The VN-Index has rebounded to the 1,300-point level after six weeks of recovery since the sharp adjustment in early April due to tariff concerns. As of last week’s close (May 16, 2025), the VN-Index stood at 1,301.39 points, up 34.09 points, or 2.69% from the previous week, with a 28% improvement in trading volume.

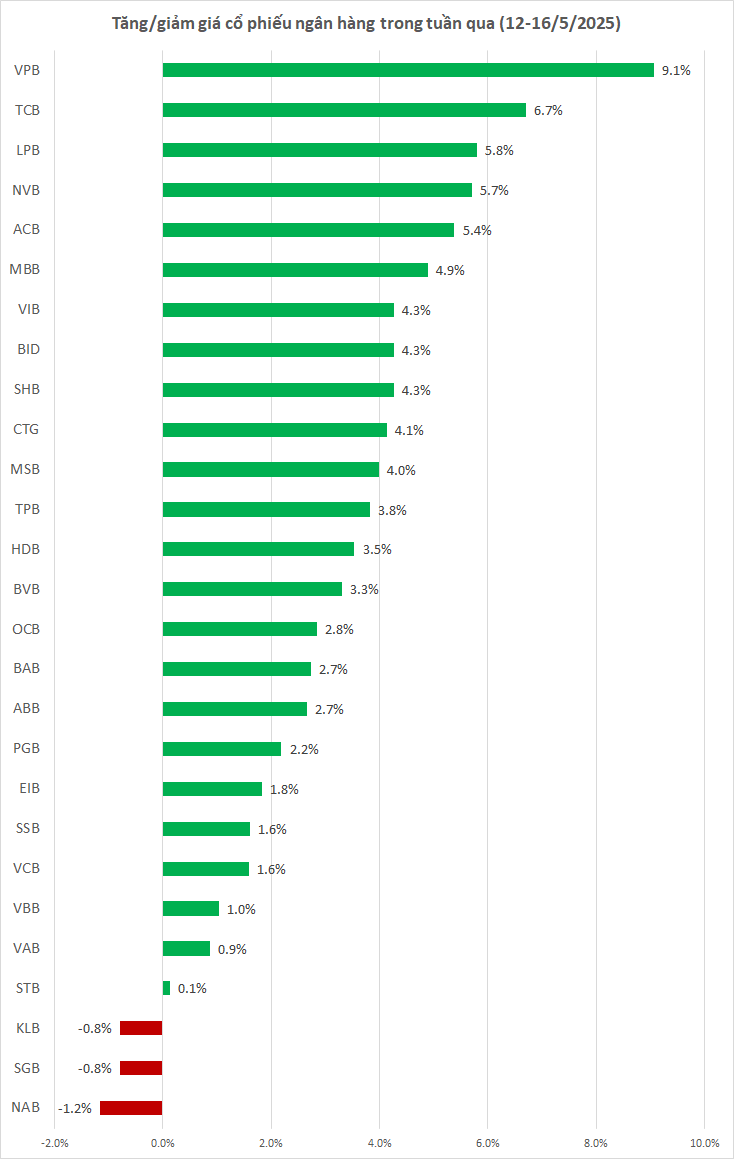

Banking stocks witnessed a positive trend last week, with the majority of them trading in the green. Out of 27 bank stocks, 24 recorded price increases during the week of May 12-16. VPB of VPBank saw the biggest weekly gain, ending the week at VND18,050 per share, a 9.1% increase. The surge in VPB’s share price came ahead of its May 16 record date for a 5% cash dividend payout, with a payout date of May 23 and a total payout of nearly VND4 trillion. On May 14, the day before the ex-dividend date, the stock soared by 6.78% with a trading value of nearly VND1,800 billion.

Additionally, VPBank also made headlines with the announcement of the VPBank K-Star Spark mega-concert on June 21, featuring two renowned K-pop artists, G-Dragon from BIGBANG and CL from 2NE1. The news caused a stir on social media and received an overwhelming response, expected to be one of the most anticipated bank-sponsored concerts of the year.

