VNECO’s Stock Surges Amidst Market Cooldown

The Vietnamese stock market is experiencing a slowdown after a period of recovery. Against this backdrop, the shares of VNE, owned by Vietnam Electrical Construction JSC (VNECO), stand out as a bright spot. On May 23, VNE’s share price surged to a daily gain of 6.81%, closing at 6,740 VND per share, the highest level in 17 months.

The trading volume of matched orders surged to over 2.5 million units, the highest in 1.5 years (since November 2023).

Thus, after the “crash” phase in early April 2025, VNE’s stock witnessed a strong rally of 186% in value in just under 2 months.

VNE’s share price performance

It is worth recalling that in early February 2025, HoSE had issued a notice regarding the potential delisting of VNE due to delayed submission of audited financial statements for 2024, the third consecutive year. However, the company has since addressed this issue.

Currently, VNE is classified as a warned and controlled security due to its unprofitable business operations.

Bleak Business Performance

According to our understanding, VNECO was established in 1988 from the merger of two companies, namely Construction Company of Power Lines and Substations 3 and Construction Company of Power Lines and Substations 5. VNECO operates in the field of technical, construction, turnkey equipment supply, technology transfer, and investment in renewable energy projects, power transmission, and substations for the power industry, industry, and infrastructure. The company privatized in 2005 and listed its shares on HoSE in 2007.

As a leading electrical construction company, VNECO was once highly regarded by securities companies for its prospects in the coming time due to the increasing demand for construction and repair of high-voltage power lines and substations in Vietnam. Especially after the approval of the Power Plan 8, the demand for investment in upgrading the power grid infrastructure accounts for about 11% of the capital needs of the power industry in the period 2021 – 2030, equivalent to 1.48 billion USD per year; 7% in the period 2031 – 2050, equivalent to 1.74 billion USD per year.

The 500 kV line extension project (Quang Trach – Pho Noi) with a total investment of 23,000 billion VND is being promoted by the management agency and is expected to be implemented in the last months of 2023 and completed in June 2024. MBS Securities assesses VNECO as one of the beneficiaries when this project is implemented, undertaking the construction stage.

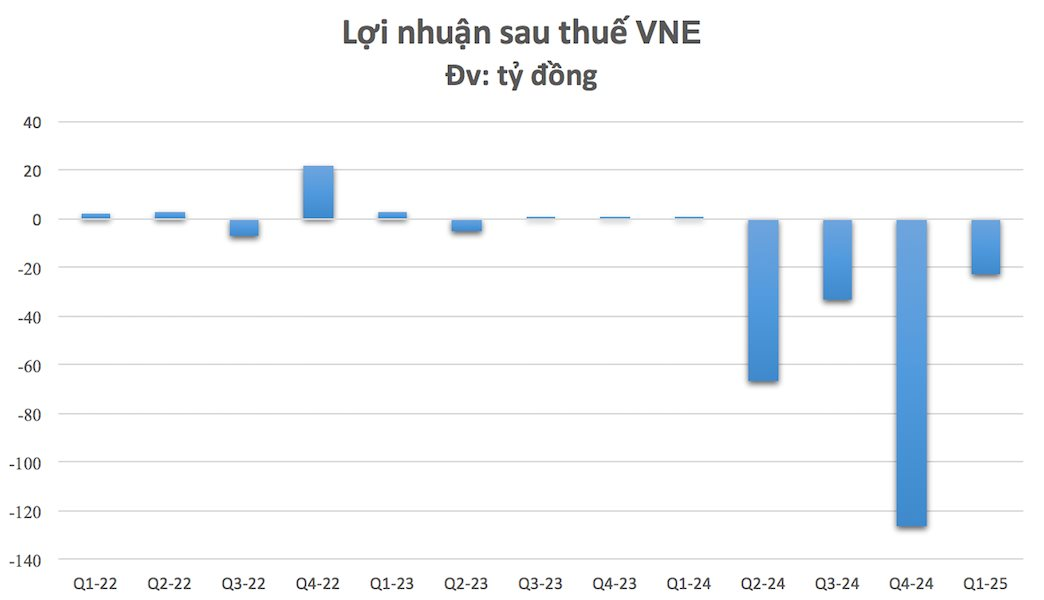

However, in recent years, VNECO has witnessed a decline in business results. The company started making losses in 2023 and recorded its heaviest loss in history in 2024 with a loss of up to 266 billion VND.

In the first quarter of 2025, VNE recorded revenue of VND 66 billion and gross profit of VND 17 billion. However, interest expense reached VND 30 billion, and management expenses were over VND 9 billion. As a result, VNE reported an after-tax loss of VND 23 billion, marking the fourth consecutive quarterly loss.

VNE’s financial highlights

The Foreigners’ Buying Spree Continues: Over $4 Million Net Buying in a Single Stock Trading Session

Foreign sell-side transactions were a positive factor, with net buying of nearly 69 billion VND in today’s session.

Stock Market Update for Week of May 19-23, 2025: Navigating Volatility Around the 1,300-Point Mark

The VN-Index demonstrated resilience by rebounding above the reference level following an extended period of volatility and below-average trading volume. This recovery indicates a cautious sentiment among investors. However, the resumption of net selling by foreign investors has introduced challenges, causing fluctuations around the 1,300-point mark and presenting obstacles to sustaining the upward momentum in the near term.