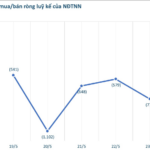

Vietnam’s stock market witnessed a relatively volatile trading session on the final trading day of the week. The VN-Index closed slightly higher, gaining 0.62 points to end at 1,314.46. Against this backdrop, foreign investors offloaded a net amount of over VND 199 billion across all markets.

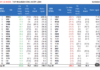

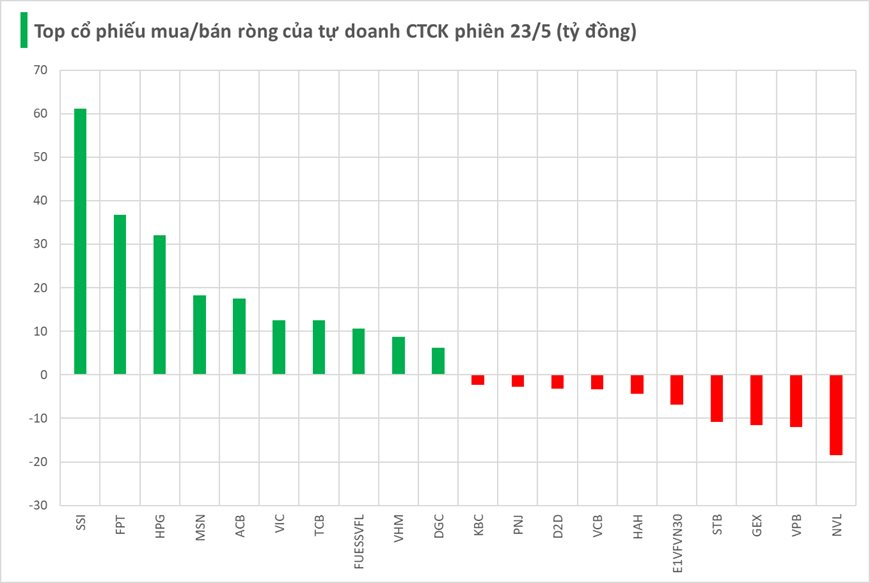

Proprietary trading by securities companies resulted in net buying of VND 188 billion on the HoSE.

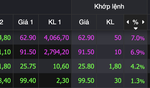

Specifically, SSI and FPT Securities were the most actively bought securities by proprietary trading arms, with respective net purchases of VND 61 billion and VND 37 billion. HPG shares were also net bought to the tune of VND 32 billion. Other stocks that saw net buying included MSN, ACB, VIC, and TCB.

On the other hand, NVL witnessed the strongest net selling by securities companies, offloading VND 18 billion worth of shares. This was followed by VPB and GEX, which saw net selling of approximately VND 12 billion each. E1VFVN30, STB, HAH, and VCB were among the other stocks that experienced net selling during today’s session.

“FPTS Boosts Charter Capital to VND 3,365 Billion After Bonus Share Issuance”

On May 15th, FPTS successfully issued 30.59 million bonus shares to its 18,105 shareholders, thereby increasing its charter capital to VND 3,365 billion.

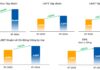

The Billionaire’s Assets Surge to Unprecedented Heights

“Vingroup’s stock surge: VHM and VIC soar to new heights. In a thrilling rally, Vingroup’s stocks witnessed a substantial surge with VHM and VIC reaching their peak. This exhilarating performance has propelled billionaire Pham Nhat Vuong’s net worth to a record-breaking $10.2 billion, according to the latest updates from Forbes.”