillion to the development investment fund, leaving approximately VND 14 trillion for dividend payout in shares. ACV expects to issue around 1.4 billion new shares, representing a ratio of 64.58% (for every 100 shares held, shareholders will receive 64.58 new shares).”

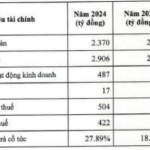

Sasco Shares Cash Dividends for 2024 Profits

The business lounge and duty-free operator at Tan Son Nhat Airport has seen a significant boost in profits as international travel rebounds. In 2024, Sasco recorded a net profit of VND 422 billion, with an impressive earnings per share (EPS) of VND 2,789. The company is now planning to distribute all of these earnings to its shareholders.

Unleashing the Potential: Unveiling Long Thanh International Airport

“Vietnam’s Minister of Construction, Tran Hong Minh, has urged the investors and developers of the Long Thanh International Airport project to direct their focus on allocating resources and closely monitoring the construction progress of each component. With a vision to meet the essential completion goal by the end of 2025, the minister has emphasized the importance of meticulous supervision to ensure timely progress.”