LDG Investment JSC (HoSE: LDG) has announced that it was unable to proceed with the 2025 Annual General Meeting of Shareholders (AGM) for the second time on May 22nd, as the number of shareholders present was 139, representing over 38.2 million shares, accounting for nearly 14.92% of the total circulating shares – falling short of the required quorum.

According to the announcement, LDG will soon send information about organizing the 3rd AGM in accordance with the current laws and the Company’s Charter. This is also the fourth consecutive year (since 2022) that this real estate company has had to organize the 3rd AGM.

The documents presented at the 2nd AGM did not differ much from the first one. Specifically, LDG’s management proposed a 2025 business plan with a target of nearly VND 1,823 billion in net revenue and nearly VND 92 billion in after-tax profit. This reflects the company’s significant efforts, given that in 2024, revenue reached only VND 173 billion, and a loss of nearly VND 1,506 billion was recorded.

To achieve these goals, LDG will focus on maintaining stability and improving its financial situation. Some of the company’s highlighted orientations include: continuing to deploy transferred products, completing legal procedures, accelerating construction progress, and selling products at projects where LDG is the investor. Moreover, the company is proactively seeking and negotiating with potential investors for cooperation or transfer of projects, assets, and shares to restructure cash flow and improve solvency.

A series of “backlogged” projects will be presented to the 2025 AGM for approval, including: Saigon Intela, High Intela, West Intela (Ho Chi Minh City); The Viva City, Viva Square, Viva Park, Viva Tower (Dong Nai); Thanh Do (Can Tho); LDG Sky (Binh Duong), LDG Grand Da Nang (Da Nang); and LDG Grand Ha Long (Quang Ninh).

Regarding investment, the LDG Board of Management also seeks shareholder approval to adjust the business plan if there are significant changes in reality, requiring flexibility in management.

In terms of personnel, as the 2020-2025 term has ended, LDG plans to elect a new Board of Management for the 2025-2030 term at the upcoming conference, comprising five members.

Additionally, the company also proposes to shareholders the relocation of its headquarters from the old address at No. 104.4, Hoa Binh Hamlet, Giang Dien Commune, Trang Bom District, Dong Nai Province to the new address at Lot E9, D2 Road, Giang Dien Residential – Service Area (Area A), still within the same locality.

In a related development, on April 28, 2025, the People’s Court of Dong Nai Province sentenced Nguyen Khanh Hung, former Chairman of the Board of Directors of LDG Investment JSC, and six other defendants for “Cheating Customers” and “Abusing Position and Power in Performance of Official Duties” related to the construction of nearly 500 illegal villas and townhouses.

The Trial Panel also sentenced defendant Nguyen Khanh Hung (former Chairman of the Board of Directors of LDG Investment JSC) to 16 months in prison and Nguyen Quoc Vy Liem (46 years old, former Deputy General Director of Business – Marketing of LDG Investment JSC) to 12 months in prison.

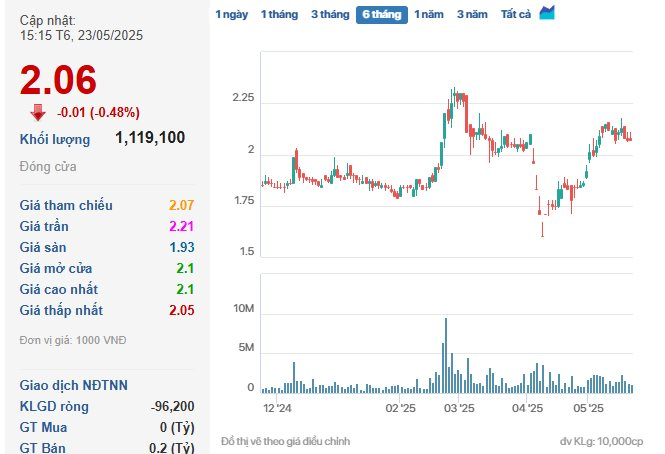

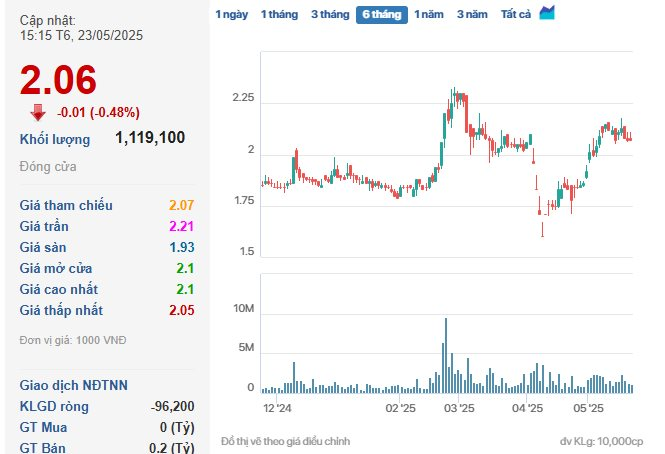

LDG’s share price has fluctuated recently and remains at its lowest historical listing price.

In the stock market, at the end of the May 23 session, LDG shares were priced at 2,060 VND/share, down 0.48% from the previous session, with a matched volume of over 1.1 million units.

A Garment Business Prioritizes Salary Expenses, Reducing Over 900 Employees After 18 Years

Once boasting a workforce of nearly 1,100 employees at its privatization, Thanh Tri Garment JSC now has fewer than 150 staff members. The company has recently adjusted its plans for the use of proceeds from a private placement, opting to allocate funds towards paying salaries for the third quarter of 2025 instead of upgrading its factory as initially intended.

“Shareholder Meeting: Considering Multiple Payment Installments to Regain the Phuoc Kien Project”

At the 2025 Annual General Meeting held on the afternoon of May 17th, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure that is second only to the years 2010 and 2017, along with a record-breaking revenue. Most surprisingly, the company is proposing to change its name after more than 30 years of operation.

“Shareholder Meeting: Considering Multiple Payment Installments to Reclaim the Bac Phuoc Kien Project”

At the 2025 Annual General Meeting held on May 17, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure surpassed only in 2010 and 2017, alongside record-breaking revenue. The most surprising item on the agenda is the proposal to change the company’s name after over three decades of operation.