Services

|

Miza’s 2025 Annual General Meeting was held in Hanoi on the morning of May 26th

|

The event marked an important milestone in Miza’s transformation into a public company, underscoring its commitment to transparent governance and enhanced engagement with the investment community. The meeting took place as the company reported positive results in its 2024 operations and embarked on an acceleration phase with large-scale strategic projects.

Miza’s 2025 Annual General Meeting was held in Hanoi on the morning of April 26th

|

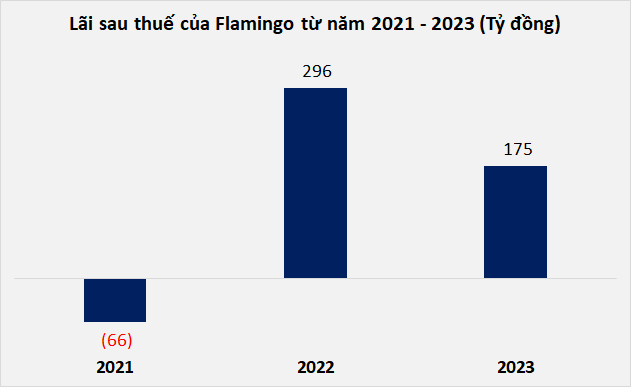

MZG had a relatively impressive performance in 2024. Revenue exceeded VND 4,440 billion, a nearly 31% increase compared to 2023; and after-tax profit reached nearly VND 73 billion, a growth of over 14%.

Notably, MZG completed a 6% stock dividend payout, increasing its charter capital from VND 999 billion to VND 1,059 billion. Additionally, the company continued to execute its key project, PM5 Phase 2 at the Miza Nghi Son factory, aiming to boost total packaging paper capacity to 220,000 tons per year. The charter capital of Miza Nghi Son Company was also raised to VND 1,021 billion. Furthermore, Miza proceeded with its ESG report, expected to be finalized in 2025.

During the meeting, the Board of Directors of Miza Joint Stock Company unveiled impressive growth plans. Specifically, the revenue target for 2025 is approximately VND 4,800 billion, a 9.1% increase compared to 2024; and the after-tax profit plan is about VND 90 billion, reflecting a growth of over 23.9%.

For the first quarter of 2025, MZG recorded nearly VND 276 billion in net revenue, a 2% increase year-over-year. Gross profit reached VND 16 billion, a rise of over 14%. After-tax profit surpassed VND 15 billion.

According to Miza’s leadership, 2025 is a pivotal year for acceleration and breakthrough toward sustainable development, expansion, and deeper integration into the global supply chain. As a result, the Board has set several crucial orientations and goals.

|

First is optimizing production and product structure by maximizing the operational efficiency of recycled paper production lines, especially for high-value-added products like Testliner, Kraft, and Medium, meeting domestic and export market standards. The product mix will be adjusted flexibly based on actual demand fluctuations to ensure business efficiency and competitive advantage.

Next is maintaining a stable growth trajectory in revenue and profits while formulating a dividend policy that balances sustainable development goals and shareholder interests, taking into account business performance and financial capacity at the time of settlement.

Significantly, MZG considers 2025 a crucial year to finalize and operationalize Phase 2 of the PM5 project at the Miza Nghi Son factory. Additionally, the company is initiating the construction and infrastructure development of the Miza Nghi Son Industrial Park, spanning over 200 hectares, with a total investment of approximately VND 1,200 billion. The necessary legal procedures are expected to be carried out in 2025. The second phase of the PM5 Miza Nghi Son project will encompass equipment installation, process optimization, and capacity testing.

“This is one of our key strategic projects aimed at boosting total packaging paper capacity to 220,000 tons per year. It will serve as a pivotal driver, contributing to expanded production, increased revenue, and strengthened competitive position in the coming years,” the company representative stated.

Moreover, MZG demonstrates ambitious vision. From 2025 to 2030, following the completion of PM5, MZG will initiate and finalize PM6 and PM7. The company targets an average profit growth rate of over 20% per year and aspires to evolve from a leading company in Northern Vietnam to a top player in the national paper industry.

Another noteworthy aspect is MZG’s proposal to offer existing shares in 2025. The planned volume exceeds 10 million shares, priced at VND 10,000 per share. The proceeds (VND 105 billion) will be utilized to repay medium and long-term loan balances. Disbursement is anticipated from the fourth quarter of 2025.

The meeting concluded with the approval of all proposals.

– 11:30 26/05/2025

The Great Dismantling: Initiating the Enclosure Project with a Shark’s Tooth

On May 25, Hoan Kiem District commenced safety measures, including the dismantling and relocation of equipment and the deconstruction of the Ham Ca Map (Shark Mouth) structure on Dinh Tien Hoang Street. These tasks are expected to be completed by June 2025.