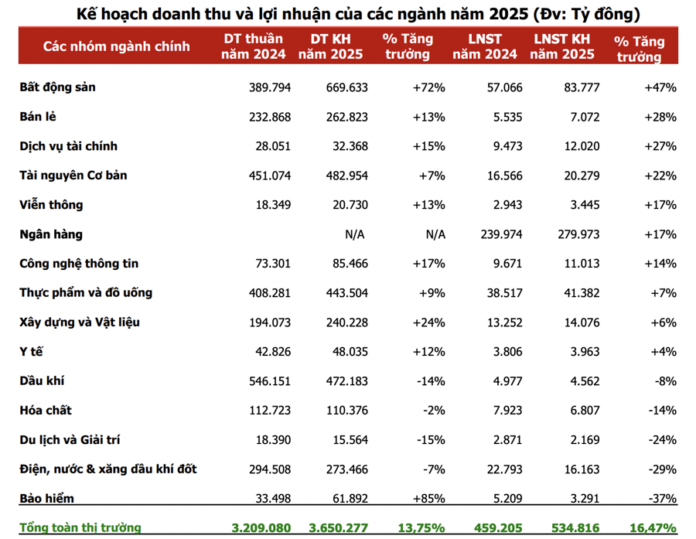

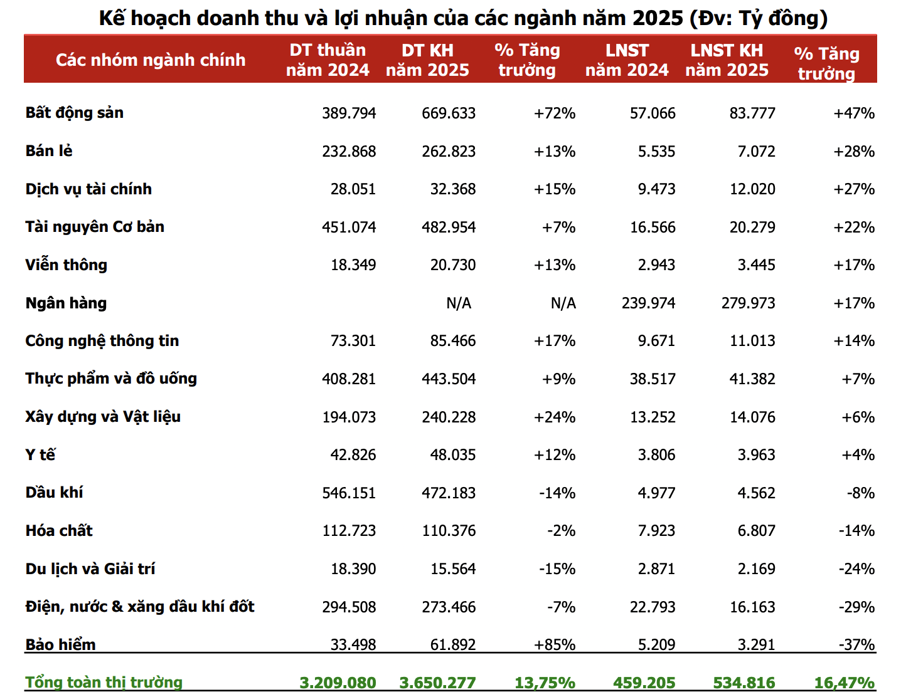

The majority of enterprises with growth business plans for 2025, accounting for 74% compared to 2024, reflect positive expectations for market prospects and the continued growth of domestic production and business activities.

Overall, the picture of the whole market’s profit plan for 2025 is positive but clearly divided among industries. Notably, the profit plan of industries such as Real Estate, Retail, Financial Services, Basic Resources, Banking, Telecommunications & Information Technology reflects a stronger recovery than revenue, indicating the expectation of improved profit margins of listed companies.

On the other hand, the Travel & Entertainment, Chemicals, Oil & Gas, Power, Water & Utilities, and Insurance industries are more cautious in their plans for this year.

Specifically, leading real estate businesses have set ambitious growth plans for 2025 compared to 2024, such as KBC (+600%), VIC (+90%), KDH (+24%), VHM (+20%), and VRE (+15%). Their plans are backed by numerous real estate projects entering the delivery and profit recognition phase. Real estate project sales are expected to increase significantly with the launch of new projects.

For the industrial park group, although the business plan is optimistic about growth, mid-term risks remain if Vietnam is subjected to higher tax rates by the United States.

Agriseco assesses that leading real estate businesses with stable financial foundations, large land funds, and continuous revenue recognition from ongoing projects are on track to achieve their 2025 business plans. However, they still face challenges in debt pressure and bond maturities.

Retail Industry: The retail industry is forecast to continue growing in 2025 due to the recovery of domestic demand, supported by the VAT reduction to 8% until June 30, 2025, and a possible extension into 2026. The basic salary increase also boosts consumption. Total retail sales of goods and services in the first four months of 2025 increased by 9.9%, higher than the 8.6% growth in 2024. Enterprises such as FRT (+76%), MWG (+30%), and DGW (+18%) target high profit growth in 2025 and are likely to achieve their plans due to their flexible, multi-channel retail models and effective expansion strategies.

