After facing downward pressure in the first session of the week, the VN-Index witnessed a positive turnaround, influenced by the strong performance of large-cap stocks. The index closed with a gain of 18.86 points (+1.45%) at 1,315.15, surpassing the psychological resistance level of 1,300. However, foreign investors’ net selling of nearly VND 561 billion on the overall market was a downside.

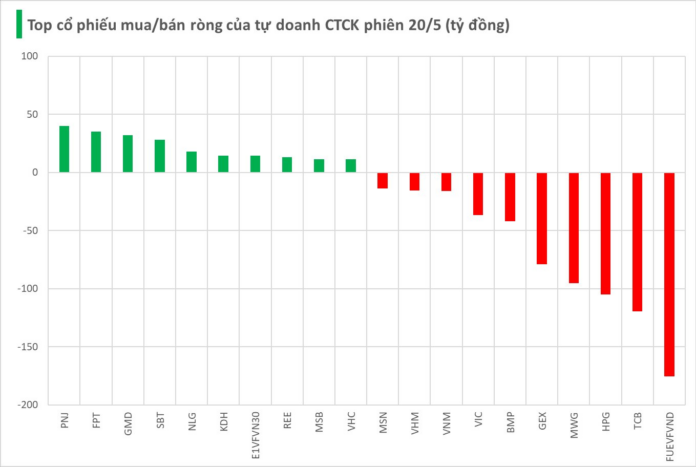

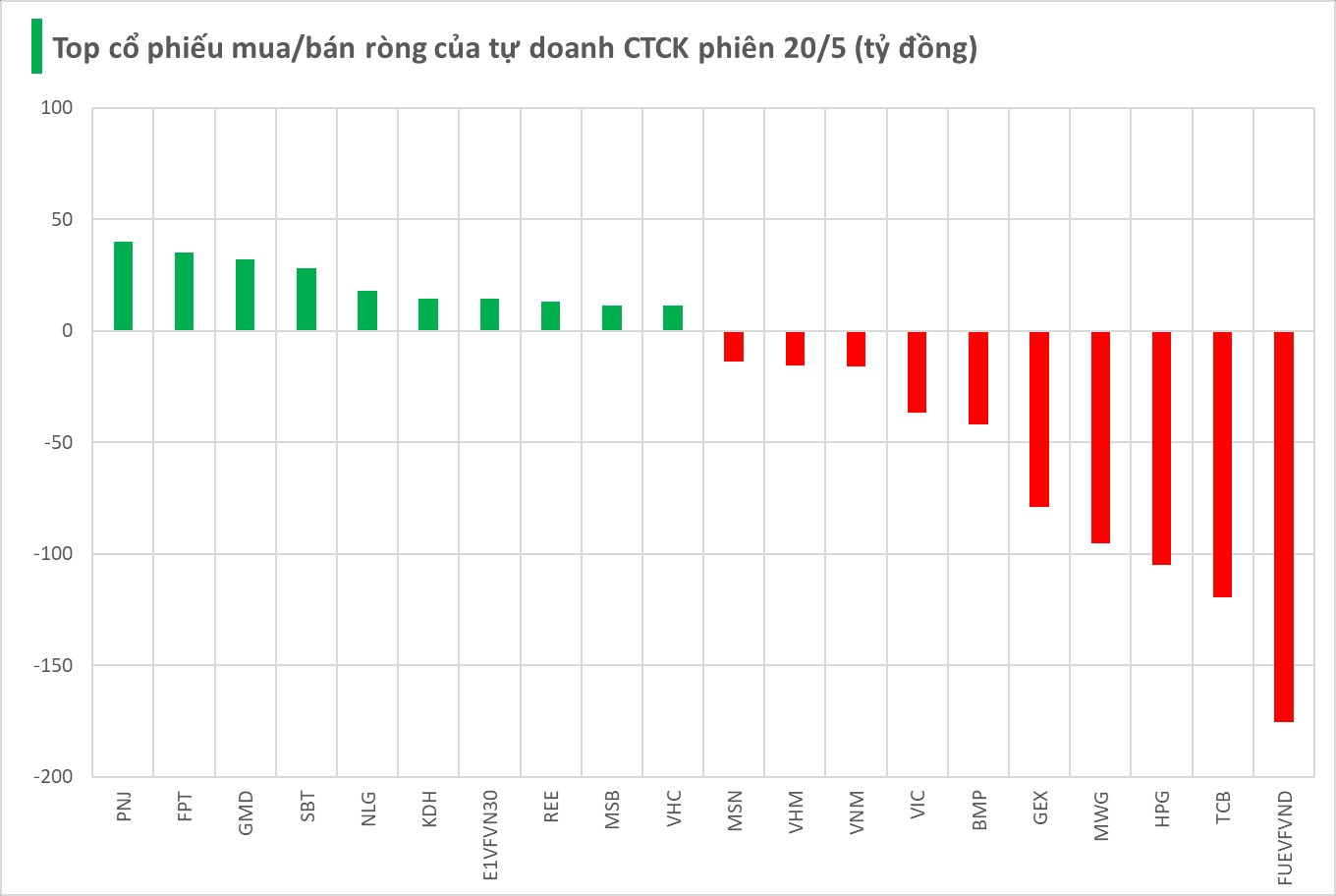

Securities companies recorded a net sell value of VND 418 billion on the HoSE exchange.

The Billionaire’s Assets Surge to Unprecedented Heights

“Vingroup’s stock surge: VHM and VIC soar to new heights. In a thrilling rally, Vingroup’s stocks witnessed a substantial surge with VHM and VIC reaching their peak. This exhilarating performance has propelled billionaire Pham Nhat Vuong’s net worth to a record-breaking $10.2 billion, according to the latest updates from Forbes.”

Technical Analysis for May 21: A Cautious Sentiment Prevails in the Market

The VN-Index and HNX-Index moved in opposite directions during the morning session, with the latter experiencing a significant drop in liquidity. This cautious investor sentiment indicates a hesitant approach to trading, with a potential wait-and-see attitude prevailing in the market.

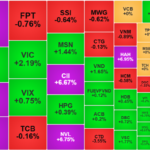

The Great Divide: Mid-Range Stocks on the Rise

The money flow showed a shift towards mid- and small-cap stocks in the afternoon session, with many of these stocks witnessing a sharp rise in prices. While the large-cap VN30 stocks still hold the majority weight on the HoSE exchange, it is the smaller stocks that are currently the main attraction for individual investors.