Oil Prices Slip as OPEC+ Considers Boosting Output

Oil prices slipped as investors weighed the potential impact of increased supply from OPEC+ starting in July 2025. This possibility has sparked concerns about a potential oversupply in the global market, outpacing demand growth.

Brent crude oil fell 47 cents, or 0.72%, to $64.44 a barrel, while WTI crude oil dropped by 37 cents, or 0.6%, to $61.20 a barrel, at the close of trading on May 22.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, are discussing whether to further boost production at their meeting on June 1, 2025. One of the options on the table is to increase output by 411,000 barrels per day in July, although no final agreement has been reached yet.

Additionally, oil prices reacted to data from the Energy Information Administration (EIA) showing that U.S. crude and fuel inventories rose last week due to higher crude imports and lower demand for gasoline and distillate products.

Crude stocks for the week ending May 16 rose by 1.3 million barrels to 443.2 million, contrary to analysts’ expectations of a 1.3-million-barrel drop.

U.S. Natural Gas Prices Fall by 3%

Natural gas prices in the U.S. fell by 3% due to higher-than-expected inventories, lower production in recent days, and reduced feed gas to LNG export plants so far in May.

The front-month June natural gas contract on the New York Mercantile Exchange fell 11.5 cents, or 3.4%, to $3.253 per million British thermal units.

Gold Prices Ease

Gold prices slipped as a stronger U.S. dollar and profit-taking by investors after an earlier two-week high prompted a retreat from the precious metal.

Spot gold on the LBMA platform fell by 0.6% to $3,295.21 an ounce, having earlier touched its highest since May 9 at $3,310.90. Gold futures for June delivery on the New York Mercantile Exchange fell 0.6% to $3,294.90 per ounce.

The U.S. dollar index rose 0.3%, making gold more expensive for holders of other currencies.

Copper Hits Three-Week Low, Other Base Metals Also Weaker

Copper hit a three-week low, and other base metals also weakened, as economic uncertainties and demand growth concerns continued to weigh on the market.

Three-month copper on the London Metal Exchange fell 0.4% to $9,498 a ton. Earlier in the session, prices touched the lowest since May 1 at $9,223.20.

Meanwhile, lead declined 0.3% to $1,968 a ton after touching its lowest since May 9 at $1,947.50, as inventories in London rose 91% to 234,000 tons over the previous two sessions—the highest since December 2024.

Dalian Iron Ore Edges Higher, Singapore and Shanghai Steel Futures Mixed

Iron ore futures on the Dalian Commodity Exchange traded within a narrow range as investors weighed strong demand for steelmaking ingredients in top consumer China against rising imports from top producers Australia and Brazil.

The September iron ore contract on the Dalian Commodity Exchange rose 0.14% to 727 Chinese yuan ($100.93) per ton.

Meanwhile, the June iron ore contract on the Singapore Exchange fell 0.56% to $99.25 a ton.

Iron ore inventories at 47 Chinese ports fell to 146.28 million tons last week, down 1.74% from the previous week.

Imports of the steelmaking ingredient from Australia and Brazil, the top two suppliers, rose 11.7% last week to 27.1 million tons, according to consultancy Mysteel.

On the Shanghai Futures Exchange, hot-rolled coil and stainless steel rose 0.09% and 0.04%, respectively, while rebar and wire rod fell 0.03% and 0.06%.

Rubber Prices Rise in Japan

Rubber prices in Japan rose amid strong demand for tire ingredients in top consumer China, although a stronger yen and the upcoming rubber-tapping season capped gains.

The October rubber contract on the Osaka Exchange (OSE) rose 1.7 yen, or 0.53%, to 321.9 yen ($2.25) per kg.

Meanwhile, the most-active rubber contract for September delivery on the Shanghai Futures Exchange fell 0.3% to 14,810 yuan ($2,056.03) per ton.

Butadiene rubber futures for June delivery on the Shanghai Futures Exchange fell 0.33% to 12,030 yuan ($1,670.09) per ton.

Rubber futures for June delivery on the Singapore Exchange fell 0.3% to 171.6 U.S. cents per kg.

Coffee Prices Ease in Vietnam and Indonesia, Hit One-Month Lows in London and New York

Coffee prices in Vietnam eased in quiet trade, with supplies improving from other robusta producers such as Brazil and Indonesia.

Vietnam’s robusta coffee exports were offered at $50-$70 per ton above the July contract on the London market for July shipment.

Domestic coffee beans were sold at 12,450,000-12,520,000 Vietnamese dong ($479-$482) per ton, down from 12,570,000-12,620,000 dong a week earlier.

