The Diverse Strategies of Brokerage Firms: A Battle for Market Share

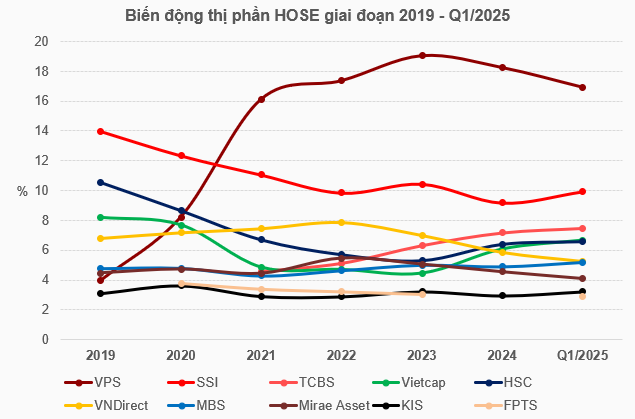

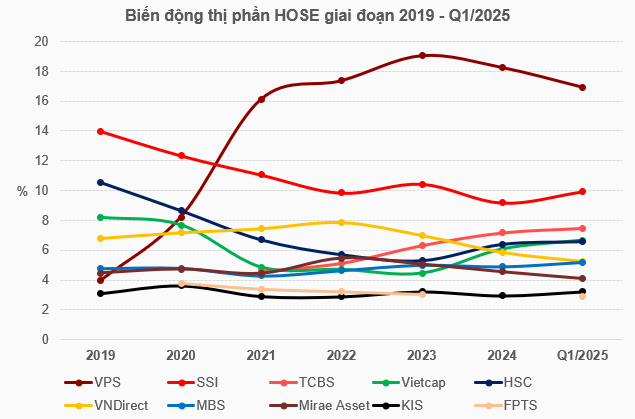

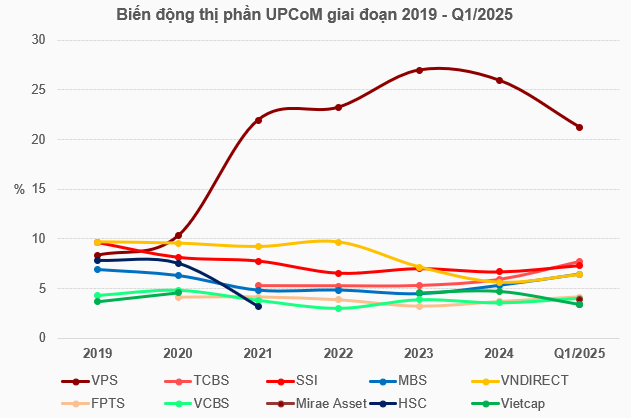

A prominent player in the top 10 brokerage market share is VPS Securities. In recent years, VPS has consistently held the number one position. However, after years of widening the gap with its competitors, VPS’s market share is showing a downward trend.

VPS reached its peak in 2023, with a market share of 19.06% on HOSE, 25.44% on HNX, and 26.95% on UPCoM. Since then, the company’s market share has continuously declined across all three exchanges, falling to 16.94% on HOSE, 19.09% on HNX, and 21.22% on UPCoM by the end of Q1/2025.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

Among the runners-up, several companies are demonstrating their ambition to increase market share or, at the very least, maintain their position.

MB Securities (MBS) aims for rapid growth in brokerage market share, targeting a minimum of 6% (aspiring for 6.5%); with a minimum of 2% (aspiring for 2.5%) in digital business market share. This target is considered ambitious, as the last year the company surpassed a 6% market share on HOSE was back in 2017. However, MBS is showing its efforts, as its market share at the end of Q1/2025 on HNX and UPCoM simultaneously crossed the 6% threshold, reaching 6.29% and 6.43%, respectively.

As for Vietcap Securities, based on the expanded capital base achieved in 2024, the company aims to focus its resources on continuing to invest in technology and improving service quality to develop and expand its brokerage market share (including both individual and institutional clients). Their goal is to firmly maintain their position in the top 5 securities companies with the largest brokerage market share on the HOSE exchange and to continue leading in institutional client brokerage market share.

By the end of Q1/2025, Vietcap temporarily climbed to the 4th position in the HOSE rankings.

Dragon Vietnam Securities (VDS) aims to maintain its market share by enhancing the quality of its consulting services, simplifying processes, strengthening customer care, and regularly measuring and evaluating its performance. Similarly, KIS Vietnam Securities has set a notable target for 2025, aiming to maintain its position in the top 9 brokerage market share and striving for an even higher rank.

