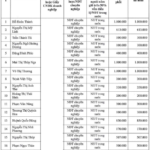

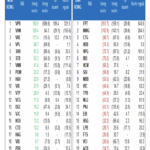

A number of investors and financial institutions, both domestic and foreign, have sent an urgent second petition to the Government, the Ministry of Industry and Trade, the Vietnam Electricity Group (EVN), and relevant agencies. They are requesting to maintain the preferential electricity purchase price (FIT) and the commercial operation date (COD) for 173 wind and solar power projects.

According to the petition, these 173 projects had their COD recognized before or during 2021 but lacked construction acceptance approval at the time. However, the investors argue that the legal regulations in force at that time did not mandate having an acceptance document for COD recognition.

A wind power project in Ninh Thuan province

However, starting in January 2025, EVNEPTC, EVN’s power trading unit, began withholding a portion of the payments and applying a temporary rate lower than the contracted FIT. There are even proposals to retroactively adjust the COD to the date of the acceptance document, which could result in a reduction in electricity rates.

The investors argue that this not only violates the power purchase agreements but also contradicts Resolution 68-NQ/TW of the Politburo and Resolution 223/NQ-CP of the Government. Both resolutions emphasize the principle of non-retroactivity, respect for contracts, and protection of legitimate interests of bona fide investors.

“Revenue from electricity sales is the lifeline for businesses to repay bank loans, cover operating expenses, and fulfill tax obligations,” said a representative of an international investor. “If reduced, we face the risk of losing our ability to pay and breaking commitments with domestic and foreign financial partners.”

A solar power project in Long An province

According to statistics, the total affected capacity exceeds 6,000 MWp, with a total investment of over $13 billion, including approximately $4 billion in foreign capital from countries such as Japan, Singapore, the UK, France, South Korea, and China…

The investors are requesting the Government to maintain the recognized COD, implement the contracted FIT rates, and refrain from retroactively applying new regulations. “Upholding the commitments will demonstrate consistency in policies, protect the country’s reputation, and attract sustainable investment in clean energy,” the petition states.

A New Housing Policy Proposal for Civil Servants During Provincial Mergers

“The government believes that it is necessary to implement a policy that enables enterprises, state administrative agencies, and public non-business units to rent social housing for their officers, civil servants, officials, and employees. This policy will ensure that these individuals have access to affordable and secure housing, allowing them to focus on their work with peace of mind.”

“Experts: Vietnam’s Crucial Moment to Foster Sustainable Growth Amid Global Turbulence”

Recently, Raise Partners and Vietnam Innovators Digest joined forces to present the Vietnam ESG Investment Conference 2025 in Ho Chi Minh City.

Unlocking Pink Books: A Dialogue-Driven Approach to Resolving Issues for 8 Projects in Ho Chi Minh City

“Director of the Department of Agriculture and Environment in Ho Chi Minh City, Nguyen Toan Thang, took charge of facilitating dialogue on individual projects to resolve issues pertaining to long-standing delays in the issuance of land ownership certificates. The bottleneck was attributed to investors’ sluggish response to emergent issues, consequently impeding the process of granting certificates to homebuyers.”