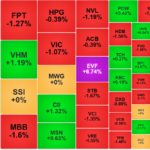

Vietnam Stock Market: A Tale of Green on the Outside, Red on the Inside

The stock market on May 21st presented a peculiar scenario: while the VN-Index maintained a green hue for most of the trading session, the number of stocks in the red slightly outnumbered those in the black. The upward momentum was concentrated on a handful of stocks, with standouts including Vinhomes ( VHM), Vietnam Airlines (HVN), Novaland (NVL), and Gelex (GEX).

Vinhomes’ market dominance illustrated

Vinhomes’ VHM Stock: Vinhomes’ VHM stock soared for the second consecutive trading session, reaching a three-year high. With a market price of 67,300 VND per share, Vinhomes’ market capitalization stood at approximately 276 trillion VND (~10.8 billion USD). This positions Vinhomes as the second largest enterprise in the stock market, surpassed only by Vietcombank and Vingroup. This solidifies Vinhomes’ standing as the largest real estate company in the stock market.

Vietnam Airlines’ impressive performance

Vietnam Airlines’ HVN Stock: Vietnam Airlines’ HVN stock also witnessed a significant surge, climbing to 36,450 VND per share and approaching its historical peak from 2018. Since the beginning of the year, HVN has appreciated by over 27% in market price. Consequently, its market capitalization has risen to nearly 81 trillion VND. The upward momentum in HVN stock followed the Annual General Meeting of Shareholders in 2025, where several critical resolutions were passed.

Among the key resolutions, Vietnam Airlines plans to offer a sale of shares to existing shareholders, with an expected volume of 900 million shares at a price of 10,000 VND per share, totaling 9 trillion VND in value. The entitlement ratio is set at 40.6% as of the record date (100 rights entitle the holder to purchase 40.64 newly issued shares). The proceeds from this offering will be utilized to repay short-term and long-term debts, as well as settle overdue payments to suppliers.

Additionally, the General Meeting approved an investment plan for 50 narrow-body aircraft (<200 seats, equivalent to A320Neo/B737Max8) and 10 spare engines, with a total investment of nearly 3.6 billion USD (over 92.3 trillion VND). The investment will be funded with 46% owner's equity and 54% borrowed capital. The new aircraft will be sourced directly from the manufacturer.

Novaland’s NVL Stock: Novaland’s NVL stock also hit its highest price since September 2024, following a dramatic surge on May 21st. However, the current market price remains significantly lower than the historical peak reached in 2021. Novaland’s market capitalization stands at approximately 25 trillion VND.

Novaland’s market performance

Novaland recently submitted a proposal to seek shareholder approval and subsequently obtain approval from the State Securities Commission of Vietnam to implement the necessary procedures in accordance with legal regulations. This initiative aims to execute a debt-to-equity swap for certain shareholders who sold secured assets to Novaland as repayment for loans and bonds, including two major shareholders: NovaGroup and Diamond Properties.

Prior to this, five shareholders associated with Mr. Bui Thanh Nhon registered to sell nearly 19 million NVL shares to balance their investment portfolios, restructure their debts, and for personal reasons. The transaction is expected to take place between May 16th and June 13th, 2025, through order matching and/or negotiated deals. If successful, the total ownership ratio of Novaland’s large shareholder group will decrease to 37.4%.

Gelex’s GEX Stock: In contrast to NVL, Gelex’s GEX stock is approaching its historical peak from late 2021 after hitting the ceiling on May 21st. With a market price of 32,500 VND per share, Gelex’s market capitalization stands at approximately 28 trillion VND. Since the beginning of 2025, GEX has witnessed an impressive 82% increase in market price, solidifying its position as one of the USD billion-dollar enterprises with the strongest stock performance.

Gelex’s market overview

In summary, the stock market is undergoing a phase of strong differentiation, resulting in the VN-Index’s subdued performance despite the existence of “rocket” stocks. Conversely, numerous stocks are struggling to find their footing, even as the index reclaimed the 1,300-point threshold.

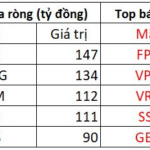

The Foreigners’ Buying Spree Continues: Over $4 Million Net Buying in a Single Stock Trading Session

Foreign sell-side transactions were a positive factor, with net buying of nearly 69 billion VND in today’s session.

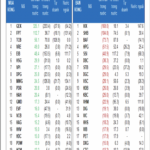

The VN-Index Plunges by 9 Points as Proprietary Traders Sell-Off

Today’s liquidity across the three exchanges reached 28 trillion dong, indicating that money is still pouring in confidently at current price levels. The VIPs net sold 357.8 billion dong, and they net sold 412.6 billion dong in matching orders alone.