After a prolonged bullish phase, the market is entering a challenging period as it alternates between gains and losses. Today, the VN-Index gave back all of yesterday’s gains, with VIC stock taking a hit. The morning session saw a more positive performance, with the index up over seven points, but it ultimately closed 9.21 points lower at 1,313, and negative breadth worsened with 214 declining stocks versus 98 advancing ones.

Most sectors faced profit-taking pressure and underwent deep corrections. In the real estate sector, while VHM managed to stay afloat with a 1.19% gain, VIC fell by 1.07%, VRE declined by 1.55%, and several other stocks dropped more than 2%, including KDH, VPI, and PDR.

VinGroup’s stocks took a beating today, with VPL plunging by 6.12%. A sea of red engulfed banks, from large-cap to mid-cap and small-cap names, such as VCB, TCB, CTG, BID, MBB, LPB, MSB, and ACB.

The morning’s vibrant securities market lost its luster in the afternoon session, with sentiment affected by the broader market. VCI fell by 1.35%, SSI held steady, while VIX and VND managed to eke out gains of over 1%. Information technology and software were not spared, with FPT and CMG declining by 1.27% and 3%, respectively.

Following a sustained market rally, this corrective phase is necessary for a breather and reassessment of potential sectors. Indeed, during the recent uptrend, large-cap stocks, notably VinGroup’s equities and select banks, led the charge. In contrast, sectors significantly impacted by tariffs, such as exports, logistics, and industrial real estate, have yet to recover fully.

Looking ahead, it is hoped that the US will set reasonable tax rates for Vietnam, prompting a return of capital to these undervalued sectors, which have yet to reclaim their highs on the VN-Index.

Today’s robust liquidity of 28,000 billion VND in matched transactions indicates strong participation at current levels. Foreign investors net bought 67.3 billion VND, and their net buying in matched transactions alone amounted to 106.2 billion VND.

Their net buying in matched transactions focused on banks and financial services. The top net bought stocks by foreign investors in matched transactions included VIX, MWG, VHM, EIB, STB, HVN, VND, MSN, VIC, and KBC.

On the other hand, their net selling in matched transactions centered on industrial goods and services. The top net sold stocks in matched transactions by foreign investors were FPT, VPB, VRE, SSI, GEX, DPM, PNJ, VNM, and VSC.

