On April 2, the US announced new retaliatory tariffs. The results showed that many countries were subject to a minimum tax rate of 10%; Vietnam was taxed at 46% on all imports (except for gold, aluminum, and steel). This number came as a surprise to the stock market. On April 3, the VN-Index lost over 81 points, plunging to 1,236, with 247 stocks hitting the daily limit down across all three exchanges.

The index continued to evaporate to 1,073 points and then attempted to recover with dozens of alternating up and down phases. As of May 21, about two months after the US announced the 46% retaliatory tariff, the index has rebounded to the old peak of 1,321 points.

The recovery efforts during this period were mainly due to the US delaying the imposition of tariffs on Vietnam for 90 days and ongoing negotiations. President Donald Trump and China reached a “truce” agreement, reducing tariffs on China to 30%.

Domestically, the National Assembly has just passed Resolution 68 on private sector development. After the 1986 Renovation, this is the second time that Vietnam has undergone a strong renovation in the private economic sector. The State Bank launched a credit package of VND 500,000 billion for infrastructure and digital technology lending. Along with a series of solutions to promote domestic public investment, this has brought positive expectations for the stock market recovery.

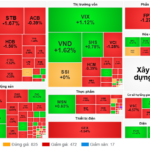

However, statistics show that during this period, there has been a profound differentiation between industries and between stocks within the same industry. The growth of the VN-Index was mainly driven by real estate, especially the VinGroup group, along with banks, while most other industries have not returned to their old prices.

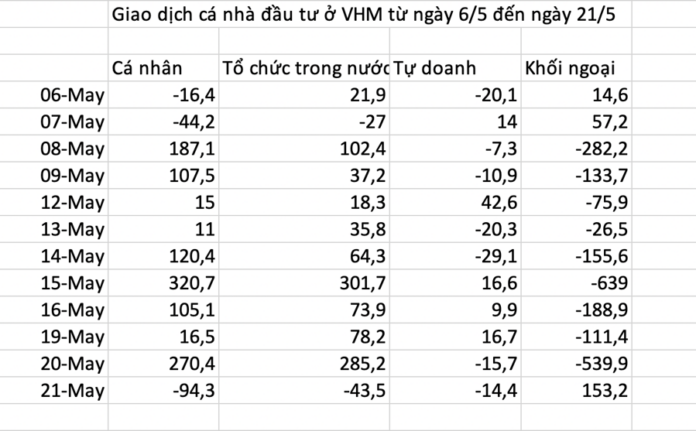

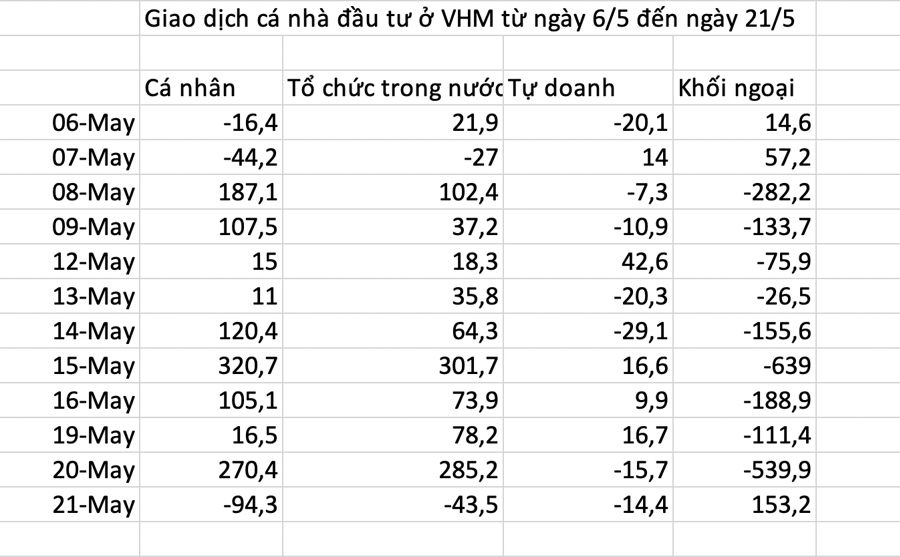

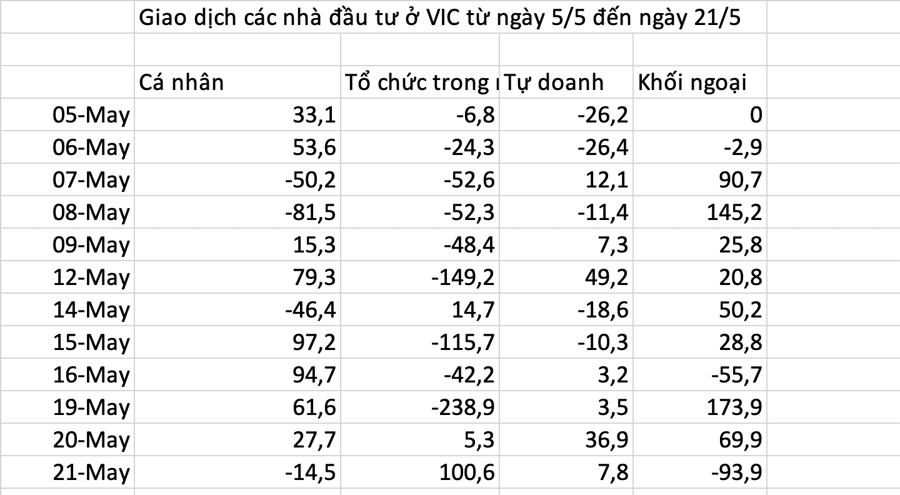

Specifically, from the April 10, 2025 session, when the VN-Index started to recover, VIC shares surged 63.86%, VHM rose 38.76%, and VRE increased by 42.78%, while the VN-Index recovered by 23% compared to the bottom session. In addition, the newly-listed VPL shares also rose sharply by 34.78%. This group was the main driver of the VN-Index recovery in the past period. Notably, just four stocks, VIC, VHM, VRE, and VPL, contributed nearly 11 points on May 20. Since the beginning of the year, VIC has surged 130.83%, VHM has gained 68.25%, and VRE has climbed nearly 50%.

