Specifically, SSI Securities announced the issuance of 10 million shares under its employee stock ownership plan (ESOP), equivalent to a ratio of 0.51% of the circulating shares at a price of 10,000 VND per share, with a scale of 100 billion VND. The company plans to issue these shares in the second to fourth quarters of 2025. With this ESOP allocation, recipients will only be allowed to transfer 50% of the shares after two years and the remaining 50% after three years from the end of the issuance period.

Previously, the list of 307 eligible employees who can participate in the ESOP program was also announced, with Chairman Nguyen Duy Hung allocated the highest number of shares at 1 million.

SSI’s shareholders also raised questions about the ESOP plan at the 2025 Annual General Meeting of Shareholders. One shareholder expressed concern about the potential impact on investors due to the difference between the current share price of 23,500 VND and the ESOP issuance price of 10,000 VND. In response, Chairman Nguyen Huy Hung emphasized that this issue has been brought up annually, but it is necessary for the company’s growth and benefits both the company and its shareholders.

“The development of the company from its initial chartered capital of 6 billion VND to over 19 trillion VND today is attributed to the significant contributions of our staff. Implementing the ESOP program is one way to attract and retain talented individuals for the future,” asserted the Chairman of SSI.

Chairman Nguyen Duy Hung sharing at SSI’s 2025 Annual General Meeting of Shareholders

|

On May 20, another securities company, Vietcap, announced its plans for an ESOP issuance as well. The Board of Directors of Vietcap passed a resolution to issue 4.5 million ESOP shares, equivalent to 0.627% of the circulating shares, at a price of 12,000 VND per share, totaling over 54 billion VND. Notably, the issuance price is only one-third of the current market price of VCI shares.

Vietcap intends to implement this plan in 2025, and these ESOP shares will be restricted from transfer for one year from the end of the issuance period. The resolution also included a list of 176 employees eligible to purchase ESOP shares, although the number of shares allocated to each individual was not specified.

At Vietcap’s 2025 Annual General Meeting of Shareholders, a VCI shareholder expressed their observation about the significant discount on the issuance price compared to the market price and recommended that the company consider adjusting the discount rate to create long-term value. Another shareholder questioned if the ESOP ratio was too low. At that time, General Director To Hai shared that Vietcap considered the average rate based on the average scale of comparable companies in the market.

“For example, we take into account our market capitalization, number of employees, and profit ratio, and then determine an appropriate ESOP ratio. We usually go with the average rate and then apply a 10-20% discount to stay competitive with other companies. This is how we calculate the ESOP allocation, which is then distributed based on the KPI of each department. While the ESOP ratio might seem slightly low, it is appropriate,” explained the General Director of Vietcap.

General Director To Hai (right) at Vietcap’s 2025 Annual General Meeting of Shareholders

|

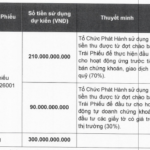

In addition to SSI and Vietcap, on May 16, the Board of Directors of DNSE Securities (HOSE: DSE) also passed a resolution to implement the 2025 ESOP program, divided into two phases: issuing 9.9 million shares at 10,000 VND per share in the second quarter of 2025 and an additional 2.7 million shares afterward, totaling 12.6 million ESOP shares.

Huy Khai

– 20:00 21/05/2025

“Go Green, Grow Together”

“Vietcap Securities kicks off its community-driven initiative, Go Green Go Up, offering investors a unique opportunity to engage in meaningful activities. We believe in coupling financial freedom with environmental responsibility, and through this project, we aim to showcase how every transaction can make a positive impact on our planet.”

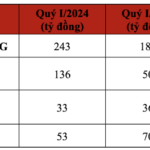

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.

The Timber and Stone Export Company Resets Profit Goals for 2025.

The business plan revealed and approved at the congress was 8% lower than the figure announced by the enterprise earlier in 2025.