Has the C-segment Sedan Lost its Appeal to Vietnamese Car Buyers?

Just under a decade ago, the C-segment sedan was the default choice for urban middle-class car buyers. Names like the Mazda3, Toyota Corolla Altis, and Kia Cerato (now K3) once sold thousands of units every month, ranking among the top 10 best-selling cars in the market.

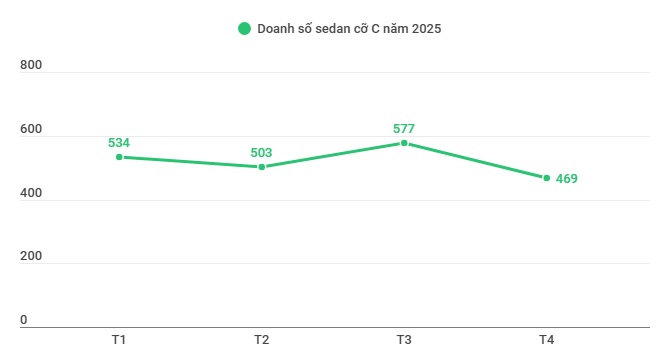

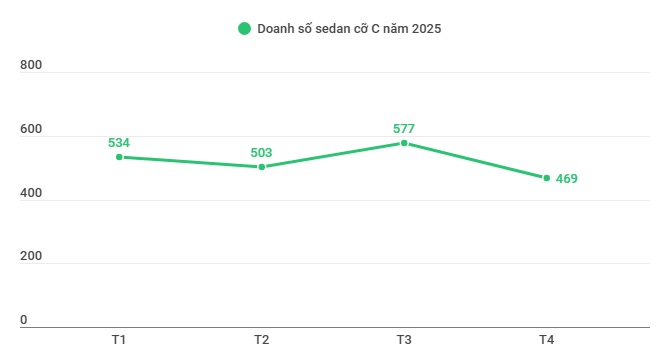

However, in April 2025, the entire segment sold only 469 units, less than the sales figure of a single B-segment SUV model, the Hyundai Creta (over 1,000 units). Mazda3, despite being the brightest name in the segment, sold only 204 units. As of the first four months of the year, the total sales of C-segment sedans barely reached 2,000 units—a surprisingly low figure.

Specifically, in the first four months of 2025, the Mazda3 led the segment with 865 units sold, followed by the Kia K3 with 650 units, Honda Civic with 243 units, Hyundai Elantra with 231 units, and Toyota Corolla Altis with just 94 units.

Monthly sales of C-segment sedans in 2025.

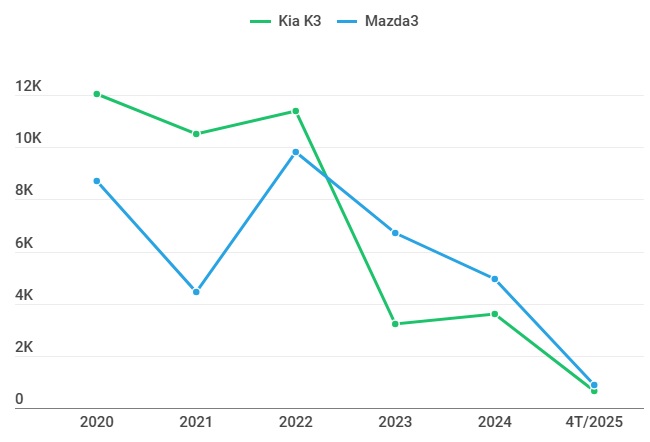

Five years ago, the Kia K3 alone sold over 12,000 units, while the Mazda3 sold about 8,000 units in 2020. But in 2024, these figures dropped to around 3,600 and 4,900 units, respectively—a decrease of two-thirds and half, respectively. If the current sales trend continues, 2025 will likely extend the sad record of C-segment sedans in the Vietnamese market.

This is not just a “slump” but a clear decline. Vietnamese consumers are no longer interested in sedans, especially those priced at 700–900 million VND—a range where they now have many more attractive options. The segment’s saturation, coupled with the shift towards SUVs and electric vehicles, has caused C-segment sedans to gradually fade into oblivion.

SUVs, Crossovers, Electric Vehicles, and the “Blood Transfusion” of Automotive Consumer Taste in Vietnam

The decline of C-segment sedans reflects the most significant change in Vietnamese car-buying habits: from “beautiful, city-friendly cars” to “versatile, comfortable, high-riding, and airy vehicles.” The rise of urban SUVs like the Toyota Corolla Cross, Hyundai Creta, Kia Seltos, and more recently, electric vehicles like VinFast VF 6, is the clearest evidence of this shift. At the same price as a C-segment sedan, consumers can easily choose a high-riding SUV with a modern design, more features, a more airy cabin, and even better fuel efficiency.

The downward trend of the two best-selling C-segment sedans in the market during 2020-2025.

Meanwhile, C-segment sedans are increasingly seen as mediocre. Compared to B-segment sedans, these cars are more expensive but do not offer a significantly different experience. Compared to similarly priced SUVs, they lose out on utility and modern aesthetic appeal. This segment is “beautiful but not striking, luxurious but not quite, convenient but not truly versatile”—a hard sell to new customers.

Additionally, many C-segment sedans in Vietnam have lost their brand value advantage. The Kia K3 has lost its appeal as a “great value for money” car. The Toyota Altis is no longer the “symbol of durability” as customers now have many other equally durable options. The Mazda3, although still the best-selling model in the segment, no longer creates a wave of excitement as it did when it was known for being “youthful and prominent” from 2015 to 2018. The Honda Civic, with its mature and sporty design, has become too niche and expensive, no longer catering to the mass market. As for the Hyundai Elantra, despite its recent refresh, it has not left a strong impression, only managing to maintain its presence without significant growth.

C-segment sedans are no longer in line with market trends.

Even with active price reductions and promotions to stimulate demand, sales of these models have consistently declined year after year. From 2020 to the present, the sales volume of this segment has decreased by about 60-70%, indicating a natural decline in demand—not just due to competition or economic factors.

Looking at the structure of Vietnam’s automotive market in 2025, it is clear that the C-segment sedan has lost its place. The thriving segments are B-segment SUVs, small electric vehicles, and recently, affordable MPVs. They all have one thing in common: they cater well to young families, suit urban roads, and match market preferences. C-segment sedans do not fulfill these criteria and lack the uniqueness to create a “segment of their own.”

The Vietnamese automotive market is undergoing a clear phase of differentiation: those who are agile and adapt to trends will survive, while those who cling to an old “legacy” will be left behind. The C-segment sedan is a classic example. It’s not that the cars have become worse, but consumer habits have irreversibly changed. In this equation, the C-segment sedan is a piece that no longer fits.

The Power of Partnership: Grab’s Collaboration with the World’s Leading Electric Vehicle Manufacturer Guarantees Driver Income of VND 25 Million per Term

With this agreement, Grab guarantees that drivers can earn an impressive income of 20 to 25 million Vietnamese Dong during each 30-day work period.

“City Auto’s Shareholder Meeting: Foraying into Electric Vehicles, Electing Chairman’s Son to the Board”

At the 2025 Annual General Meeting held on the morning of May 20, City Auto Joint Stock Company (HOSE: CTF) unveiled several new strategic orientations. Notably, the company announced its plans to expand into the electric vehicle sector and its ambition to move deeper into the automotive value chain, aiming to transcend its traditional role as a mere distributor.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)