BIDV Securities (BSC, code: BSI) recently announced that it has received approval from the State Securities Commission (SSC) for its stock dividend issuance.

June 12 has been set as the record date for BSC to finalize the list of shareholders eligible for a 10:1 stock dividend (for every 10 shares held, shareholders will receive 1 new share), resulting in the issuance of over 22.3 million new shares. The capital source for this issuance will come from undistributed post-tax profits as per the audited 2024 financial statements.

Through this stock dividend, BSC aims to bolster its capital adequacy ratio and strengthen its balance sheet. The company’s registered capital is expected to increase by over VND 223 billion, reaching nearly VND 2,454 billion. This move is designed to enhance their competitive position and support future growth strategies.

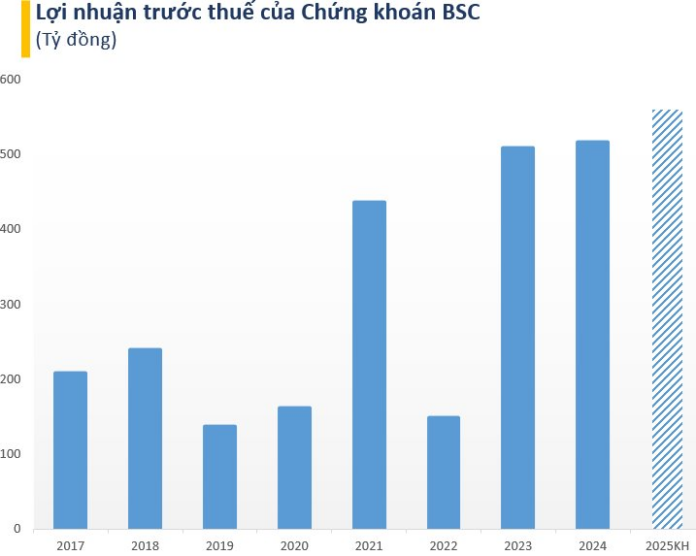

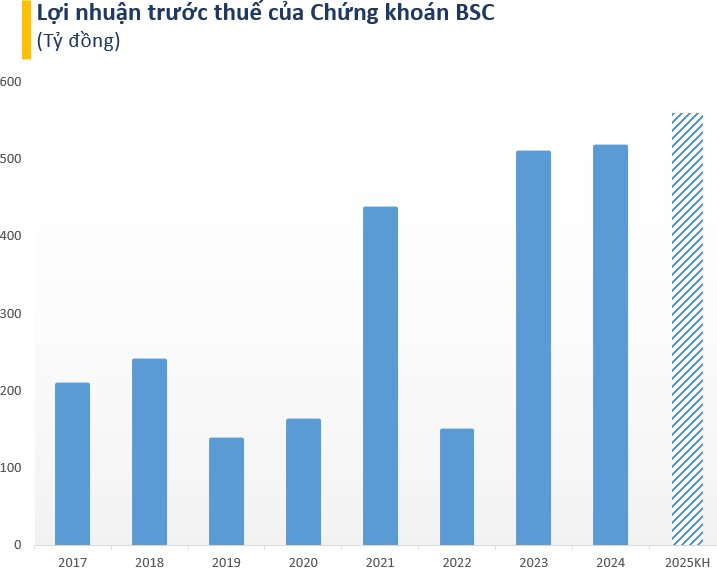

This stock dividend issuance was approved by shareholders during the 2025 Annual General Meeting. Additionally, BSC has set ambitious business targets for 2025, aiming for a 9% increase in pre-tax profits to VND 560 billion. The company also strives to maintain a healthy capital adequacy ratio of over 260%.

BSC’s management is optimistic about the prospects for the securities industry this year, citing positive factors such as macroeconomic recovery and low-interest rates, which are expected to attract more capital into the stock market. The anticipated market upgrade and ongoing “institutional, human resources, and structural revolution” are also seen as catalysts for economic growth and enhanced stock market attractiveness.

Looking at BSC’s Q1 2025 financial performance, operating revenue stood at VND 337 billion, a slight decrease of 4% compared to the same period last year. However, post-tax profit witnessed a significant drop of 41% year-on-year, amounting to VND 81 billion. This decline was attributed to a surge in operating expenses, which rose by 47% to VND 139 billion, mainly due to losses on financial assets measured at fair value through profit or loss.

The New Issue of Nearly 1.3 Billion Shares as Dividend Payment by Hoa Phat Has Taken a New Turn

With approximately 6.4 billion shares currently in circulation, Hoa Phat Group is set to release an additional 1.28 billion new shares, equating to a nominal issuance value of VND 12,793 billion.

The Ultimate Guide to Investing in Thuduc House (TDH) Stock: Unveiling the Secret Behind the Astonishing 102% Surge

“Thuduc House’s TDH stock has been on a remarkable rally, surging over 102% since the beginning of April, marking one of the most impressive performances in the stock market during this period.”