“Vietnam’s Banking Landscape: Streamlining Physical Presence and Embracing Digital Transformation”

A strategic shift is underway in Vietnam’s banking industry, with prominent players like Sacombank and SCB trimming their physical branch and transaction office presence. Sacombank resolved to cease operations at five transaction offices in Ho Chi Minh City, reducing its total count to 437 for 2024. SCB followed suit, shutting down three transaction offices in the same city. This move aligns with a broader trend among leading banks to streamline their physical footprint.

VietinBank, one of the ‘Big Four’ banks, recently ceased operations at seven transaction offices across various provinces and cities, including Hanoi, Ho Chi Minh City, Gia Lai, Quang Ninh, and Dong Nai. This decision came after the closure of 25 transaction offices in March. VietinBank’s chairman, Tran Minh Binh, affirmed their commitment to a leaner, more efficient network, leveraging digital transformation and AI in customer care and governance.

Banks Adopt a Cautious Approach to Branch and Transaction Office Expansion

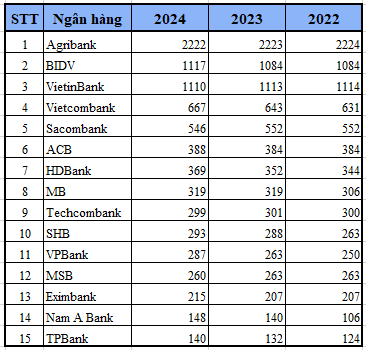

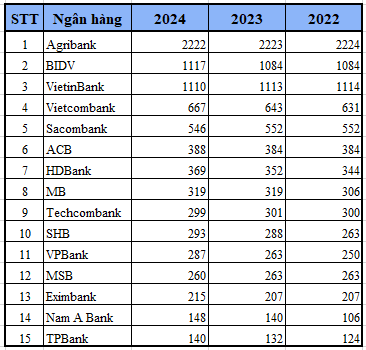

The once-fierce race to expand physical branches and transaction offices among domestic banks has noticeably slowed. While HDBank, Nam A Bank, BIDV, and Sacombank aggressively expanded their networks between 2018 and 2019, the pace has since decelerated. This shift is evident in the relatively stable number of transaction offices maintained by Agribank, the current leader with over 2,200 offices nationwide.

Domestic Branch and Transaction Office Count for Select Banks: 2022-2024 (Annual Report Data)

Vietcombank and BIDV, renowned for their substantial assets, have adopted a measured approach, adding around 20 transaction offices annually. Private banks like Techcombank, SHB, and ACB have maintained stable networks, while Sacombank has proactively reduced its transaction office count.

While physical expansion enhances brand visibility and customer reach, it also inflates operational costs, especially in rural areas with lower transaction volumes. The surge in digital transactions and online banking further diminishes the necessity of extensive physical networks.

Vu Viet Dung, Chairman of KeyPerson Academy, asserts that the ‘Big Four’ banks’ network restructuring is long overdue. He observes instances of transaction offices clustered within close proximity, indicating a lack of clear network planning.

In Hanoi and Ho Chi Minh City, where transaction offices are most concentrated, there are 109 pairs of offices within a 1km radius and 41 pairs within a 500m radius.

Mr. Dung predicts that smaller and medium-sized banks will continue physical expansion, while larger institutions will explore flagship branches and automated transaction offices. However, the latter option entails higher setup and maintenance costs, alongside increased personnel requirements.

Transaction offices will increasingly focus on delivering enhanced services and experiences for VIP customers, reflecting the anticipated growth trajectory of Vietnam’s market. In the credit sector, banks are expected to establish centralized hubs for specialized loan services, optimizing efficiency and productivity.

This evolving landscape underscores the delicate cost-benefit analysis banks must undertake when weighing the deployment of human resources versus technology, particularly in VIP customer consulting and lending, where fraud risks remain a concern.

Payment Agency Model: A Viable Alternative for Rural Penetration

As banks gravitate towards urban areas for higher efficiency, the payment agency model emerges as a cost-effective strategy to enhance rural presence. In 2024, VPBank and The Gioi Di Dong (Mobile World) forged a partnership, enabling customers to access essential banking services, including deposits, withdrawals, transfers, and account openings, at Mobile World and Dien May Xanh stores nationwide.

This collaboration empowers VPBank, previously concentrated in Hanoi and Ho Chi Minh City with approximately 300 transaction offices, to leverage Mobile World’s extensive network of nearly 3,000 stores. It also facilitates cross-selling opportunities by tapping into Mobile World’s existing customer base.

Techcombank previously expressed interest in similar collaborations with One Mount Group, Vinmart, and Vinshop for basic financial services. Additionally, between 2014 and 2015, the State Bank of Vietnam (SBV) piloted three bank agency models: MBBank-Viettel, PGBank-Petrolimex, and Vietcombank-FPT Retail.

Given the tangible benefits, financial institutions and fintech enterprises eagerly anticipate the government and SBV to finalize the legal framework for the widespread implementation of this model.

In June 2024, SBV issued Circular No. 07/2024/TT-NHNN, effective from July 1, 2024, providing an expanded range of services for payment agency models compared to previous pilot programs, encouraging wider adoption.

However, Vu Viet Dung emphasizes the critical need for comprehensive training and supervision of staff at these “bank agencies” to maintain customer trust and mitigate potential risks associated with the unique nature of the banking industry.

A Transformational Year for PGBank: Rising to New Heights

In 2025, PGBank aims to build on its transformative progress in 2024 and forge ahead with robust, efficient, and sustainable growth. This ambitious goal will be achieved through a continued focus on process optimization, strategic expansion, vigorous brand-building, and enhancing the customer experience.

“Over 108 Million Customers’ Biometric Data Verified: Unlocking the Power of Secure Authentication.”

“After a 10-month pilot of biometric authentication using the National Population Database (via CCCD chip-enabled cards and VneID), over 108 million customer records have been collected and cross-referenced with biometric data. Payments have been processed smoothly, and this initiative has helped curb incidents of fraud and financial loss for customers.”

“Vietnam Airlines and FPT: Forging Ahead with Next-Gen Aviation Technology”

Vietnam Airlines and FPT have joined forces, signing a comprehensive strategic cooperation agreement with a shared vision of digital transformation. This partnership aims to enhance operational capabilities and optimize the customer experience through innovative solutions. With FPT’s expertise in technology and Vietnam Airlines’ commitment to excellence, this collaboration is set to revolutionize the industry, taking both companies to new heights.

The Ultimate Guide to Online Doormat Sales: How Three Entrepreneurs Navigated Village Traditions to Tap into the Digital Market

The story of Thân Vui straw mats and the centuries-old craft of the village came to life online, despite initial hesitance and the challenge of shipping bulky items. With a presence on TikTok Shop, the artisans, who grew up amidst the straw, have overcome exploitation by traders, fulfilling over 30,000 orders and selling 200,000 mats annually.

“Empowering Vietnamese Enterprises: Marching Alongside the Nation’s Private Sector Development”

Aiming for the Government’s targeted GDP growth rate of 8%, Resolution No. 68-NQ/TW positions the private sector as the central driving force of the economy. Masan (HoSE: MSN) is expected to be one of the exemplary consumer-retail businesses, actualizing this orientation through its strategy of developing domestic value chains.