According to data from Batdongsan.com.vn, after a bustling March, the real estate market showed signs of cooling down in April 2025. This adjustment was partly due to the extended holiday period, which caused a widespread slowdown in search and transaction activities.

Specifically, in the rental segment, the level of interest in April decreased by 19% compared to the previous month, while the number of new listings also narrowed by 13%. Similarly, in the buying and selling market, interest decreased by 18%, and the number of sales listings decreased by 6%.

Notably, the demand for rental real estate segments is exhibiting seasonal trends. As we have not entered the peak season yet, interest in April 2025 for most property types decreased compared to the previous month. Specifically, searches for apartment rentals decreased by 19%, detached houses by 20%, rooms for rent by 20%, and shophouses by 22%.

Following this trend, the number of rental listings also decreased across the board. The apartment segment decreased by 6%, detached houses by 5%, shophouses by 7%, and rooms for rent by 9%.

The buying and selling market saw only minor adjustments in the number of listings, indicating that sellers remain optimistic about long-term demand.

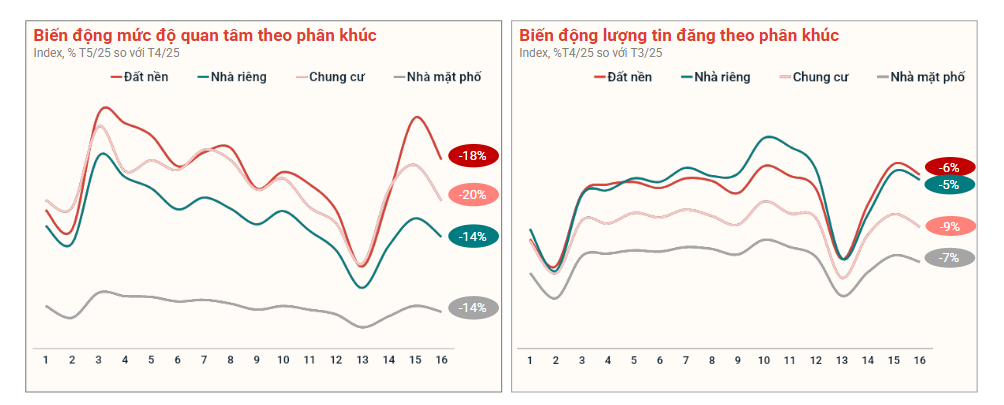

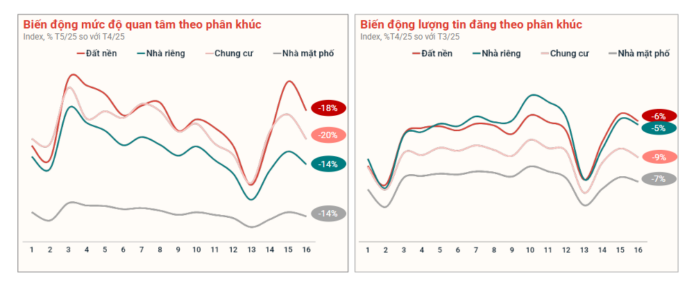

Meanwhile, in the buying and selling market, the number of listings only underwent minor adjustments, suggesting that sellers are still optimistic about long-term demand. However, buyers’ interest across segments showed a noticeable decrease compared to the previous month. Specifically, searches for land plots decreased by 18%, apartments by 20%, detached houses by 14%, and shophouses by 14%.

At the same time, the number of sales listings across segments also declined, with land plots down by 6%, detached houses by 5%, apartments by 9%, and shophouses by 7%.

The latest report from DKRA Group also noted that during the first three weeks of April, real estate transactions in the southern region, including Ho Chi Minh City, Binh Duong, Long An, Dong Nai, Ba Ria-Vung Tau, and Tay Ninh, decreased by 30-40% compared to the previous month. This decline occurred in both practical products such as apartments and investment-oriented products such as land plots, shophouses, and resort real estate.

The market absorption rate was also low, with apartments reaching only 22%, landed houses at 21%, while land plots and resort real estate fluctuated between 3-6%. For more than half of April, the market was almost frozen, with transactions concentrated at the end of the month and the beginning of May.

In the northern region, typically in Hanoi, a decrease was also recorded – according to data from the Market Research and Customer Insight Center of One Mount Group, in the first quarter of 2025, Hanoi recorded approximately 18,300 real estate transactions, a 14% decrease compared to the same period last year.

According to this unit, the real estate market for residential land in Hoang Mai district continued the downward trend in March, with a 26% decrease in transactions compared to the previous month. The situation was even more subdued in Dong Da district, which recorded a 70% drop in transactions.

Mr. Dinh Minh Tuan, Southern Regional Director of Batdongsan.com.vn, attributed this market stagnation to three main reasons: the cooling down of expectations regarding administrative mergers, new supply mainly belonging to the high-end segment beyond the affordability of most buyers, and the cautious sentiment among small-scale investors after several land price surges.

Land prices in various localities have seen significant fluctuations compared to the previous quarter, mainly due to information about the merger of provinces and cities.

According to the Ministry of Construction, land transactions and prices in various localities have experienced significant fluctuations compared to the previous quarter, mainly due to information about the merger of provinces and cities. In the provinces and cities selected as locations for new administrative centers, price levels have been pushed up, and transaction volumes tend to increase.

However, the Ministry affirmed that the growth in prices and transaction volumes in these areas involves speculation and entails risks for the market. The Ministry’s report also stated that the authorities in these localities have had to warn about this situation, while strengthening control and management of the market.

Although the market in April was rather subdued, many units reported a revival starting in early May. Experts expect that in the second half of the second quarter of 2025, the real estate market will recover due to the push from public investment, key infrastructure projects, and diverse supply catering to various customer segments.

The New Halong Bay Condo Market: High Compression, Opportunities for the Early Birds.

The Halong real estate market is experiencing an extended period of accumulation, with a stagnation in the supply of high-rise apartments. However, the first signs of recovery are emerging, presenting opportunities for astute investors with a keen eye for future trends and a willingness to embrace the right segments.

Unstable Real Estate Market: Vice Premier Addresses Vietnam’s Volatile Property Prices and Their Impact on Credit and Finance.

Let me know if you would like me to tweak it further or provide additional suggestions!

“The Deputy Prime Minister highlighted the ongoing instability in the real estate market, underscoring how research reveals that the rate of increase in property prices in Vietnam is among the highest globally. This concerning trend is coupled with a decreasing affordability of housing for citizens. This alarming situation warrants immediate attention and strategic interventions.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)