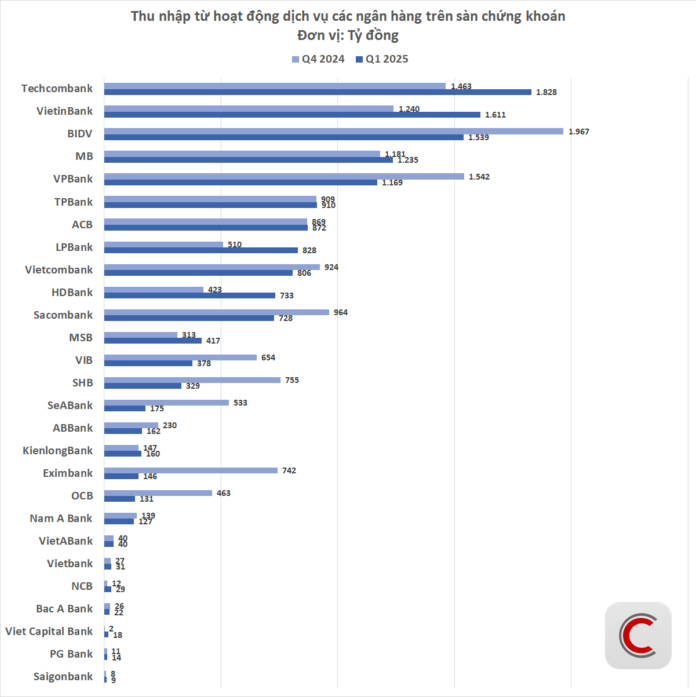

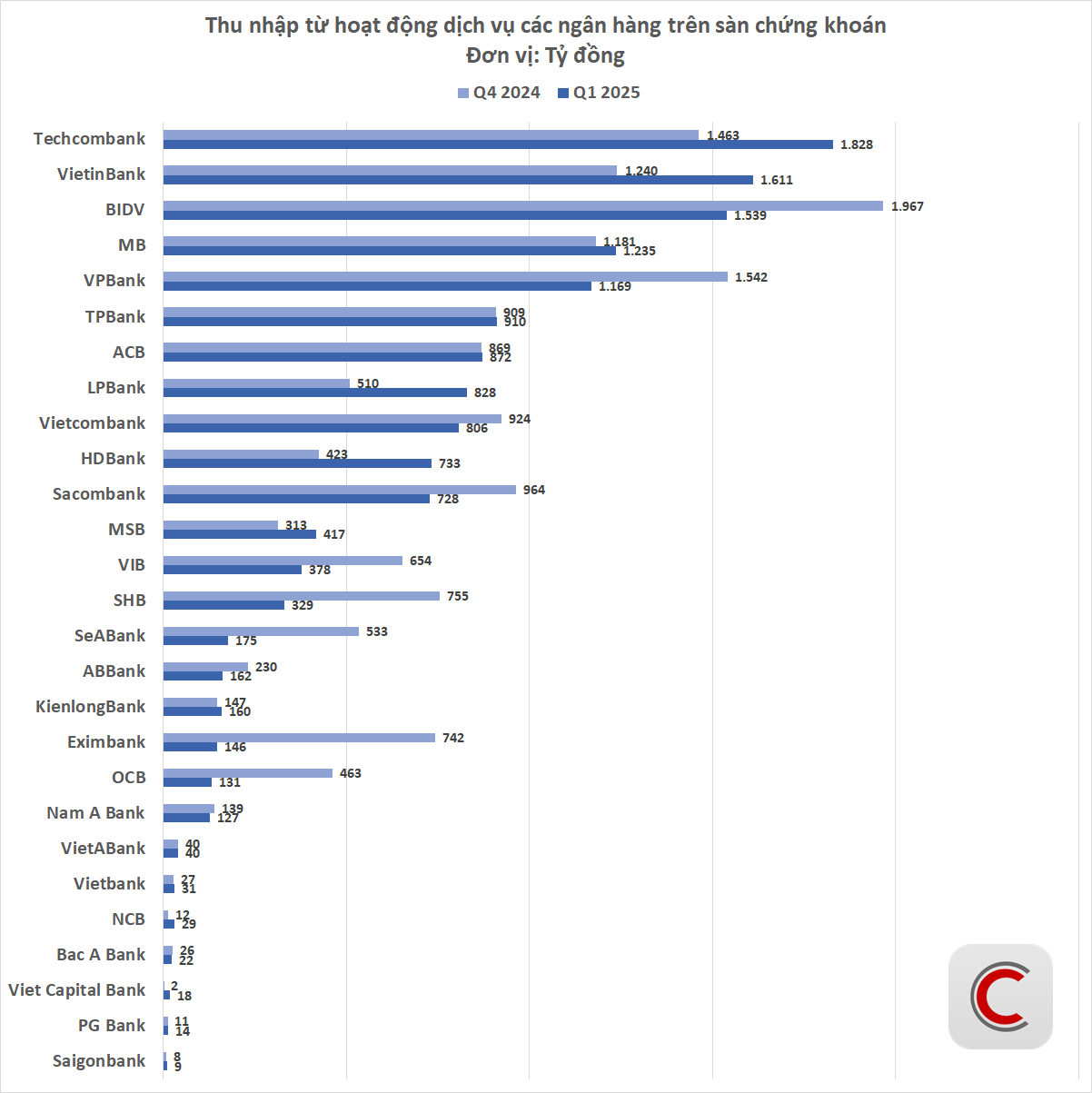

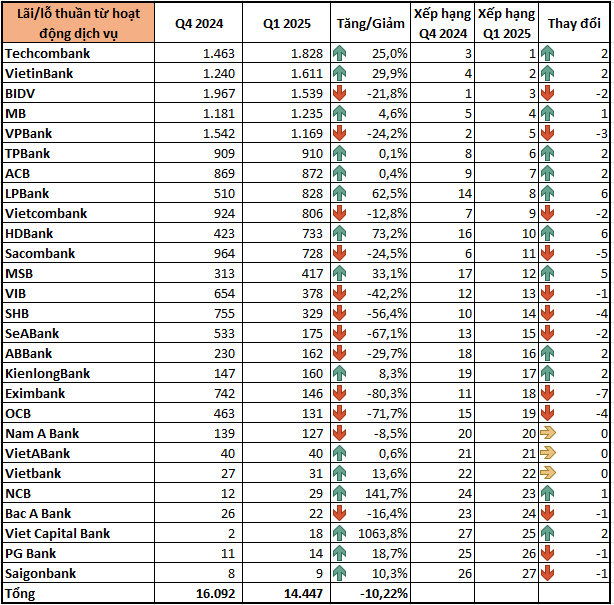

The Q1 2025 financial data from 27 banks revealed a total of VND 14,447 billion in net profit from services, a 10.2% decrease from Q4 2024. This decline was widespread, with up to 12 banks reporting downward results.

Typically, service income in banks tends to surge in the last quarter and dip in the following year’s first quarter. However, the modest increase in the last quarter of the previous year, followed by a year-over-year decline in Q1 2025, indicates a possible ‘downtrend’ in service-based revenue generation.

Among the top performers, Techcombank took the lead with a 25.0% increase in service profit, amounting to VND 1,828 billion, surpassing BIDV. VietinBank also exhibited impressive growth, with a 29.9% increase, reaching VND 1,611 billion and climbing two spots to second place. HDBank’s service profit surged by 73.2%, propelling it from 16th to 10th place in the rankings.

MB experienced a modest 4.6% increase, moving up one spot in the top group. Meanwhile, ACB and TPBank remained relatively stagnant.

Conversely, some industry giants witnessed significant declines. BIDV, despite leading in Q4 2024, dropped by 21.8%, falling to third place. VPBank suffered a 24.2% decrease, slipping three places to fifth position. Vietcombank, another prominent player, saw a 12.8% decline, landing in ninth place.

Several mid-sized and small banks also faced steep declines. Eximbank’s profit plunged by 80.3%, while SHB lost more than half of its service income compared to the previous quarter. OCB and SeABank both experienced declines of over 50%.