TCB of Techcombank was the second-best performer among bank stocks last week, closing at VND29,450 per share on May 16, a 6.7% increase from the previous week. Notably, on May 12, TCB surged by 6.52% with a significant increase in trading volume, recording a trading value of over VND1,300 billion.

Other notable gainers included LPB of LPBank (+5.8%), ACB (+5.4%), MBB (+4.9%), VIB (+4.3%), and BID of BIDV (+4.3%).

Only three bank stocks witnessed price declines last week, with minor losses of around 1%. Specifically, NAB of NamABank fell by 1.2%, SGB of Saigonbank dropped by 0.8%, and Kienlongbank decreased by 0.8%.

Notably, foreign investors have resumed net buying in the Vietnamese stock market. The week of May 12-16 marked the second consecutive week of net buying and the strongest since September 2022. Bank stocks were the primary focus of foreign net buying.

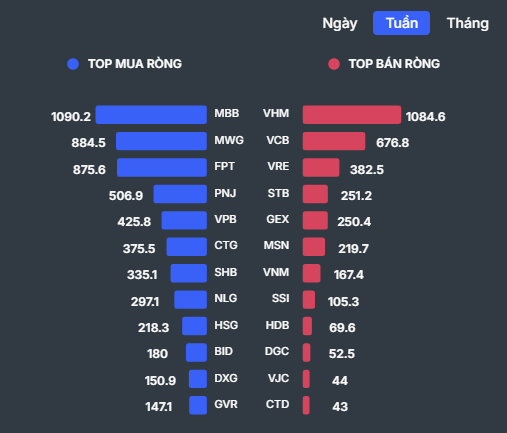

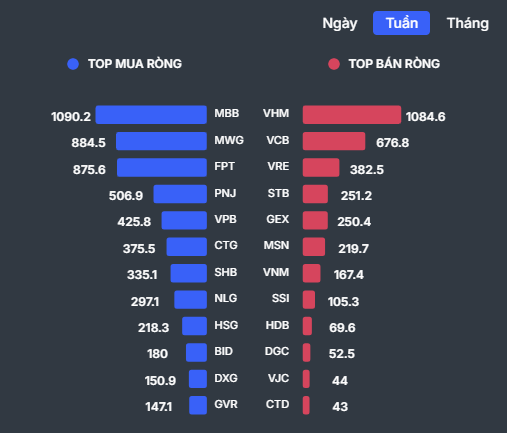

Out of the top ten stocks with the highest net buying by foreign investors last week, five were bank stocks: MBB, VPB, CTG, SHB, and BID. MBB topped the list, with net buying exceeding VND1 trillion. On May 15 alone, net buying reached over VND500 billion, with a buying volume of over 26 million units and a selling volume of just over 4 million units.

VPB of VPBank also witnessed net buying of over VND400 billion during the week. Foreign investors net bought CTG worth VND375 billion, SHB worth VND335 billion, and BID worth VND180 billion.

Foreign investors’ net buying/selling for the week of May 12-16. Source: Wichart

According to BSC Securities, last week, investment funds shifted their focus to bank stocks, and the return of net buying by foreign investors helped the VN-Index quickly surpass the psychological threshold of 1,300 points. The industry trend was clear despite profit-taking pressure in the last two sessions. Bank stocks accounted for 4 out of 5 positions with the highest contribution to the VN-Index, with the sector contributing approximately 56% of the week’s gain. Foreign investors continued to be net buyers with a value of VND107 million, compared to VND49 million in the previous week. The market is returning to the old peak thanks to the rotation of large-cap stocks. The trend is unclear due to increasing profit-taking pressure.

The Stock Market Takes a Toll on Vingroup Shares

Closing the first trading session of the week (May 19), the VN-Index lost the 1,300-point mark. Support from VIC was not enough to buoy the VN-Index, while the rest of the market was dominated by red.

The Bank Stock Aggressively Accumulated by Proprietary Trading Securities Firm in Monday’s Session

“Local brokerage firms witnessed a net buy position of VND 77 billion on the HoSE. This development has caught the attention of investors, sparking curiosity about the potential opportunities that lie ahead.”