In addition, there are some other stocks that have also contributed to the VN-Index recovery, such as TCB, GEE, MBB, SHB, LPB, and HVN.

The explosion in Vin Group’s stocks is believed to be due to three main factors: First, the listing of VPL, a subsidiary of Vinpearl, has raised great expectations among investors. Second, Vingroup Joint Stock Company is one of the contractors for the construction of the Tu Lien Bridge – one of Hanoi’s key infrastructure projects, which officially started on May 19.

Especially recently, VinSpeed, a subsidiary of Vingroup, has proposed to invest in the North-South high-speed railway project, with an investment of about VND 1,562,000 billion, equivalent to about USD 61.35 billion, excluding compensation, support for relocation, and resettlement costs for site clearance.

On the other hand, most other industries have not been able to return to their old prices. Accordingly, the performance of the seafood industry is still down 23.3% compared to the old peak of 1,300 – 1,315 points; Rubber is down 20.6%; Textile is down 18.8%; Industrial Real Estate is down 16.2%; Insurance is down 14.9%; Technology is down 14.8%; Securities is down 7.3%; Construction and Building Materials are down 7.7%.

Typical stocks in each industry such as ANV are still down 8.79% from the old peak; VHC is down 14.33%; MPC is down 23.13%. Industrial real estate stocks like KBC are down 13.42%, and SIP is down 22.48%. Textile stocks include MSH, down 15.54%, and TNG, down 19.73%…

Commenting on the market trend, Mr. Nguyen Viet Duc, Director of Digital Business, VPBank Securities Company, said that for leading stocks, investors should not expect the trend to stop.

For VIC, when this stock loses the MA50, it will peak. Currently, the levels of 80,000, 100,000, or 120,000 VND/share are entirely dependent on the market trend, along with the VHM and VRE groups. The green stocks in this session will be the leading stocks in the second half of the year, including real estate stocks (VIC, VHM, VRE), banks (VPB, TCB, ACB, and HDB), and retail stocks (MWG, VNM)…

“The keyword is ‘differentiation.’ Export or FDI-related enterprises will be affected. Consumer and retail businesses will be influenced by consumer psychology. But real estate, banking, and energy stocks are worth watching in the second half,” Mr. Duc emphasized.

According to Mr. Duc, there are currently two scenarios for the Vietnamese market. First, the market will stop and turn to a downward trend. But since it has only increased by 38%, while most markets in the past have risen by more than 100%, there is still room for growth of at least 70%. This level corresponds to the VN-Index reaching 1,900 – 2,000 points. “I am currently inclined to the view that the market will surge strongly like in 2016 – 2017. With the leadership of large-cap stocks like VPB and VIC, this result can happen soon,” Mr. Duc emphasized.

Therefore, in this period, according to Mr. Duc, investors should not hold stocks below 70% of their portfolios. In case tariffs cause fluctuations, the remaining 30% can be disbursed to stocks unaffected by tariffs, such as undervalued bank stocks.

The Market Pulse: Will Profit-Taking Pressure Emerge?

The VN-Index witnessed a negative turn with a significant surge in trading volume above the 20-day average. This indicates profit-taking pressure as the index retests the old peak from March 2025 (around the 1,320-1,340 point range), triggering market jitters. If selling pressure persists in upcoming sessions, the correction risk will escalate. The Stochastic Oscillator, a key indicator, has been in a downward trajectory after signaling a sell-off in the overbought zone. Investors are advised to exercise caution if the indicator falls out of this range in the near term.

“Markets Soaring High: Vietstock Daily Overview for May 21, 2025”

The VN-Index surged, dismissing the previous two sessions’ losses with the emergence of a White Marubozu candlestick pattern. This reflects a highly optimistic sentiment among investors. However, trading volume needs to show a marked improvement for the index to sustain its upward trajectory. If the VN-Index firmly holds above the current level, it may have the potential to revisit the old peak of March 2025 (around the 1,320-1,340 range). Notably, the MACD indicator has maintained a buy signal since late April 2025, boding well for the short-term outlook if this status quo persists.

Market Pulse May 24: Extended See-Saw Movement, Foreigners Resume Net Selling

The market closed with the VN-Index up 0.62 points (+0.05%), reaching 1,314.46; while the HNX-Index fell 0.47 points (-0.22%) to 216.32. The market breadth was relatively balanced, with 374 gainers and 371 losers. Similarly, the VN30 basket saw a tight contest between bulls and bears, resulting in 15 gainers, 12 losers, and 3 unchanged stocks.

Market Pulse: Red Alert!

The VN-Index took an unexpected turn in the afternoon session, plunging over 9 points to close lower, contrary to the hopeful trajectory it had set in the morning with a near 9-point gain.

Market Momentum: Sustaining the Uptrend

The VN-Index continued its upward trajectory, retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume maintained above the 20-day average, indicating positive signs of sustained cash flow participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it retests this range. Currently, the MACD indicator has been signaling a buy since late April 2025. If this status quo persists, the short-term outlook for the index remains optimistic.