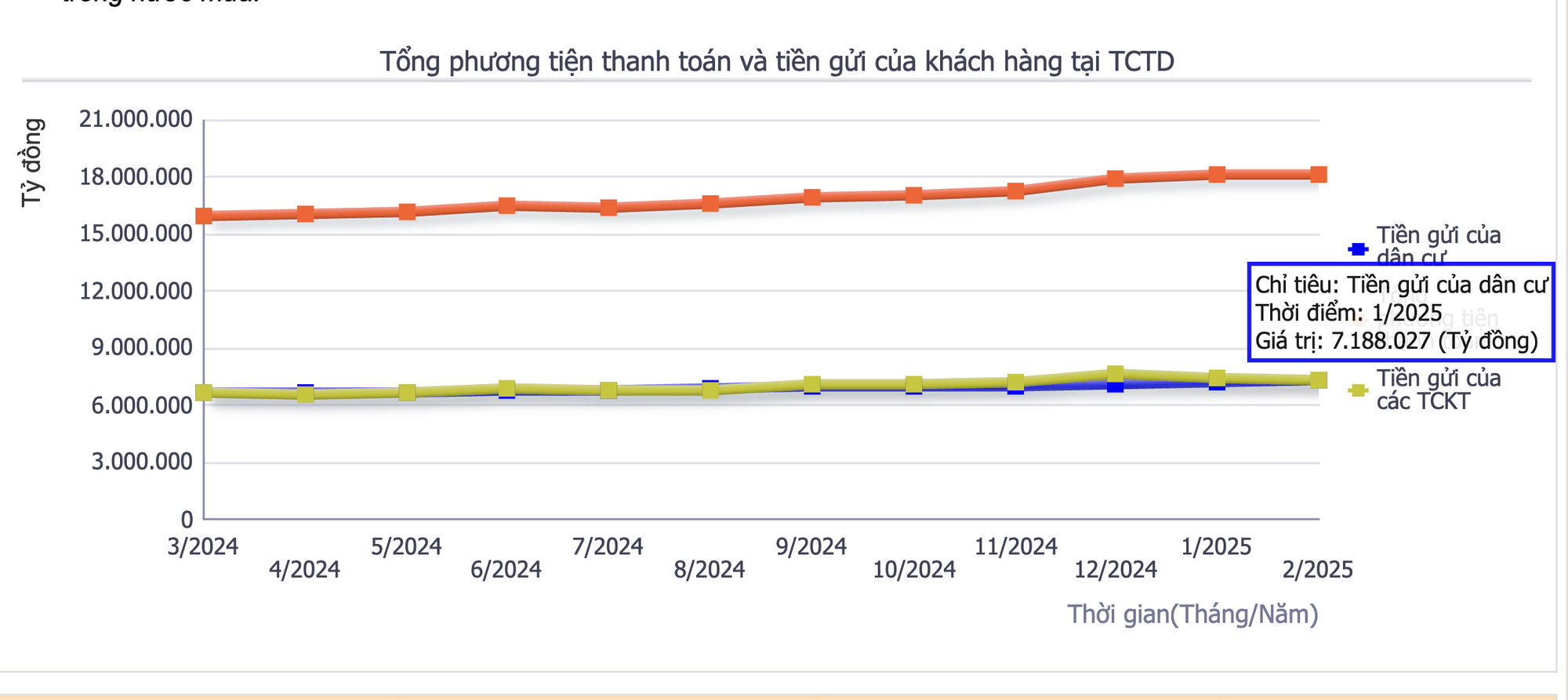

The latest figures from the State Bank of Vietnam reveal that personal customer deposits in credit institutions reached over VND 7,366 trillion by the end of February 2025, a 4.26% increase compared to the end of last year.

This means that in just the first two months of this year, more than VND 301 trillion in idle funds from the population flowed into the banking system. Notably, individual deposits now exceed those of economic organizations (over VND 7,362 trillion).

This influx of idle money into banks comes as other investment channels are also quite vibrant.

