Interest rates of 3.9%/year for priority sectors

In April, the average interest rate on VND deposits of domestic commercial banks (NHTM) was 0.1-0.2%/year for non-term and under 1-month term deposits; 3.2-4.0%/year for term deposits from 1 month to under 6 months. The interest rate for term deposits from 6 months to 12 months remained at 4.5-5.5%/year; 4.8-6.0%/year for term deposits from over 12 months to 24 months and 6.9-7.1%/year for term deposits over 24 months.

Movement in the banking system’s interest rates over the past time

Meanwhile, the average lending interest rate of NHTM for new and old loans with outstanding balances ranged from 6.6-8.9%/year, slightly lower than the average lending rate of 6.6-9.0%/year in March 2025.

The average short-term lending rate in VND for priority sectors was about 3.9%/year, lower than the maximum short-term lending rate prescribed by the SBV (4%/year).

The average lending rate in USD of domestic commercial banks for new and old loans with outstanding balances was 4.2-5.0%/year.

More than VND 2,400 trillion of interbank transactions

Regarding fluctuations in the interbank market, in the week from May 12 to May 16, 2025: According to reports from credit institutions (CIs), foreign bank branches through the statistical reporting system, transaction value in the interbank market in VND was approximately VND 2,473,471 billion, averaging VND 494,694 billion/day, a decrease of VND 11,461 billion/day compared to the previous week; transaction value in USD converted to VND in the week was about VND 582,959 billion, averaging VND 116,592 billion/day, a decrease of VND 8,671 billion/day compared to the previous week.

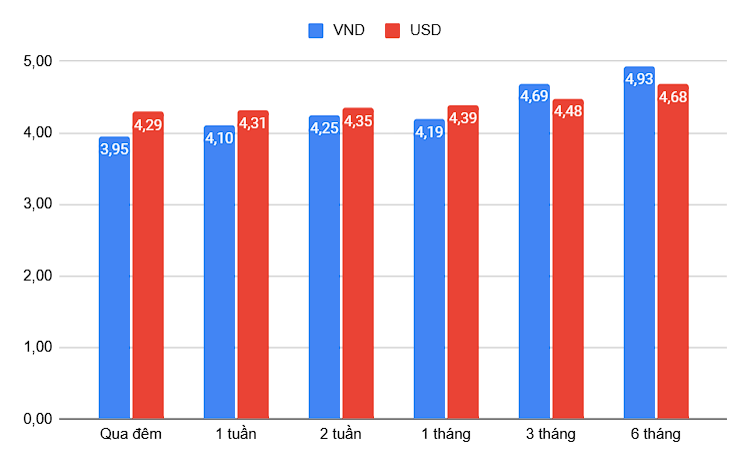

Average interbank interest rates for key terms in the week of May 12-16, 2025

By term, VND transactions were mainly focused on overnight term (93% of total VND transaction value) and 1-week term (3% of total VND transaction value). For USD transactions, the terms with the largest transaction values were overnight and 1-week terms, accounting for 85% and 11% respectively.

For VND transactions, the SBV stated that the average interest rate tended to decrease for most key terms compared to the previous week. Specifically, the average interest rates for overnight, 1-week, and 1-month terms decreased by 0.12%/year, 0.16%/year, and 0.29%/year to 3.95%/year, 4.10%/year, and 4.19%/year, respectively.

For USD transactions: The average interest rates for most terms showed slight fluctuations compared to the previous week. The average interest rates for overnight and 1-month terms increased slightly by about 0.01%/year to 4.29%/year and 4.39%/year, respectively. The average interest rate for the 1-week term remained unchanged from the previous week at 4.31%.

The Fed is in a Bind: Walking the Tightrope of Interest Rates

From the beginning of the year to mid-April 2025, the average lending interest rates for new transactions of commercial banks decreased by 0.6 percentage points compared to the end of 2024. This move has provided a much-needed respite for businesses by alleviating the pressure of capital costs in production and trading activities, thereby fostering economic growth.

Social Housing Loan with Zero Disbursement in Quang Binh

Despite the efforts of the Social Policy Bank (SPB) – Quang Binh branch, to promote and facilitate social housing loans, there has been a notable lack of uptake in the region. The bank’s social housing loan package has seen zero disbursements, with only sporadic individual borrowers seeking funds for construction and home repairs.

Peer-to-Peer Lending: Navigating the Risks

The government has recently introduced a new decree, 94/2025/ND-CP, which outlines a controlled experimentation framework for the banking sector, coming into force on July 1st, 2025. Peer-to-peer lending, or P2P lending, is one of the key areas that will undergo this innovative regulatory sandbox approach.