Moreover, although not aiming to break into the top 10, many companies are also displaying clear objectives regarding market share.

At the 2025 Annual General Meeting of Phu Hung Securities (PHS), a market share target of 1.23% was approved. This figure was calculated based on trading indices of the 3 exchanges – HOSE, HNX, and UPCoM, as well as PHS’s data. Chen Chia Ken, the CEO, personally shared that, in the short term, brokerage remains PHS’s core business and will continue to receive significant investment. The launch of their Mobile App Trading in 2024 is a testament to this, with the source code developed by the company itself. Moving forward, the company will continue to enhance its software and trading system features, ensuring full ownership of the source code to facilitate the development of unique products in the market.

The CEO also mentioned that PHS will leverage AI, not only for its brokerage division but also for its analysis, consulting, and other departments.

For Baominh Securities (BMSC), increasing brokerage market share is one of its strategic focuses for 2025. At the recent Annual General Meeting, CEO Phan Tan Thu shared that BMSC’s brokerage business is still very modest and lacks the tools to expand its client base. However, the company has ample room for growth. BMSC plans to reduce lending rates, build a margin basket, focus on VN30 stocks, and more. They aim to attract new and potential clients, provide care for high-volume traders, and launch a trading app in Q2 to diversify trading channels for investors and enhance service quality.

Similarly, OCBS Securities aims to break into the top 15 market share after undergoing a significant restructuring process.

While brokerage remains a key focus, the industry faces significant challenges.

Brokerage has long been known as the core activity of a securities company. However, the landscape has evolved in recent years. Nowadays, the revenue structure of a securities company is typically diversified, with the most common being the “three-legged stool” model comprising brokerage, margin, and proprietary trading. In the past few years, the brokerage segment seems to be losing its importance. In 2021, 41 companies had brokerage segments contributing over 25% to their revenue. This number has consistently declined in subsequent years, falling to 30 companies in 2022, 21 companies in 2023, 16 companies in 2024, and only 8 companies by the end of Q1/2025.

It’s evident that the wave of reduced or zero-fee trading is pushing securities companies into fierce competition for market share.

The zero-fee trend is driving securities companies into intense competition for market share – Illustrative image

|

At the 2025 Annual General Meeting of FPT Securities (FPTS), CEO Nguyen Diep Tung revealed that the expected challenges in the brokerage business were a key reason for the company’s cautious planning. The primary factors included the zero-fee policies of securities companies, which reduced revenue from this segment, and lower margin lending rates. CEO Tung emphasized that securities companies’ growth relies on trading fees, margin lending, and proprietary trading, and as FPTS did not foresee significant growth in these areas, they maintained a similar plan to 2024.

Assessing the Q1/2025 performance of the securities industry, Mr. Nguyen Viet Duc, Director of Digital Banking at VPBankS, noted a clear polarization. The largest market share holders, such as SSI and TCBS, generally maintained steady growth of 8-9%, with supporting businesses. Notably, companies affiliated with banks witnessed substantial profit increases, including VPBankS, MBS, and HDS. Overall, companies that could provide margin lending and had the backing of a banking system to sell bonds performed well.

There were two groups with negative results. Firstly, many small-scale companies incurred losses due to their heavy reliance on brokerage fees and individual investor lending. However, in Q1, the industry-wide brokerage fees decreased due to intense competition, while individual investor lending did not recover significantly. Consequently, small companies without a banking background are likely to continue facing challenges.

Secondly, companies heavily dependent on proprietary trading were also impacted, as the stocks they favored in the past did not perform well in Q1.

Thus, the brokerage business plays a significant role in the polarization of financial performance among securities companies.

– 10:00 23/05/2025

The Great Credit Surge: A Record-Breaking Quarter with a $35 Billion Rise

As of the end of Q1 2025, the total lending balance across the market reached an astounding VND 280,000 billion, with margin lending estimated at a record-breaking VND 273,000 billion.

VCBS Ranks in the Top 10 Brokerage Firms by Market Share in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) unveiled the top 10 securities companies with the largest brokerage market share in Vietnam. This list showcases the leading firms in the industry, commanding a significant portion of the market and playing a pivotal role in shaping Vietnam’s burgeoning investment landscape.

Tomorrow’s Stock Market Outlook, November 29: Will Profit-Taking Pressure Subside?

In the November 28 stock session, profit-taking selling pressure on stocks eased. Investors hope that this signal will persist into the next session.