According to reports from the Vietnam Automobile Manufacturers’ Association (VAMA) and TC Motor, the B-segment sedan segment recorded 3,020 units in sales for April. This figure represents a 12.8% decrease following the overall market downturn but is a slight 6.5% increase compared to the same period last year.

Cumulatively, a total of 10,805 B-segment sedans were delivered to Vietnamese customers in the first four months of 2025, a 2.3% increase from the previous year. This indicates that B-segment sedans still hold a certain position in the Vietnamese market, despite consumers’ shift towards B- and C-sized crossovers.

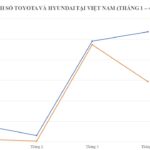

This segment is primarily led by three models: Toyota Vios, Hyundai Accent, and Honda City. This “tripod” formation has been maintained since the beginning of 2025, but the rankings among the models have changed.

Honda City experiences significant growth to become the best-selling B-segment sedan for April.

Specifically, in the past month, Honda City sold 957 units, becoming the best-selling B-segment sedan. This 39% sales growth compared to the previous month also propelled the Japanese sedan into the top-selling models across the entire market.

Notably, Honda City achieved this result without relying on promotional discounts from the manufacturer in April, unlike its two competitors. In contrast, Toyota Vios (773 units) and Hyundai Accent (568 units) both recorded negative growth, decreasing by approximately 26% and 46%, respectively.

Vios and Accent experience significant sales declines after both surpassing 1,000 units in sales in March.

This downward trend has narrowed the gap between Toyota Vios and Honda City in the B-segment sedan sales race to just 100 units. Cumulatively, for the first four months, these two Japanese models sold 3,058 and 2,958 units, respectively.

Meanwhile, Hyundai Accent’s cumulative sales reached 2,602 units, placing it in third place in the segment. In comparison to the same period in 2024, Accent led the B-segment sedan group with 3,096 units sold.

|

B-Segment Sedan Sales in Vietnam for the First Four Months of 2025 (Units)

|

|||

|

Model

|

March Sales

|

April Sales

|

Cumulative Sales (4 Months)

|

|

Toyota Vios |

1,041 |

773 (-25.7%) |

3,058 |

|

Honda City |

690 |

957 (+38.7%) |

2,958 |

|

Hyundai Accent |

1,049 |

568 (-45.9%) |

2,602 |

|

Mazda2 |

389 |

475 (+22.1%) |

1,496 |

|

Mitsubishi Attrage |

273 |

190 (-30.4%) |

571 |

|

Kia Soluto |

20 |

57 (+185%) |

120 |

The rankings of the remaining models in the B-segment sedan group remain unchanged. Following the trio of Vios, Accent, and City are Mazda2 with 1,496 units sold in the first four months, and Mitsubishi Attrage (571 units) and Kia Soluto (120 units) in the last two positions.

Overall, the sales race in the B-segment sedan category is divided into two halves, with one group comprising Vios, Accent, and City, and the other consisting of the remaining models. However, the common denominator in both groups is that Korean models are at a relative disadvantage compared to their Japanese counterparts.

In this affordable sedan segment, Korean cars are typically known for their competitive pricing, rich features, and a variety of options for customers to choose from. However, due to the limited number of Korean models participating in this segment, and as Japanese cars continue to evolve and become more affordable, the advantages of Korean cars seem to be diminishing.

Starting in May, all six representatives in the B-segment sedan group mentioned above will be offered with promotional discounts by their manufacturers to stimulate demand. This move promises to bring excitement to the segment, especially in the sales race among the top contenders: Toyota Vios, Hyundai Accent, and Honda City.

The Ultimate Segment-Leading Cars for 2024: Will VinFast VF 5 Make History? The Vios and Accent Battle Rages On.

The VinFast VF 5, Toyota Vios, and Mitsubishi Xpander are poised to be the new segment kings in 2024. With their impressive features and specifications, these models are set to dominate the automotive market and captivate drivers across the globe. Stay tuned to discover how these vehicles plan to revolutionize the industry and offer unparalleled experiences on the road.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)