At the recent 2025 annual shareholder meeting of Berkshire Hathaway, billionaire Warren Buffett announced his departure from executive roles at the company after more than six decades.

Under the stewardship of this legendary investor, Berkshire Hathaway has built a stock portfolio worth nearly $290 billion and established itself as a trillion-dollar empire with a long-term investment philosophy.

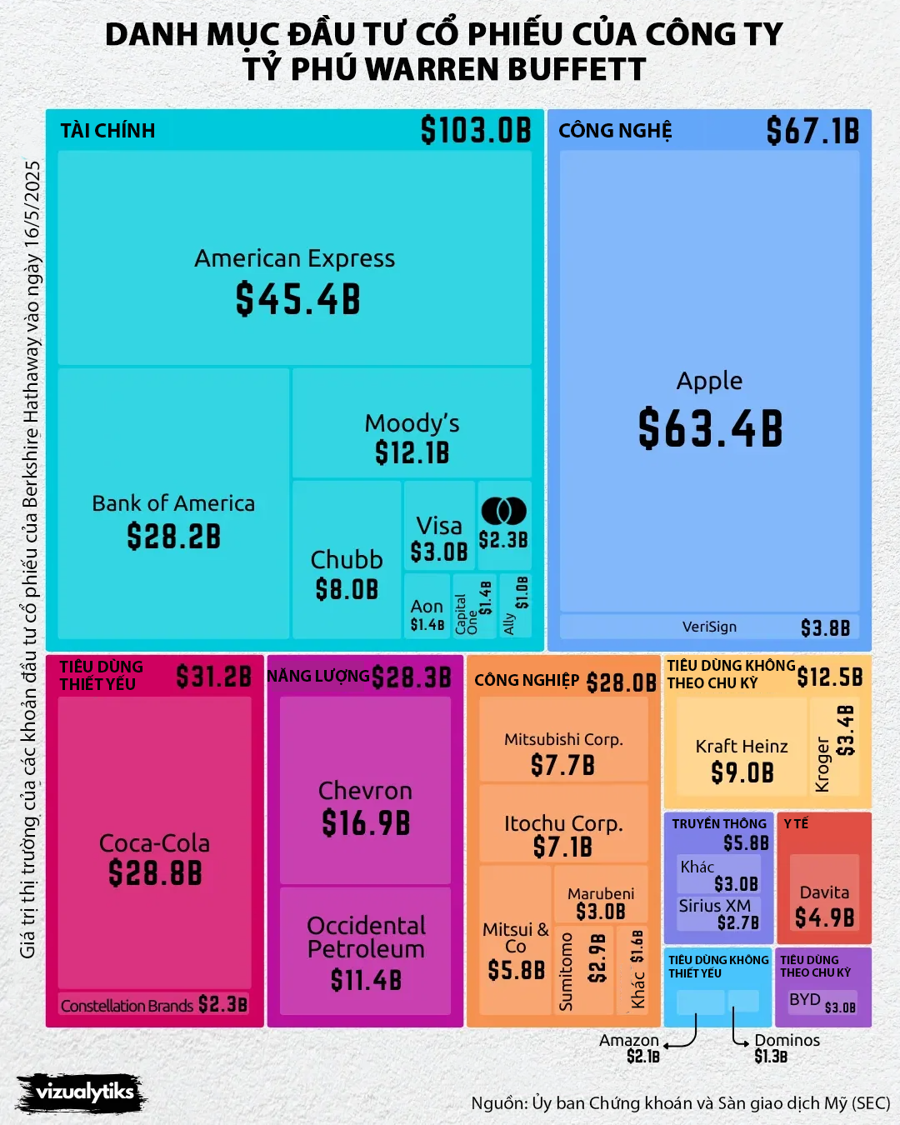

In Berkshire’s portfolio, financial stocks make up the largest sector, with top holdings including American Express and Bank of America. However, the largest individual stock holding is that of tech giant Apple, with a market value of over $63 billion.

The presence of large consumer stocks like Coca-Cola and Kraft Heinz, as well as energy stocks, reflects Buffett’s taste for investing in companies with stable profits and strong brands.

While new additions like BYD electric vehicles and Amazon e-commerce show a shift, Buffett’s portfolio largely adheres to his core investment philosophy: investing in what he understands, holding for the long term, and ignoring short-term market fluctuations.

The Value Investing Strategy is “Making a Comeback”

Warren Buffett, the greatest investor of all time, has just announced his retirement, shocking the value investing community. But they have bigger problems to worry about. Their favored investment style has been out of favor for years, and their clients are growing impatient. In a world where the US stock market consistently outperforms, low-cost passive funds seem like the sensible option.

Tim Cook’s ‘Bad Joke’ Falls Flat: Trump’s Stinging Rebuke – ‘You Came Here With $500 Billion, Now Investing in India, I Don’t Want That’

“President Trump has reiterated his desire for Apple to establish manufacturing facilities on American soil, holding the company to its previous pledge. Trump’s insistence on domestic production highlights his administration’s focus on bringing jobs back to the United States and revitalizing the country’s manufacturing sector.”