## VIX Shareholders’ Meeting Approves Ambitious 2025 Business Plan with a Focus on Brokerage and Proprietary Trading

|

Targeting Profits in the Billions

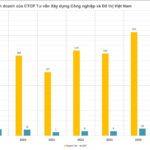

The recent General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved the company’s business reports and plans for 2025. Notably, VIX Securities aims for a pre-tax profit of VND 1,500 billion, a significant increase of 184% compared to 2024. The expected after-tax profit is VND 1,200 billion, a surge of 181%.

According to VIX, the company’s positive growth strategy for 2025 is centered on brokerage and proprietary trading as the foundation for its main business areas. This approach aligns with the current market conditions and indicates a promising direction for the company’s future development.

Notably, there is a potential opportunity for a market upgrade in September 2025. The Ministry of Finance’s Circular 68/2024 has established a legal framework for developing products that meet the criteria for market upgrades by both FTSE and MSCI. Additionally, the successful implementation of the KRX system in May 2025 brings us one step closer to achieving this upgrade goal.

Based on the baseline scenario set by securities companies, Vietnam’s stock market could be considered by MSCI for its Watch List in June 2025, with a potential announcement of market upgrade acceptance by FTSE Russell in September 2025.

Amid these developments, VIX Securities will closely follow the government’s orientations for the development of the securities market in 2025 and beyond. We are committed to preparing the necessary resources to adapt to market changes regarding products and operating mechanisms as we move closer to the market upgrade goal.

While 2025 presents challenges, there are also opportunities in the stock market. Notably, there are prospects for investing in good stocks at reasonable prices. Given the current characteristics of the stock market, with the VN-Index in a distribution phase, foreign investors continuing net selling, and a volatile global economy, the stock market in 2025 will likely undergo significant differentiation, with fundamental factors driving stock prices. Specifically, there will always be stocks of companies with solid business foundations and stable cash flows. Therefore, when the prices of these stocks adjust according to the overall market movement, value investment opportunities will arise.

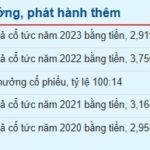

Another important topic for investors and shareholders is dividend information. Specifically, the VIX General Meeting approved a dividend payout ratio of 5% in stocks, derived from undistributed post-tax profits on the 2024 audited financial statements, with an expected value of over VND 729 billion. This dividend rate is calculated based on the company’s current charter capital of over VND 14,585 billion.

Fortifying Internal Strength

Given the challenges and opportunities in the securities market in 2025, VIX is committed to enhancing its financial and governance capabilities. We will continue to develop and expand our business operations to maximize efficiency, with a focus on securities brokerage and proprietary trading activities.

|

At the General Meeting, VIX Securities emphasized the importance of human resources as a key factor in the company’s development. As such, building a professional team has always been a top priority in our strategy. Currently, VIX boasts a dynamic, enthusiastic, and highly competent team of young professionals.

A testament to our team’s capabilities is evident in our performance in 2024, a year of market challenges. VIX successfully invested in stocks and bonds with high potential, resulting in remarkable returns. Our proprietary trading activities contributed 64.8% to the company’s total revenue, an increase of 11.9% compared to 2023.

Moving forward, we will continue to invest in training and development, focusing on our core businesses of proprietary trading and brokerage. We aim to create competitive advantages and deliver value to our clients through service quality, customer care, and technological capabilities, including the integration of artificial intelligence (AI) in investment advisory services.

VIX Securities has made significant investments in modern technology infrastructure, including the successful implementation of the Xpower securities trading system, which went live on January 27, 2024. XPower offers superior features such as faster order processing speeds and enhanced trading tools, enabling investors to manage their assets and make investment decisions conveniently, quickly, and efficiently. Additionally, XPower integrates AI to provide investment recommendations, and it serves as a foundation for integrating new products and services in the future.

VIX has also completed a comprehensive rebranding effort, including a new website that is both modern and user-friendly. It effectively promotes the range of products and services that VIX offers to its clients.

In 2025, VIX will continue to invest significantly in information technology infrastructure to enhance processing capabilities, increase storage capacity, and ensure system security and safety. We have established partnerships with leading providers of cybersecurity services and regularly audit our securities trading system to identify and address any potential security vulnerabilities.

Services

– 12:00 23/05/2025

The Viconship Group Raises Stake to 11.6% in Hai An Port Handling

“A group of shareholders, Viconship, and two related legal entities have been steadily increasing their stake in Hai An Port Services. On May 13 and 14, they collectively purchased over 1 million additional HAH shares, bringing their total ownership to an impressive 11.6% of the company’s capital.”