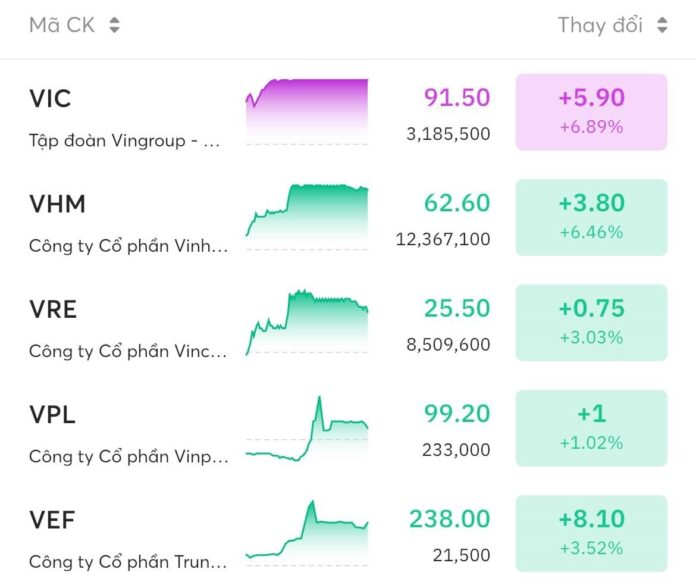

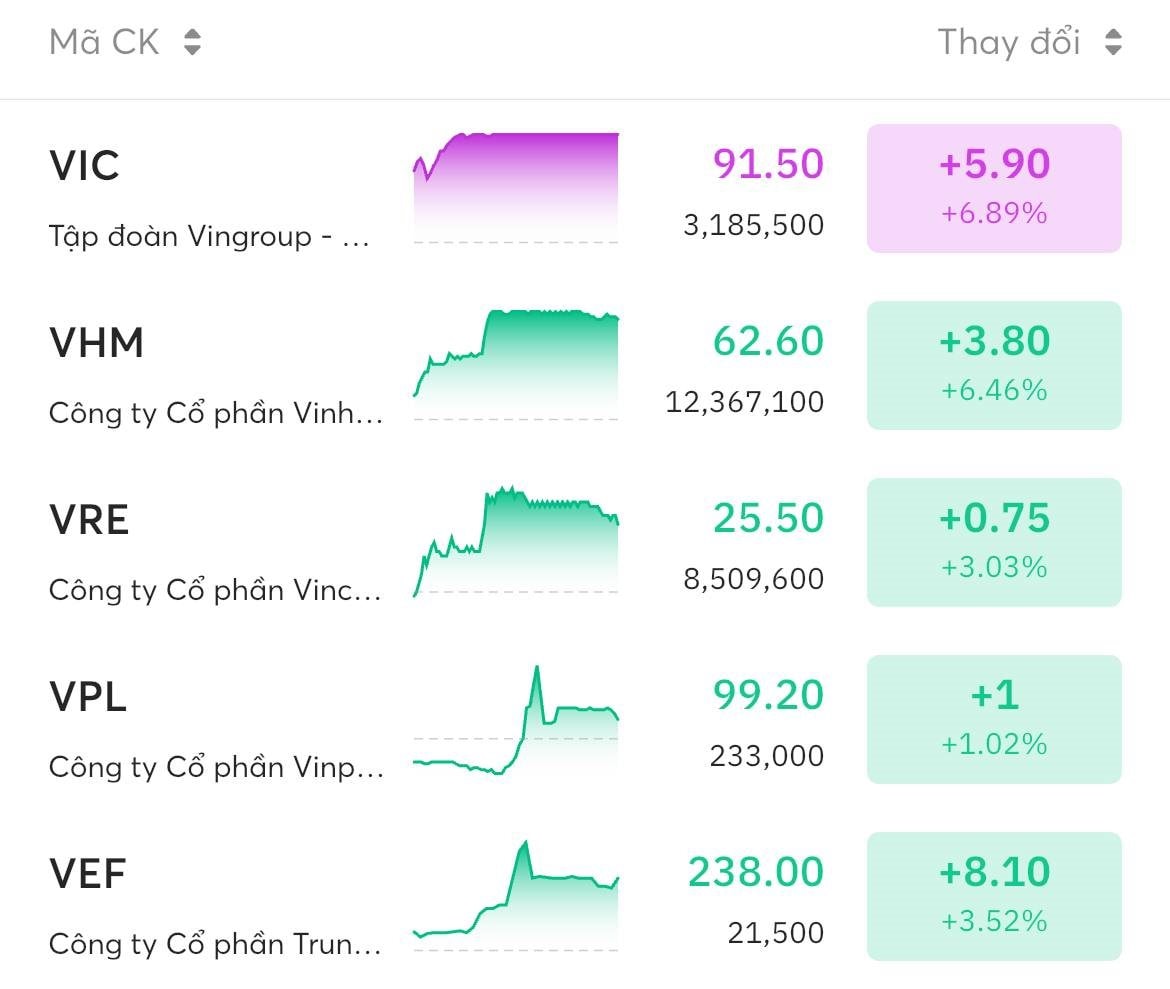

Riding on the momentum, VinGroup’s shares (code: VIC) of billionaire Pham Nhat Vuong soared to the ceiling for the second consecutive session, reaching 91,500 VND/share, the highest in 40 months since the end of January 2022. Other stocks in the VinGroup family, such as Vinhomes (VHM), Vinpearl (VPL), Vincom Retail (VRE), and VEFAC (VEF), also surged on May 20th.

Performance of VinGroup stocks as of 10:15 am, May 20th

Since the beginning of 2025, VIC shares have surged over 125%, pushing the market capitalization of VinGroup to approximately VND 350,000 billion ($13.7 billion). This solidifies the conglomerate’s position as the largest private enterprise in the stock market. VinGroup’s capitalization is second only to Vietcombank (VCB).

The surge in VIC shares has drastically boosted billionaire Pham Nhat Vuong’s wealth. It is estimated that the Chairman of VinGroup’s assets in the Vietnamese stock market (including direct and indirect holdings) now amount to about VND 180,000 billion, an increase of roughly VND 100,000 billion since the beginning of the year. This figure far surpasses the rest of the list of Vietnam’s richest people.

According to Forbes’ latest update, billionaire Pham Nhat Vuong possesses a fortune of $10.2 billion, ranking 277th globally and being the wealthiest person in Vietnam. Per Forbes’ calculations, the Chairman of VinGroup’s wealth has increased by over $6 billion since the beginning of the year, propelling the billionaire more than 400 places up in the world’s richest people ranking.