On the other hand, some smaller banks reported remarkable growth. Viet Capital Bank’s profit increased by almost tenfold, from VND 2 billion to VND 18 billion, while NCB’s profit surged by 141.7%, from VND 12 billion to VND 29 billion.

Service income plays a crucial role in banks’ profit structure, especially amid slow credit growth and pressure to reduce interest rates. It not only diversifies revenue streams but also reduces reliance on traditional net interest margins.

Popular services include payment, insurance, foreign exchange, and asset management. These revenue streams hold significant growth potential, particularly with the rising demand for digitalization and financial services among individuals and enterprises.

Ha My

The Weakening Dollar: Why Are Exchange Rates Still Rising?

Despite a slight dip in the USD-Index since the beginning of the year due to expectations of a Federal Reserve rate cut in 2025, the USD/VND exchange rate has paradoxically risen. This intricate paradox reflects the multifaceted and complex nature of Vietnam’s current foreign exchange market.

A Garment Business Prioritizes Salary Expenses, Reducing Over 900 Employees After 18 Years

Once boasting a workforce of nearly 1,100 employees at its privatization, Thanh Tri Garment JSC now has fewer than 150 staff members. The company has recently adjusted its plans for the use of proceeds from a private placement, opting to allocate funds towards paying salaries for the third quarter of 2025 instead of upgrading its factory as initially intended.

The VN-Index Ticks Up 4%, But a Plethora of Stocks Soar Even Higher Since the Start of the Year, Including Billion-Dollar Market Cap Giants

Although the VN-Index has risen by less than 4% since the beginning of the year, many stocks have witnessed a remarkable surge, outperforming the index with substantial gains, and even doubling in value.