In the stock market, the VN-Index soared from the 1,200 point region to over 1,300 points. Numerous stocks have seen significant gains since the beginning of the year, notably the VinGroup’s stocks, which have nearly doubled in a short period. Trading value per session consistently surpasses VND 20,000 billion, even reaching over VND 40,000 billion on some days.

Similarly, SJC gold bullion and gold rings continuously set new record highs. SJC gold bullion prices are fluctuating around VND 120 million/tael, while gold ring prices remain above VND 115.5 million/tael as world prices rise again to USD 3,330/ounce.

Idle money continues to flow strongly into the banking system

Speaking to the NLD reporter, Mr. Dinh Minh Tri, Head of Analysis – Mirae Asset Securities Company, said that while other investment channels are vibrant, idle money still flows into banks, mainly due to the pressure of increasing interest rates.

With global inflation expected to escalate due to the impact of the new wave of tariffs, the trend of international interest rates reversing has put pressure on domestic interest rates, forcing many commercial banks to raise deposit interest rates in recent weeks, thereby attracting investors’ attention again.

On the other hand, the gold investment channel, despite price increases, is gradually losing its appeal as the price has failed to conquer the threshold of USD 3,400/ounce several times. From the record high of USD 3,500/ounce, the current gold price has decreased by about 5.1%. This narrows the profit margin in the short term, significantly reducing speculation.

Individual deposits into the banking system exceed VND 301 trillion in just the first two months of this year

“Although the VN-Index has recovered to the region above 1,300 points, equivalent to the period before the April tax hike, investor psychology remains cautious. While there has been progress in tax negotiations between Vietnam and the US, no specific agreement has been reached, making new money flow more cautiously and thus weakening the appeal of stocks,” said Mr. Dinh Minh Tri.

In its May macroeconomic update report, MBS Securities Company predicted that input interest rates would gradually increase towards the end of the year, expecting the economy to grow positively, and credit growth would reach or exceed the set target of 16%. By the end of March, the total outstanding credit of the system increased by 3.93% compared to the end of last year, 2.5 times higher than the increase in March, indicating that capital demand is gradually recovering.

“Credit growth this year is expected to reach 17% – 18%, driven by the recovery of the manufacturing industry and domestic consumption, promoting the disbursement of public investment capital. It is forecasted that the 12-month deposit interest rate of large commercial banks will fluctuate around 5.5% – 6% this year,” said MBS expert.

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

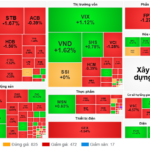

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.

The Market Pulse: Will Profit-Taking Pressure Emerge?

The VN-Index witnessed a negative turn with a significant surge in trading volume above the 20-day average. This indicates profit-taking pressure as the index retests the old peak from March 2025 (around the 1,320-1,340 point range), triggering market jitters. If selling pressure persists in upcoming sessions, the correction risk will escalate. The Stochastic Oscillator, a key indicator, has been in a downward trajectory after signaling a sell-off in the overbought zone. Investors are advised to exercise caution if the indicator falls out of this range in the near term.

“Markets Soaring High: Vietstock Daily Overview for May 21, 2025”

The VN-Index surged, dismissing the previous two sessions’ losses with the emergence of a White Marubozu candlestick pattern. This reflects a highly optimistic sentiment among investors. However, trading volume needs to show a marked improvement for the index to sustain its upward trajectory. If the VN-Index firmly holds above the current level, it may have the potential to revisit the old peak of March 2025 (around the 1,320-1,340 range). Notably, the MACD indicator has maintained a buy signal since late April 2025, boding well for the short-term outlook if this status quo persists.

Market Pulse May 24: Extended See-Saw Movement, Foreigners Resume Net Selling

The market closed with the VN-Index up 0.62 points (+0.05%), reaching 1,314.46; while the HNX-Index fell 0.47 points (-0.22%) to 216.32. The market breadth was relatively balanced, with 374 gainers and 371 losers. Similarly, the VN30 basket saw a tight contest between bulls and bears, resulting in 15 gainers, 12 losers, and 3 unchanged stocks.