It is important to note that calculating the net worth of billionaires is challenging, and Forbes’ figures are only estimates. Aside from the stocks in the Vietnamese stock market, a significant portion of Pham Nhat Vuong’s wealth lies in VinFast, a company listed on the Nasdaq. VinFast is currently Vietnam’s best-selling car brand and is among the top 10 most valuable electric vehicle companies globally, with a market capitalization of over $8 billion (according to companiesmarketcap).

In a related development, on the morning of May 19, 2025, the Hanoi People’s Committee inaugurated the construction of the Tu Lien Bridge and the roads on both sides of the bridge, connecting from Nghi Tam intersection to Truong Sa Street. The contractor for this project is a joint venture between Pacific Construction Group (China), VinGroup, and several other partners.

The Tu Lien Bridge project will consist of multiple components, including the 1km-long, 43m-wide Tu Lien Bridge spanning the Red River; a 0.3km-long, 44m-wide bridge over the Duong River; a 1.4km-long, 27.5m- to 44m-wide approach road on the Tay Ho district side; and a 0.4km-long, 35m-wide approach road on the Dong Anh district side. The total investment for the bridge and road is VND 20,171 billion.

Previously, billionaire Pham Nhat Vuong’s conglomerate announced plans to develop a large-scale urban area with a total investment of more than VND 41,000 billion. Specifically, the People’s Committee of Bac Ninh province approved the selection of investors for the New Urban Area in the Northwest of Bac Ninh City (Zone 1) project, with a total expected investment of over VND 41,270 billion.

The project is located in Hoa Long ward, Bac Ninh city, spanning an area of approximately 277 hectares. The master plan includes residential land of 60.5 hectares, social infrastructure of 98.9 hectares, green space of 11.5 hectares, and transportation infrastructure of 69.7 hectares. The maximum total floor area is projected to reach over 2.6 million square meters, catering to a population of approximately 33,000 people.

