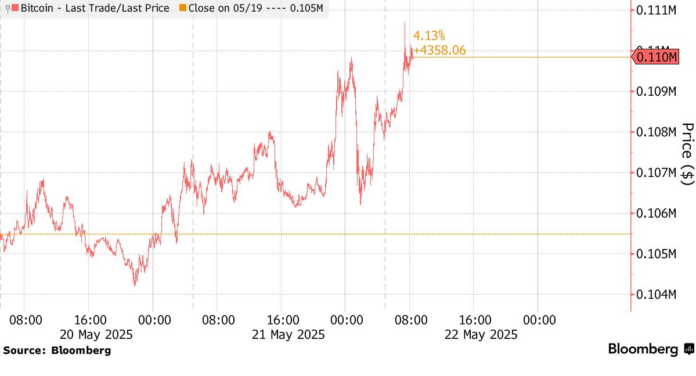

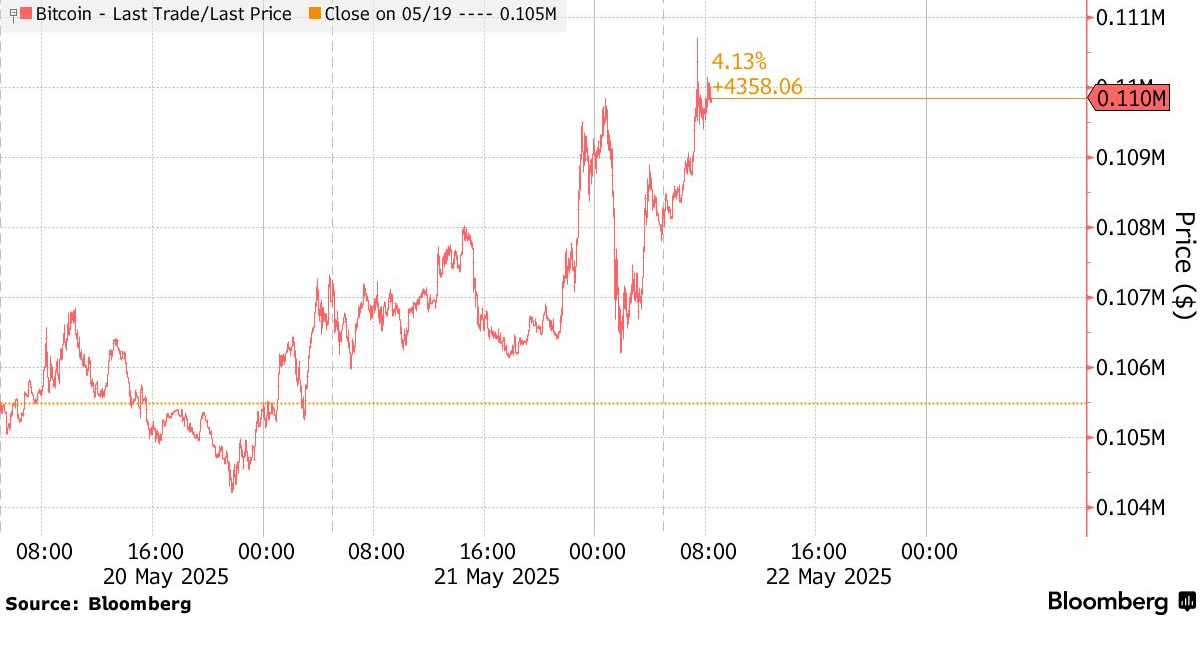

In the early hours of the Asian trading session on May 22, Bitcoin surged 2.2% to reach a peak of 110,707 USD before a slight pullback, according to Bloomberg data.

|

Bitcoin Surpasses $110,000 Milestone

|

|

A stablecoin is a digital currency built on blockchain technology with a stable value. Its price is pegged to another stable asset like gold or fiat currencies such as USD, EUR, or VND. Stablecoins are designed to be global, stable, and decentralized. |

The primary catalyst for this price rally stems from positive signals in American politics. The US Senate’s push for crucial stablecoin legislation has raised hopes for a clearer regulatory framework for crypto operators. This is something the crypto community has long awaited, as transparent regulations will provide a solid foundation for the industry’s sustainable growth.

Additionally, demand from crypto “whales” has significantly driven up prices. MicroStrategy, led by Michael Saylor, boasts a Bitcoin portfolio worth over 50 billion USD, and the list of institutions joining the crypto asset accumulation game is growing.

“This is a slow but steady climb to new highs,” remarked Joshua Lim, co-head of global markets at FalconX Ltd.

Smaller-cap companies that were previously unknown and newly-public firms founded by crypto giants are actively participating in the market. They are employing various financial tools, from convertible bonds to preferred stock, to raise capital for Bitcoin purchases.

One of the most notable moves is the collaboration between Cantor Fitzgerald LP, stablecoin issuer Tether Holdings SA, and SoftBank Group to launch Twenty One Capital Inc. The company is expected to follow a business model similar to MicroStrategy, treating Bitcoin as its primary reserve asset. Simultaneously, a Strive Enterprises Inc. subsidiary co-founded by Vivek Ramaswamy is merging with Nasdaq-listed Asset Entities to form a company specializing in Bitcoin storage and management.

Traders have built positive positions with call options at $110,000, $120,000, and even $300,000 expiring on June 27.

Tony Sycamore, market analyst at IG, asserted that the new record confirms that Bitcoin’s sharp decline from its January 20 high to below $75,000 in April was “a correction within a longer-term uptrend.” Sycamore emphasized, “A sustained break above $110,000 is needed to trigger the next leg up towards the $125,000 level.”

Vu Hao (According to Bloomberg)

– 09:35 22/05/2025

The Crypto Report – May 2025 (Part 1): The Short-Term Tug-of-War

The world of cryptocurrency is ever-evolving, and keeping abreast of the latest trends is essential for investors. This analysis delves into the most prominent and sought-after digital currencies, offering insights for both short-term and long-term investment strategies. With a meticulous examination of market movements and expert insights, this article aims to provide a comprehensive guide to navigating the dynamic landscape of crypto investments.

Tightening the Reins on Virtual and Crypto Assets

The inclusion of specific concepts and classifications of virtual assets, encrypted assets, and cryptocurrencies, along with regulations governing the provision of related services, is essential for safeguarding consumer interests and combating fraud, scams, money laundering, and terrorist financing.