Banking Industry: To achieve the State Bank’s credit growth target of 16% for 2025, capital is expected to be directed towards key sectors such as public investment, real estate, and industrial production. Personal consumer credit is forecast to recover significantly in the second half of the year.

Net interest margin (NIM) continues to improve due to low capital costs, contributing to a stable profit growth of over 15% in 2025 compared to 2024. Asset quality remains stable, with the bad debt ratio expected to decrease in 2025 due to strategies focused on handling and recovering bad debts. The pressure of forming new bad debts has eased since the end of 2024. Many banks have set positive profit growth targets for 2025 compared to 2024, including STB (+33%), HDB (+27%), VPB (+26%), OCB (+25%), TCB (+14%), MBB (+10%), and BID (+10%).

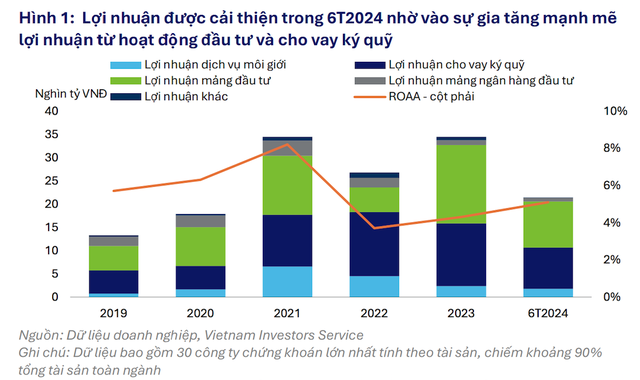

Securities Industry: The expectation of a market upgrade after the KRX system operation could attract large capital inflows from foreign investors if the upgrade process is successful, supporting liquidity and increasing brokerage, custody, and related financial services revenue. The low-interest-rate environment continues to favor the flow of investment funds into the stock market due to its more attractive expected returns compared to traditional channels like deposits or bonds.

Additionally, securities companies are entering a new cycle of increasing charter capital to enhance their financial capacity, expand margin lending limits, scale up proprietary trading, and invest in technology infrastructure.

Basic Resources Industry: The basic resources group’s performance is mainly driven by HPG (+25%), contributing 75% to the group’s profit, due to expected rising demand from the domestic real estate market and infrastructure development. This is further supported by the temporary anti-dumping tax on Chinese HRC steel and the operation of Dung Quat 2.

In contrast, coating businesses adopt a cautious approach, with NKG (-22%) and HSG (-13.3%) projecting lower after-tax profits due to export challenges amid trade protectionism waves. For mining businesses, KSV plans for a 34% decline in business results compared to the previous year’s high.

Conversely, KSB forecasts a 127% surge in its business plan due to the Tam Lap 3 mine, which started operating in November 2024, with an annual capacity of 1 million cubic meters of raw stone, compensating for the loss of capacity from the Phuc Vinh mine, which ended in 2023. KSB’s acquisition of Hoa Lu Industrial Park in mid-2024 also contributes to its revenue.

Power, Water & Utilities Industry: The power group presents a diverse profit plan, with POW aiming for a 26% increase in revenue but a 61% drop in profits year-over-year. Coal-fired power enterprises also take a cautious approach, as reflected in QTP’s plan, which foresees a 26% decrease in after-tax profit due to the end of the El Nino phase and persistently high blended coal prices. On the other hand, GEG (+498%) and REE (+22%) project profit increases.

Chemicals Industry: Fertilizer businesses like DCM and DPM typically adopt a conservative approach to business planning. Specifically, DCM and DPM set their 2025 profit targets nearly 50% lower than their 2024 performance, and DPM plans for a 40% reduction. In the chemicals segment, DGC expects its 2025 profit to remain unchanged, while CSV projects a 25% decrease.

This indicates a cautious profit outlook for the chemicals and fertilizer industry in 2025, reflecting the operational specifics of these businesses and the sector’s less favorable prospects. However, from the second half of the year, fertilizer businesses may receive a boost as the new VAT Law for fertilizers takes effect from July 1, 2025, enabling cost savings through input tax credits.

Oil & Gas Industry: Most oil and gas businesses have set lower targets for 2025 compared to 2024 due to anticipated oil price declines and ongoing volatility amid a challenging global macroeconomic environment. The looming recession in major economies poses a threat to oil consumption in the coming period.

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.

The Golden Triangle: CTX Holdings Divests from Hanoi’s Prime Real Estate Project

The Vietnam Construction and Import-Export JSC (CTX Holdings, UPCoM: CTX) has announced its decision to transfer the entire Constrexim Complex project – a prime, three-frontage location in Cau Giay District, Hanoi.

“Thai-owned Big C Vietnam’s Revenue Skyrockets to $426 Million in Q1, Contributing a Fifth to Central Group’s Earnings”

Central Retail, a leading retail company, has announced ambitious plans for Vietnam. Over the next five years, the company aims to invest a total of $2 billion in the country, including expanding its network of GO! shopping centers and GO!, Tops Market, and mini go! supermarket chains. This significant investment demonstrates Central Retail’s commitment to Vietnam and its vision for the future.

The Departing Words of CEO Nguyen Duc Thach Diem to Sacombank

On May 20, 2025, Nguyen Duc Thach Diem, CEO of Sacombank, penned an emotional farewell letter to the bank’s executive board, management, and staff, marking her official departure after nearly eight years with the organization.