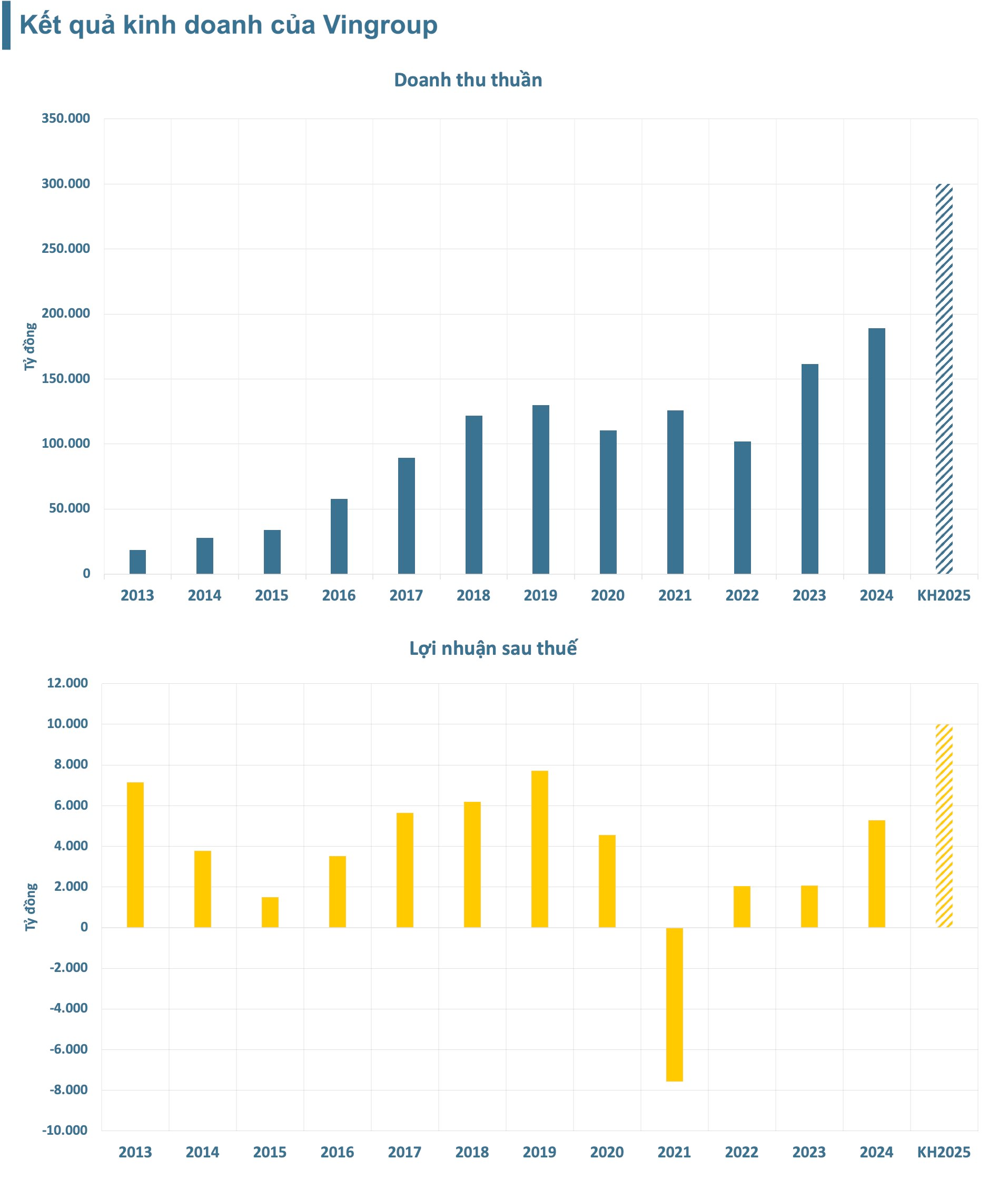

Looking at VinGroup’s business plan for 2025, the conglomerate targets a revenue of about VND 300,000 billion from production and business activities and an expected profit after tax of VND 10,000 billion. These figures represent a 56% and 90% increase, respectively, compared to the performance in 2024. In the first quarter of the year, VinGroup achieved 28% of the revenue target and 22% of the profit target.

Specifically, VinGroup recorded a record-high quarterly revenue of VND 84,053 billion in Q1, a 287% increase compared to the same period in 2024. This impressive growth was driven by strong performances in the industrial production and real estate development and investment sectors. The after-tax profit reached VND 2,243 billion, a 68% increase compared to the previous year.

Expert Opinion: Consider VN-Index’s Probability of “Giving Back Points”, Not an Attractive Price Region for Further Investment

The VN-Index is expected to fluctuate and consolidate around the 1,300-point level next week. This neutral scenario predicts a sideways movement for the index, which presents an opportunity for investors to assess their strategies and plan their next moves. With the market showing signs of uncertainty, a cautious approach is advised until a clearer trend emerges.

The Stock Market Takes a Toll on Vingroup Shares

Closing the first trading session of the week (May 19), the VN-Index lost the 1,300-point mark. Support from VIC was not enough to buoy the VN-Index, while the rest of the market was dominated by red.