The Vietnamese stock market has experienced a rollercoaster ride since the beginning of 2025. After plunging to a one-year low in early April, the market staged an impressive V-shaped recovery. Surging from below 1,100, the VN-Index swiftly reclaimed the 1,300 mark, registering a 4.44% gain compared to the start of 2025.

The vibrant green numbers on the electronic boards, the bustling trading floors, and the strong leadership of blue-chip stocks ignited hopes for a major rally. However, behind the dazzling performance of the overall index, many individual investors were left disappointed and disheartened, facing losses in their investment portfolios.

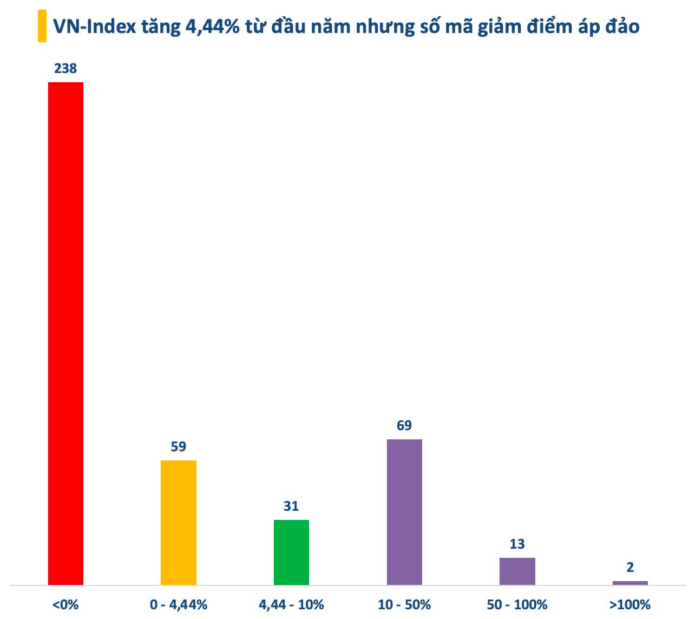

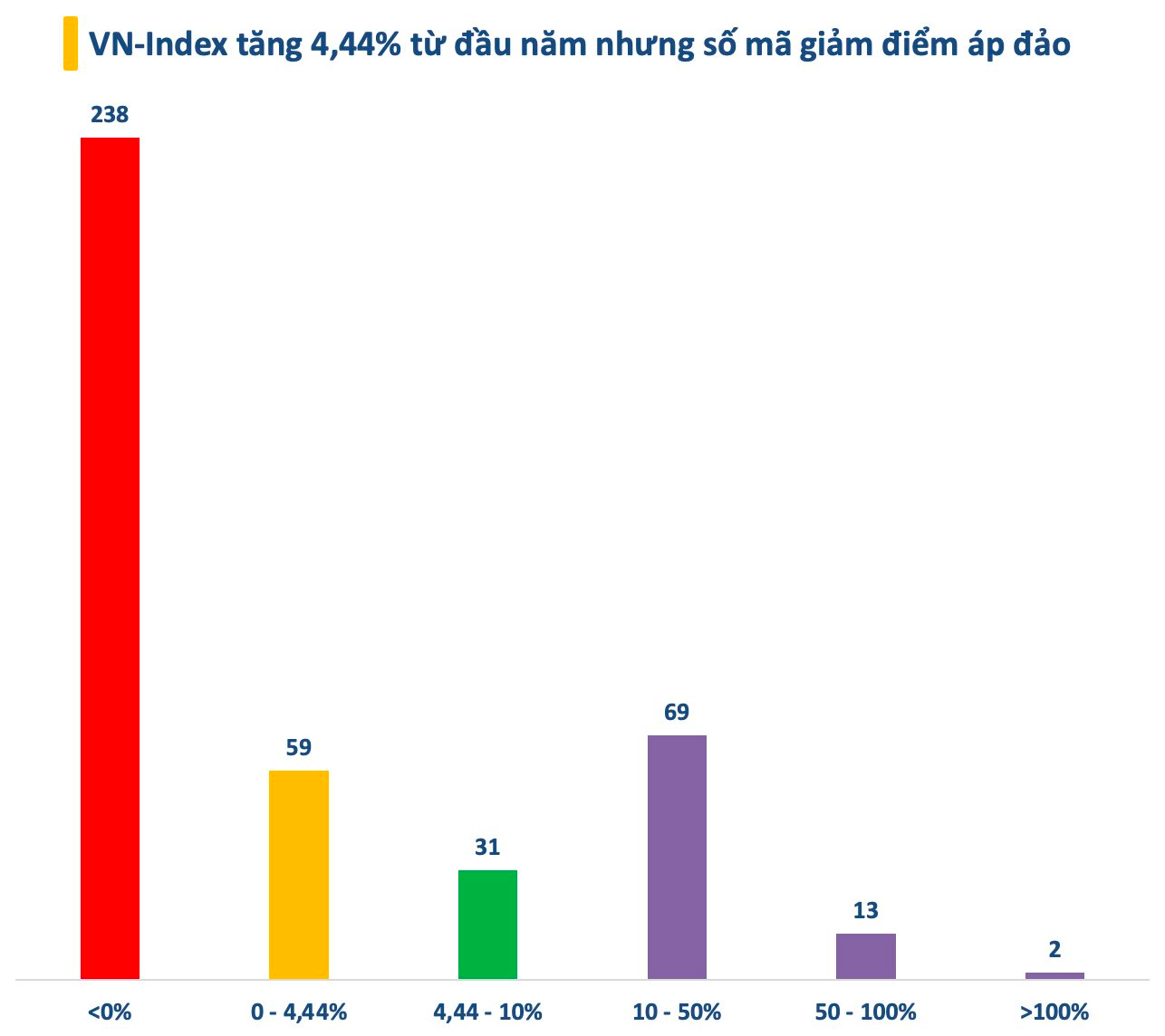

In reality, while the VN-Index climbed by 4.44% year-to-date, declining stocks outnumbered gainers, accounting for nearly 60% of the total on the HoSE. When compared to the benchmark index, nearly 300 stocks underperformed the market since the beginning of the year, including well-known names such as VCB, BID, CTG, ACB, BVH, MSN, VNM, FPT, FRT, KBC, and DCM.

