According to the audited consolidated financial statements of Saigon Jewelry Company Limited (SJC), its net revenue in 2024 reached over VND 34,751 billion, a 17% increase compared to 2023. On average, SJC generated more than VND 95 billion in revenue per day (365 days a year).

This year, the company’s gold bar business achieved a gross profit margin of approximately 2%, a significant improvement from the previous year’s 0.9%. This resulted in an additional VND 400 billion in gross profit, totaling VND 685.5 billion.

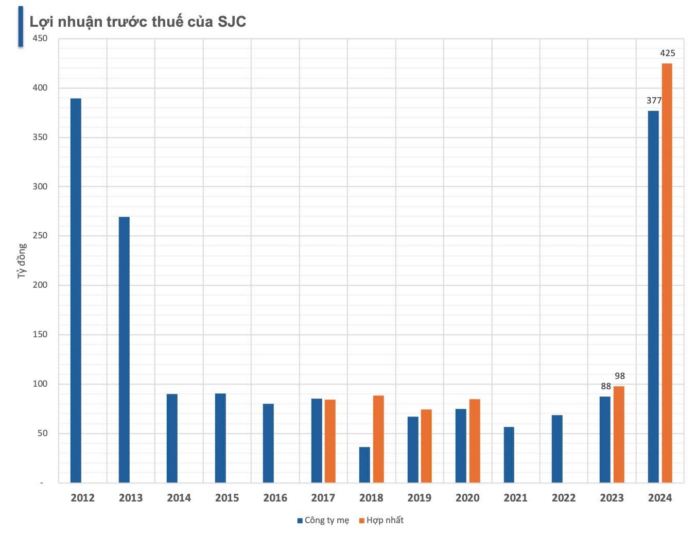

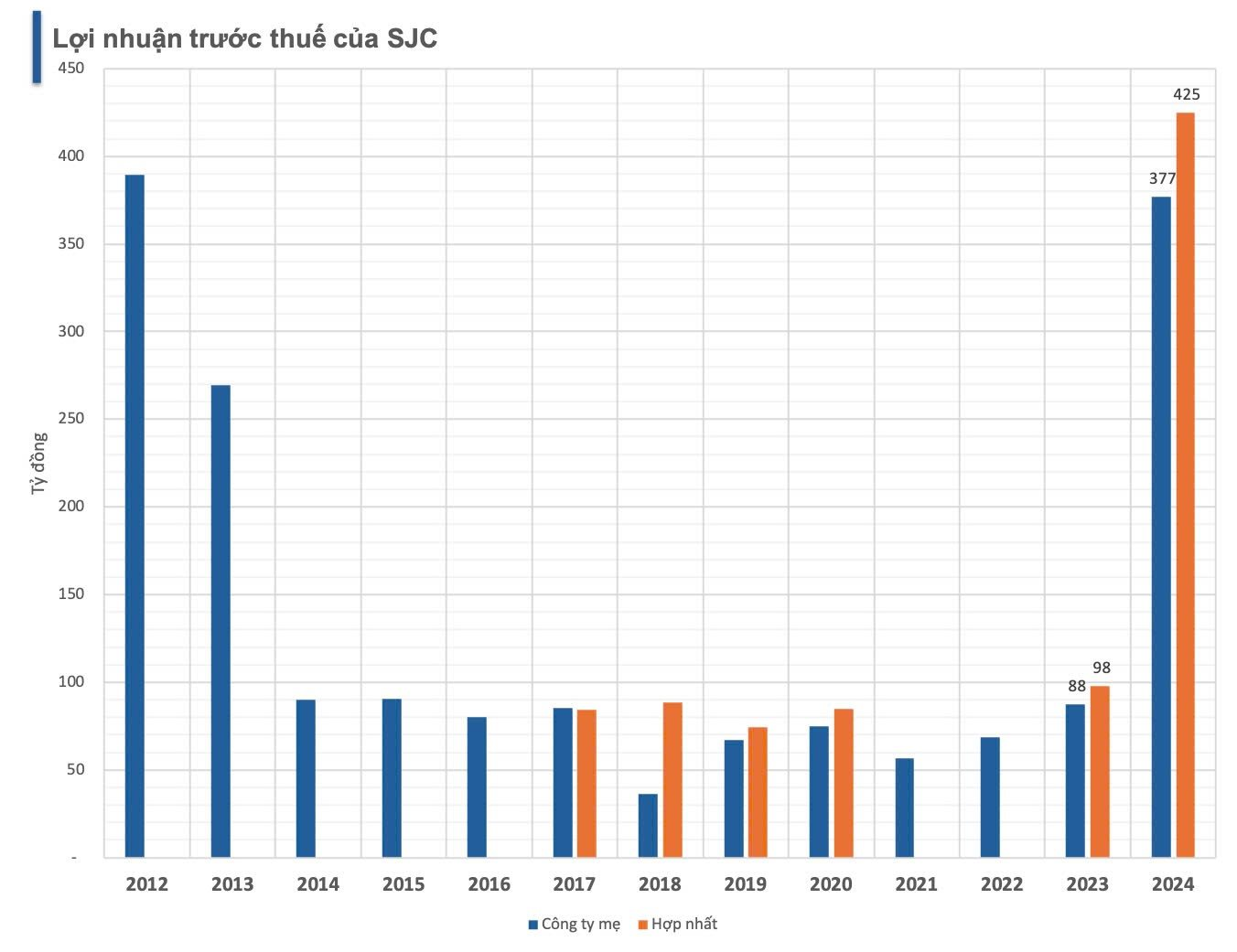

Consequently, despite increased expenses, SJC reported a remarkable pre-tax profit of VND 425 billion, reflecting a 335% surge compared to 2023. Its after-tax profit witnessed a similar upward trend, climbing nearly 381% to surpass VND 321.5 billion.

This performance marks the highest profit for SJC in the past decade, far surpassing the company’s after-tax profit target of VND 70 billion.

As of the end of 2024, SJC’s total assets amounted to nearly VND 2,317 billion. Out of this, nearly VND 1,500 billion was merchandise, VND 159 billion was finished products, and VND 51 billion worth of SJC gold was borrowed from individuals.

For 2025, SJC’s management has set a target to increase revenue to nearly VND 34,900 billion but expects an after-tax profit of only about VND 89 billion.

This year, the company plans to refurbish over 20,000 deformed SJC gold bars and introduce more than 503,000 jewelry and logo products to the market. Additionally, SJC does not intend to initiate any investment projects this year.

According to Saigon-Hanoi Securities Joint Stock Company (SHS), domestic gold demand is anticipated to remain stable, fluctuating between 55 and 60 tons annually during 2025-2026.

SJC currently holds the largest market share in the country for gold bars. The company has been exclusively authorized by the State Bank of Vietnam to produce SJC-branded gold bars nationwide.

SJC’s impressive performance in 2024 is attributed to the surge in SJC gold prices last year, rising from below VND 63 million per tael to VND 84.5 million (selling price) by the end of 2024.

“Taseco Land Proposes a 576 Billion VND Investment to Establish a Subsidiary in Ha Nam Province”

“Taseco Real Estate Investment Joint Stock Company (Taseco Land) has just approved a resolution to contribute capital to establish its 14th subsidiary, tentatively named Taseco Ha Nam Investment Co., Ltd., headquartered in the city of Phu Ly.”

“OCB to Issue 197.2 Million Bonus Shares to Boost Chartered Capital”

OCB is set to issue a bonus share dividend, offering 197.2 million new shares to its shareholders. This move will increase the bank’s charter capital from VND 24,657.8 billion to VND 26,630.5 billion.