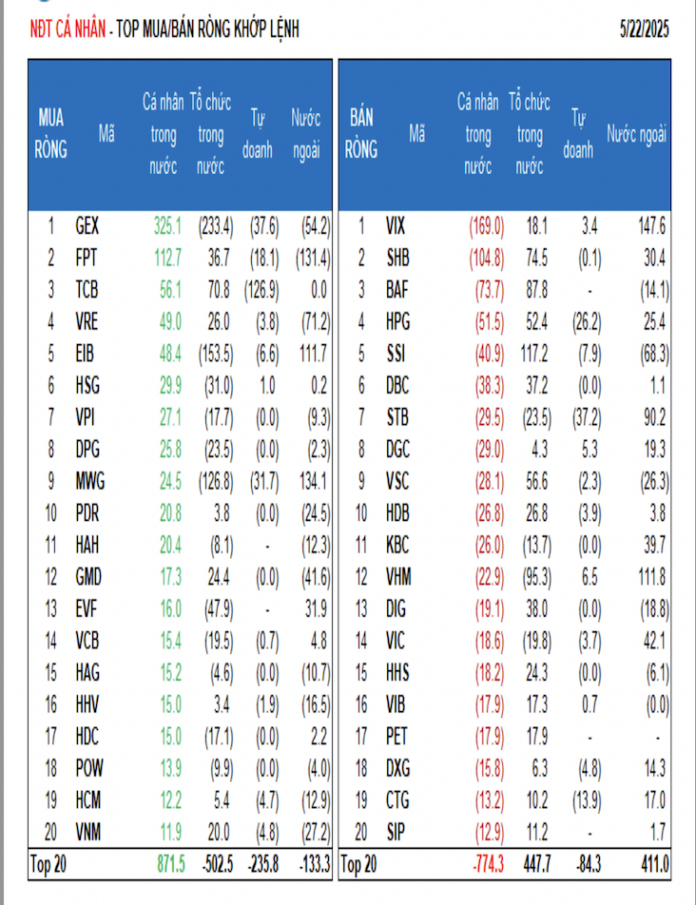

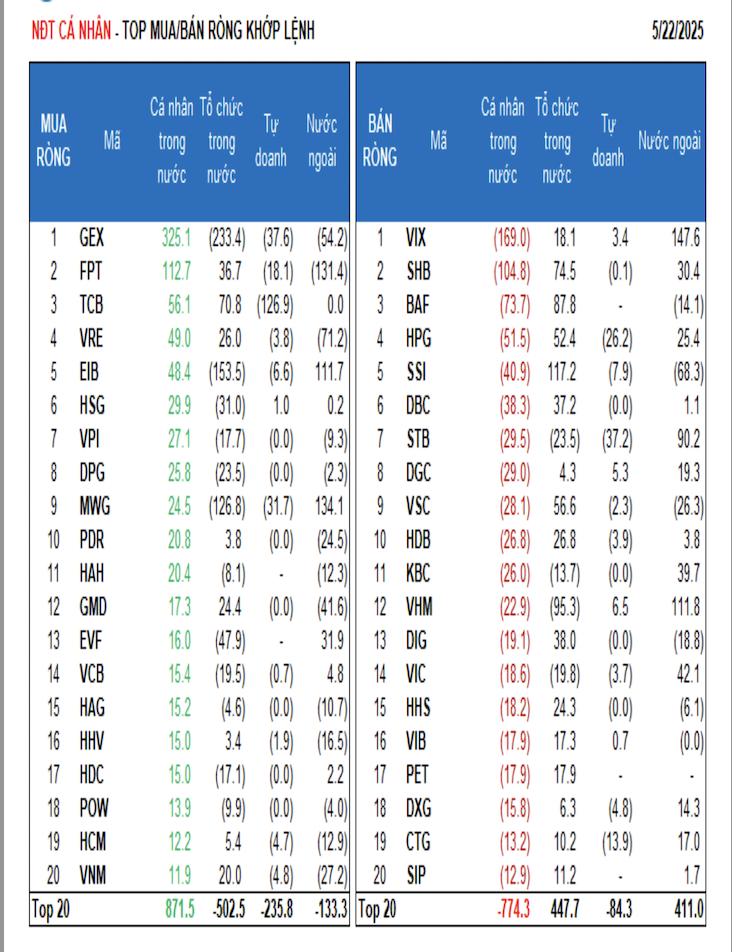

Individual investors net sold 28.5 billion VND, but their net buying in matched transactions reached 90.4 billion VND. In matched transactions, they net bought 8 out of 18 sectors, primarily industrial goods and services. Their top net bought stocks included GEX, FPT, TCB, VRE, EIB, HSG, VPI, DPG, MWG, and PDR.

On the net selling side in matched transactions, they net sold 10 out of 18 sectors, mainly financial services, food and beverage. The top net sold stocks were VIX, SHB, BAF, HPG, SSI, DBC, DGC, VSC, and HDB.

Proprietary trading net sold 357.8 billion VND, and their net selling in matched transactions amounted to 412.6 billion VND. In matched transactions, proprietary trading net bought 3 out of 18 sectors. The most substantial net buying was in financial services and chemicals. Today’s top net bought stocks by proprietary trading in matched transactions included NLG, E1VFVN30, VND, FUEVFVND, VHM, DGC, FUESSVFL, TCH, VIX, and FUEKIV30. Banks were the top net sold sector.

The top net sold stocks by proprietary trading were TCB, GEX, STB, MWG, MBB, NVL, ACB, HPG, MSN, and VPB.

Domestic institutional investors net bought 273.5 billion VND, and their net buying in matched transactions stood at 216.0 billion VND. In matched transactions, domestic institutions net sold 6 out of 18 sectors, with the most significant net selling in industrial goods and services. Their top net sold stocks included GEX, EIB, MWG, VHM, VND, HVN, EVF, HSG, MSN, and DPG. The most significant net buying was in banks. The top net bought stocks were VPB, SSI, BAF, SHB, TCB, VSC, HPG, NVL, DPM, and DIG.

Today’s matched transactions totaled 1,562.6 billion VND, down 33.3% from the previous session and accounting for 5.5% of the total transaction value. Notable block trades were observed among domestic institutions in large-cap stocks (FPT, MWG), banks (STB, HDB, EIB, VPB), and VSC.

Money flow allocation increased in securities, steel, chemicals, retail, electrical equipment, power generation & distribution, and personal finance. In contrast, it decreased in real estate, banks, construction, food, and investment funds.

Specifically, in matched transactions, money flow allocation increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) names.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.

The Art of Market Manipulation: VN-Index’s Dangerous Dance with Blue Chips

The robust upward momentum witnessed right after the morning session opened today propelled the VN-Index into the March peak zone. However, this rally was solely driven by large-cap stocks. As these heavyweight stocks started to lose steam, the index gave back almost all of its gains, ending the day with a marginal increase of less than 1 point, despite being up nearly 16.5 points earlier.

Why Do People Still Choose to Deposit Money in Banks Even Though Other Investment Channels Are Active?

In just the first two months of the year, over 301 trillion VND in savings deposits from residents flowed into the banking system, despite rising gold prices and a booming stock market.

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.

The Market Pulse: Will Profit-Taking Pressure Emerge?

The VN-Index witnessed a negative turn with a significant surge in trading volume above the 20-day average. This indicates profit-taking pressure as the index retests the old peak from March 2025 (around the 1,320-1,340 point range), triggering market jitters. If selling pressure persists in upcoming sessions, the correction risk will escalate. The Stochastic Oscillator, a key indicator, has been in a downward trajectory after signaling a sell-off in the overbought zone. Investors are advised to exercise caution if the indicator falls out of this range in the near term.