In Indonesia, the benchmark grade 4 defect coffee beans were offered at a $30 discount to the July contract, compared with a $70 discount a week earlier.

In London, robusta coffee fell $116, or 2.4%, to $4,787 a ton, after falling to a one-month low of $4,769.

In New York, arabica coffee fell 2.6% to $3.6075 per lb, after touching a one-month low of $3.592.

Sugar Prices Slip

Raw sugar on ICE fell 0.3 cent, or 1.7%, to 17.4 cents per lb.

White sugar on the London market fell 1.9% to $488.10 a ton.

Wheat Falls, Soybeans and Corn Rise

Wheat on the Chicago Board of Trade fell, with profit-taking after prices hit a one-month high in the previous session.

July soybeans added 4-3/4 cents to 10-67-1/2 cents per bushel on the Chicago Board of Trade. July corn rose 2 cents to $4.63 a bushel, while July wheat fell 4-3/4 cents to $5.44-1/2 a bushel after touching a one-month high of $5.56-1/4 in the previous session.

Rice Prices Steady in Vietnam, Near Two-Year Low in India, Ease in Thailand

Indian rice export prices fell to their lowest level in nearly two years due to a weak rupee and ample supplies amid subdued demand, while markets in other key Asian hubs remained quiet.

Vietnam’s 5% broken rice prices were unchanged from a week earlier at $397 per ton, the Vietnam Food Association said.

India’s 5% broken parboiled variety was quoted at $382-$389 per ton, down from $384-$391 the previous week. White rice 5% broken was indicated at $375-$381 a ton.

In Thailand, benchmark 5% broken rice prices were quoted at $405-$410 per ton, down from $410 the previous week, due to foreign exchange fluctuations.

Global rice prices have fallen to their lowest levels in years and are expected to remain range-bound, although ample supplies in India and a bumper harvest in Asia are likely to keep prices subdued this year.

Malaysian Palm Oil Falls for Second Straight Session

Malaysian palm oil futures fell for a second straight session, pressured by weaker soybean oil and concerns over rising output in the coming weeks.

The benchmark palm oil contract for August delivery on the Bursa Malaysia Derivatives Exchange fell 73 ringgit, or 1.87%, to 3,821 ringgit ($894.85) per ton.

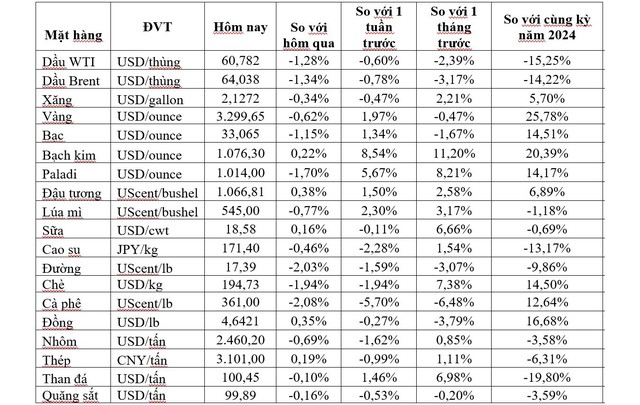

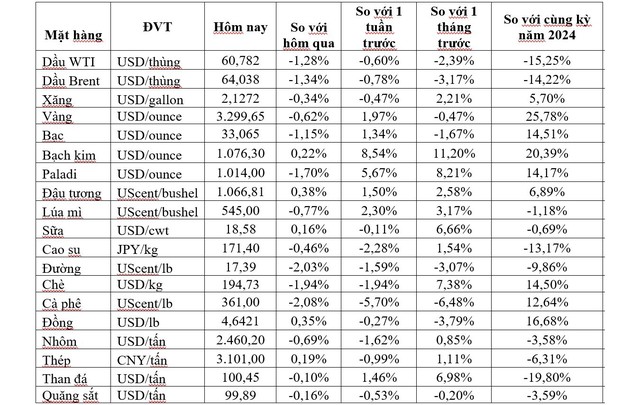

Key Commodity Prices as of May 23:

“Petrovietnam Targets ‘A New Facility Launch Every Month’ to Sustain Growth”

In April and the first four months of 2025, despite market challenges, the Vietnam National Oil and Gas Group (Petrovietnam) maintained stable production and business operations. The group ensured the progress of key projects, setting a monthly target to commission a new facility while expanding its market reach. This strategic approach aims to accomplish the mandate assigned by the Ministry of Finance.

Gold Prices Falter as the US Dollar Rallies and SPDR Gold Trust Adds Four Tons

Recent reports suggest that gold prices have found a strong support level at the $3,300 per ounce mark and are poised to reach the $4,000 per ounce milestone this year.