Since taking office, the US President has signed numerous executive orders across a range of domestic and foreign policy issues, with China being one of the key targets of the Trump administration.

Consequently, the US government has imposed additional tariffs on Chinese imports, starting with a 10% levy from February 4, alongside a 25% tariff on steel and aluminum imports into the US, effective from March 4, with no country exemptions. There has also been the introduction of reciprocal tariffs, aiming to increase import duties to match those applied by other countries on US goods.

Furthermore, the US has tightened technology restrictions on China, including export controls on semiconductors, limiting US business investment in Chinese technology, and protecting intellectual property rights, all aimed squarely at China.

These moves have strained US-China relations, particularly in the economic and trade arenas. China has retaliated by imposing tariffs of 15% on coal and liquefied natural gas imported from the US, along with a 10% levy on oil, agricultural machinery, and large-displacement automobiles. China has also restricted the export of rare earth materials and launched an anti-monopoly investigation into Google, placing two US enterprises on its list of “unreliable entities.”

CREATING COMPETITIVE PRESSURE WITH DOMESTIC GOODS

According to Nong Duc Lai, Commercial Counselor in China, both China and the US are currently major trading partners and the most important export market for Vietnamese goods. Therefore, competition between the US and China, along with their respective trade policies, can have both positive and negative impacts on Vietnam’s trade and economy.

On the positive side, Mr. Lai analyzed that due to these policies, Chinese and international businesses have sought to diversify their production to avoid US tariffs, leading to expanded investment in countries like Vietnam. This has indirectly promoted Vietnam as an attractive destination thanks to its competitive labor costs and favorable geographical location.

Along with this, foreign investment attraction opens up opportunities for Vietnam to become a supporting production hub, offering local businesses a chance to participate in the supply chain, especially in agriculture and light industry.

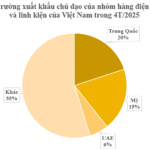

At the same time, Vietnam benefits from the US reducing its imports from China, particularly in textiles, electronics, and machinery. However, this also exposes Vietnam to the risk of US anti-dumping investigations.

These developments provide an opportunity and incentive for Vietnam to push forward with three strategic breakthroughs: improving infrastructure, making administrative procedures more transparent, and enhancing the quality of human resources.

However, there are negative impacts as well. When Chinese goods are restricted from exporting to the US market, Chinese businesses are forced to seek alternative markets, including Vietnam, creating competitive pressure for domestically produced goods. Simultaneously, Vietnamese products will face competition from Chinese goods in the US market due to excess supply caused by export limitations.

Moreover, in response to US trade policies, China will continue to devalue the renminbi (RMB) against the US dollar to boost exports, thereby increasing the pressure of Chinese goods on Vietnam. In addition to RMB devaluation, China may resort to trade diversion tactics, such as offshore assembly of goods through investment, to export to the US and other high-tariff countries. This poses risks for countries that China targets for investment as the US administration rigorously traces the origin of Chinese goods.

As Chinese enterprises redirect and intensify their exports to markets outside the US and EU, they will lower product standards according to the demands of the target markets and compete for orders with businesses from other countries (including Vietnam). This is expected to impact Vietnamese enterprises in the medium term.

THE NEED FOR TIMELY POLICY RESPONSES

To mitigate the negative impacts, Mr. Lai recommended that Vietnamese businesses closely monitor the developments and policy moves of major partners (the US and China) that could affect Vietnam. Based on this, they should assess, forecast, and formulate timely and effective response strategies.

Additionally, it is crucial to stay updated with market trends and the implementation of China’s policies, as well as to be well-informed about any new policies that China may introduce, in order to devise countermeasures and react promptly to market and partner changes. Developing contingency plans for scenarios such as tariff increases or supply chain disruptions is also advisable.

Diversifying markets and partners is another important strategy, involving expanding exports to traditional markets in ASEAN, the EU, Japan, and South Korea, as well as exploring the potential of the Middle East and African markets, rather than solely relying on the Chinese market. Leveraging free trade agreements (EVFTA and CPTPP) can help reduce dependence on a single market.

“Businesses need to enhance their competitiveness by investing in high-quality human resources training, especially in technical fields and management. Proactively complying with environmental and labor regulations will help avoid trade barriers,” Mr. Lai noted. He also suggested that businesses improve their production capabilities, invest in automation to reduce manual labor, meet international standards, and adopt blockchain technology for product traceability, particularly for agricultural products, to address issues like crop code numbers.

The Ultimate Guide to Container Shipping: Navigating the Tricky Waters of International Trade

The temporary truce on tariffs between the two nations is the primary catalyst for this surge in trade activity.

The US Just Spent Over $3 Billion on a Major Vietnamese Export: Trump Waived Countervailing Duties on a Product that Makes Vietnam the Second Largest Exporter in the World

From the start of the year to date, Vietnam has raked in a whopping $18 billion from this particular industry.