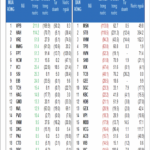

As of May 13, the Vietnam stock market ETF (VNM) has achieved an impressive 11% growth year-to-date, according to data from YCharts compiled by Visual Capitalist. With this result, Vietnam has outperformed several ASEAN economies such as Indonesia (-5.1%), Thailand (-6.5%), and Malaysia (1.6%), while also ranking among the top-performing markets globally.

In comparison to the global landscape, Vietnam has even outperformed many developed markets like the US (0.4%), Japan (7.7%), and Canada (7.7%). Notably, while economies such as India, Taiwan (China), Denmark, and Malaysia managed modest growth below 2%, Vietnam stands out with its robust momentum despite the volatile global economic environment.

Leading the rankings is Poland with a growth rate of 47.6%, followed by Austria (34.3%) and Greece (32.7%). However, among emerging markets and within the Asian region, Vietnam remains a prominent contender, indicating a strong appeal to international investors.

Vietnam stock market ETF (VNM) has achieved an impressive 11.0% growth year-to-date. Chart: Visual Capitalist.

This performance not only reflects investor confidence in Vietnam’s macroeconomic prospects and institutional reforms but also bodes well for the domestic financial market as many regional countries struggle with internal challenges.

Vietnam Stock Market 2025: Growth Drivers and Upgrade Expectations

Beyond the impressive growth, the Vietnam stock market in 2025 is propelled by numerous intrinsic and policy factors. According to a report by Agribank Securities (Agriseco), based on the 2025 business plans, net profits for the entire market are expected to increase by over 16%, while total revenue (excluding banks) is projected to rise by nearly 14% year-over-year. These figures shed light on why the ETF representing the Vietnamese market has delivered such superior performance.

Notably, sectors such as real estate, retail, and banking are anticipated to spearhead this growth. The real estate industry is witnessing a recovery thanks to numerous projects entering the handover and profit recognition phase, coupled with sustained low-interest rates reducing borrowing costs. The retail sector continues to thrive due to the rebound in domestic demand, bolstered by VAT reductions and an increase in the basic salary. Meanwhile, the banking sector benefits from improved asset quality and stable net interest margins (NIMs).

Another significant factor positively influencing investor sentiment is the expected upgrade of Vietnam’s stock market from frontier to emerging status this year. The upgrade will not only attract long-term foreign capital but also boost the country’s financial stature, facilitating the entry of large international investment funds. According to experts, this could result in billions of dollars in inflows during 2025–2026.

However, alongside these positive aspects, the market also faces certain challenges, including pressures from the USD/VND exchange rate, regional geopolitical risks, and unpredictable global economic trends. Moreover, the upgrade process necessitates substantial improvements in liquidity, financial reporting quality, and corporate transparency – issues that have long been considered bottlenecks in the Vietnamese market.

Nonetheless, with a stable macroeconomic foundation, ample policy room, and support from institutional reforms, Vietnam’s stock market is expected to remain a bright spot in the region, attracting strong interest from domestic and foreign investors in the second half of 2025.

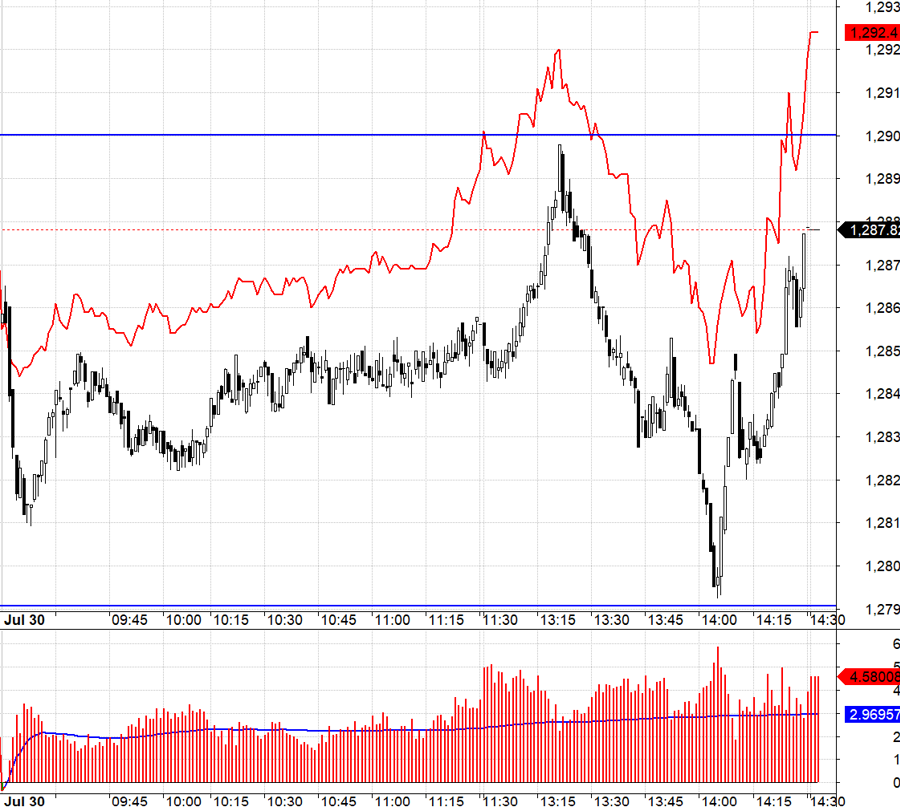

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

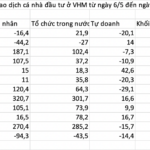

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.

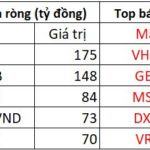

“The Big 7 of Vietnam’s Stock Market”: 4 Banks & 3 Vingroup Stocks with a Combined Market Cap of $81 Billion

The “MAG-7 Vietnamese Stocks” group holds a significant weightage, and their fluctuations greatly impact the VN-Index.