## Vietnam’s Banking Sector Announces Dividend Plans for 2025

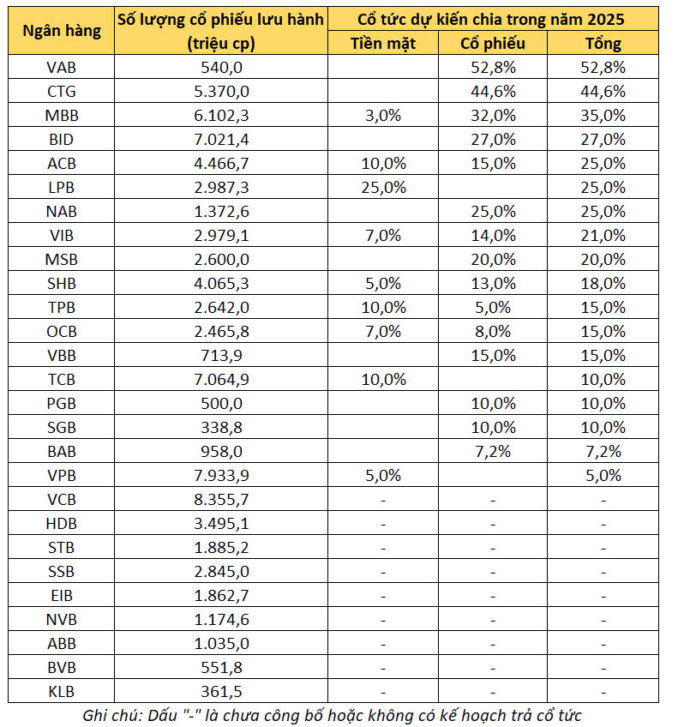

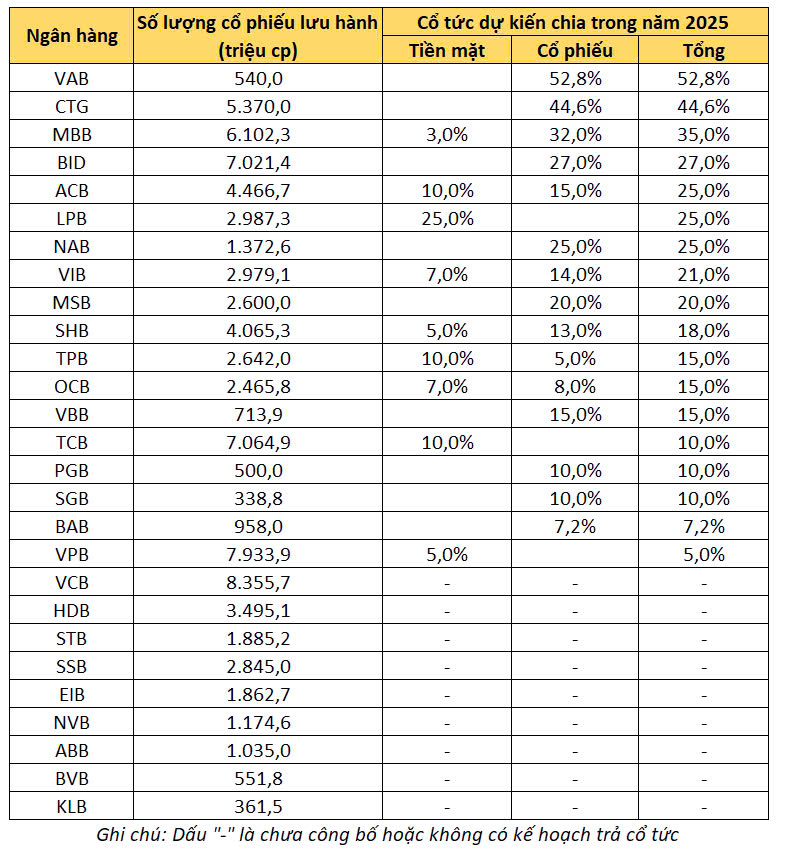

As of now, 18 out of 27 banks listed on the stock exchange have announced plans to distribute dividends or bonuses to shareholders for the year 2025.

With the highest payout ratio in the system, VietABank will issue a maximum of more than 285 million shares to pay dividends to shareholders at a ratio of 52.8% (shareholders owning 1,000 shares will receive an additional 528 new shares).