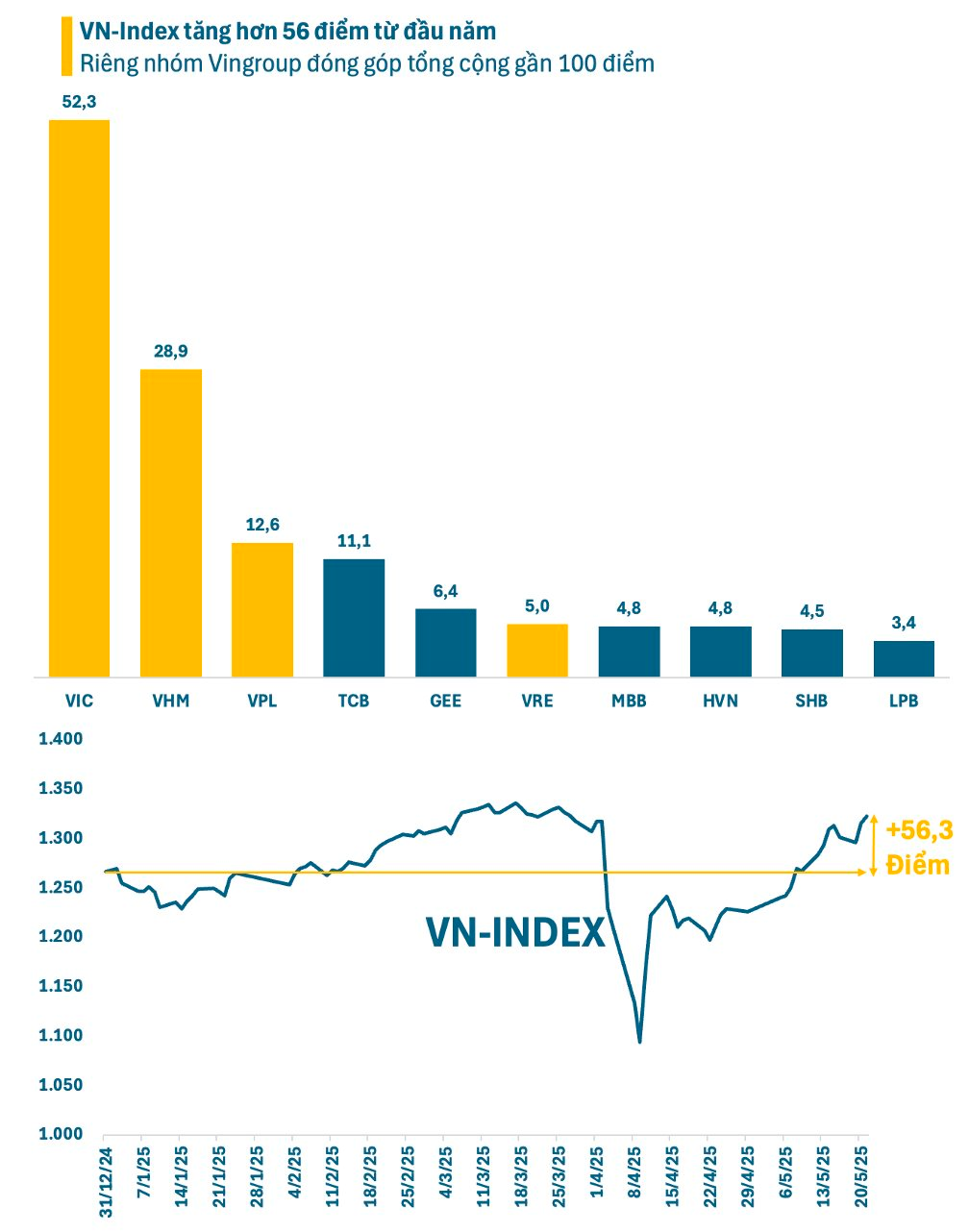

Actual profits and losses depend on the timing of buying and selling, but the likelihood of investors holding stocks from the beginning of the year underperforming the VN-Index is very high. The main reason for this situation is the market’s distinct polarization. Large amounts of capital are primarily focused on a handful of stocks, such as those in the Vingroup, Gelex, and select banks with unique narratives.

Statistics reveal that the top 10 stocks contributing the most to the VN-Index since the start of 2025 mostly belong to these three groups, adding a total of nearly 134 points. Notably, Vingroup’s stocks alone contributed almost 100 points to the VN-Index, while the index itself has only risen by 56 points.

Some stocks in these groups witnessed rapid and unexpected surges, leaving investors unprepared. As prices soared, investors were reluctant to chase, opting to hold onto underperforming stocks in hopes of a turnaround rather than jumping ship. Others accepted the risk of buying at high prices, but the returns were not significantly impressive, coupled with the constant pressure of profit-taking, especially amid a globally volatile landscape.

What should investors do?

Analyzing the market trend, Mr. Nguyen Trong Dinh Tam, Head of Analysis at Tien Viet Securities (TVS), shared that the VN-Index is currently following a textbook technical pattern. After a significant accumulation phase in 2024, the index experienced a failed breakout (during the 1,300-mark breach) before sharply correcting in early April and forming the current V-shaped recovery.

The TVS expert opined that the VN-Index is likely to witness notable corrective waves to absorb selling pressure before consolidating and gearing up to surpass the short-term peak of 1,340 +/- and initiate the next bullish wave.

“This is the base-case scenario, with an important condition that the tax rate the US plans to impose on some Vietnamese exports in the next 2-3 weeks remains at 20-25%, and our competitors in the supply chain also face similar or higher tax rates,” Mr. Tam added.

Regarding investment strategies, the TVS expert suggested that capital is primarily revolving around blue-chip stocks and a handful of stocks with compelling narratives. Typically, securities stocks surge alongside the VN-Index’s explosive performance, but this sector has largely remained stagnant over the past three weeks, reflecting the challenge of generating short-term profits.

According to Mr. Tam, investors who haven’t built a substantial stock allocation in their portfolios shouldn’t rush to buy at all costs. The market may present significant corrective waves and form new buying points. Stocks to watch include representatives from the banking, retail, and residential real estate sectors.

On the other hand, investors holding a full portfolio of strong stocks can consider reducing their allocation to realize profits, but they shouldn’t sell everything as many stocks are entering their most robust growth phase.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.

“Hai Duong Real Estate Surges Post-Merger: Unlocking Inter-Regional Infrastructure Opportunities.”

The proposed merger of Hai Duong and Hai Phong into a centrally-administered city is a game-changer in terms of governance and urban development. This move not only revolutionizes the administrative model but also unlocks vast potential for the region’s real estate market, setting the stage for a vibrant and prosperous future.

The Sudden Spike: Stocks Take a Tumble

Liquidity across both exchanges soared 28.4% in the afternoon session, hitting a 19-session high. As the sea of red expanded, it confirmed that selling pressure had intensified. While the VN-Index managed to stay in the green, it had to concede closing at the day’s low.

The Vanishing Liquidity: A Market Tug-of-War

The weakening of Vin stocks remains a key signal for investors to exercise caution. The blue-chip group’s attempts to push higher were met with strong resistance, resulting in a retreat that kept the VN-Index confined to a narrow range around the reference level throughout the session. A 40% plunge in HoSE’s liquidity to a 15-session low underscores the return of cautious sentiment.