This is one of the dividend distributions with the highest ratio in the history of VietABank’s operations. The last time VietABank paid dividends was in early 2022, with a ratio of 21.35% in shares.

Mr. Phuong Thanh Long, Chairman of VietABank, said that the dividend distribution would be completed in the third quarter or early fourth quarter of 2025.

At the recent shareholder meeting, VietinBank finalized the plan to increase its charter capital by issuing shares to distribute dividends for the period of 2009 – 2016. Accordingly, VietinBank plans to issue a maximum of nearly 2.4 billion shares to pay dividends to shareholders at a ratio of over 44.6%. The source of funding will come from retained earnings from 2021, 2022, and the period of 2009 – 2016. The General Meeting of Shareholders will authorize the Board of Directors to decide on the specific timing of the issuance after obtaining approval from the competent authority.

Also among the banks with the highest dividend payout plans for 2024 is MB, which expects to use VND 1,831 billion for cash dividends. At the same time, it will issue more than 1.97 billion shares to pay dividends at a ratio of 32%.

At BIDV, the bank will issue a maximum of more than 498.5 million bonus shares (equivalent to 7.1% of the circulating shares as of March 31, 2025) to increase capital from the supplementary capital reserve fund. Simultaneously, it will issue a maximum of nearly 1,397.3 million shares to pay dividends from undistributed accumulated profits in 2023 (equivalent to a performance ratio of 19.9% of the circulating shares as of March 31, 2025).

LPBank finalized its shareholder list on May 20, 2025, to pay cash dividends at a ratio of 25% (one share will receive VND 2,500). With a dividend payout of over VND 7,468 billion, LPBank is the bank with the highest cash dividend payout in the Vietnamese banking system in terms of both payout ratio and payout scale. Dividends will be paid on May 28.

According to the plan approved by the General Meeting of Shareholders, Nam A Bank plans to issue an additional 343.1 million shares to pay dividends this year, equivalent to a ratio of 25%.

ACB recently announced that May 26, 2025, is the record date for the 2024 dividend payment in cash and shares. The ex-dividend date was May 23, 2025.

Accordingly, ACB shareholders will receive a cash dividend at a ratio of 10% (one share will receive VND 1,000). The amount that ACB plans to use for dividend distribution is VND 4,467 billion. Dividends will be paid on June 5, 2025.

For the dividend component in shares, ACB plans to pay at a ratio of 15% (owners of 100 shares will receive 15 new shares). The timing of the dividend payment in shares has not been announced.

As per the plan, VIB will pay a total dividend of 21% for 2024, including 7% in cash and 14% in shares. Previously, the bank finalized its shareholder list on April 23 to pay cash dividends for 2024 at a ratio of 7%.

Recently, the State Bank of Vietnam approved VIB’s charter capital increase of a maximum of nearly VND 4,249 billion in the form of share issuance to existing shareholders and ESOP issuance. Thus, VIB is likely to soon issue nearly 417.1 million shares to existing shareholders, equivalent to a ratio of 14%.

Another bank with a dividend payout of up to 20% in 2025 is MSB. Accordingly, MSB plans to issue a maximum of 520 million shares to existing shareholders as dividends.

In addition to the banks mentioned above, several other banks have also approved dividend payout plans for 2025, with ratios ranging from 10% to 18%, including: SHB, TPBank, OCB, VietBank, Techcombank, PGBank, and Saigonbank.

Nine banks have not announced or do not have plans to pay dividends this year, including: Vietcombank, HDBank, Sacombank, SeABank, Eximbank, NCB, ABBank, BVBank, and Kienlongbank.

“VietABank Forges Strategic Alliance with E.SUN Bank (Taiwan)”

“Hanoi, May 22, 2025 – Vietnam Asia Commercial Joint Stock Bank (VietABank) and E.SUN Commercial Bank (E.SUN Bank) have formalized their strategic partnership and capital funding collaboration with a signing ceremony. This significant milestone underscores the strengthening relationship between these two prominent financial institutions.”

The AI-Powered Bank: Revolutionizing the Workforce

The financial industry is undergoing a significant transformation, with many banks embracing technology and artificial intelligence (AI) to streamline their operations. This has led to a notable reduction in physical branches and staff, as AI steps in as a strategic partner.