Gold experts attribute the rise in gold prices to a weakening US dollar and investors seeking safe-haven assets as US President Donald Trump made a series of new tariff threats. With the volatile movement of global gold prices, many wonder how domestic gold prices will change and whether investors should buy or sell.

How will domestic gold prices fluctuate?

Mr. Nguyen Quang Huy, CEO of Finance – Banking, Nguyen Trai University, told VTC News that US President Donald Trump’s declaration of a 50% import tariff on European goods from June 1st if negotiations do not progress has added a layer of geopolitical and trade tension to the global financial system.

Global gold prices are expected to continue rising. (Illustrative image)

“If this happens, the EU will have to retaliate, disrupting global supply chains and creating a new inflation-recession spiral. The Russia-Ukraine conflict, Middle East tensions, and other factors are all ‘open barrels of gunpowder,’ making gold the ultimate safe-haven asset, driving its price higher,” Mr. Nguyen Quang Huy stated.

Dr. Nguyen Tri Hieu explained that the US and China have met and shown signs of de-escalation in their trade war, but there are still indications of instability.

“Therefore, the gold market remains volatile, and investors are unsure of where the US-China relationship will eventually settle. Will it be at 115%, or will we enter phase two of the trade war? As a result, global gold prices fluctuate, and so do domestic prices,” Dr. Hieu said.

Regarding gold price movements in the coming days, expert Nguyen Tri Hieu predicted that prices could remain at the 120 million VND/tael mark.

“I believe that global gold prices will soon return to the level of more than $3,400/ounce, while domestic gold prices could peak at 125 million VND/tael,” Dr. Nguyen Tri Hieu stated.

Should investors buy or sell gold?

Mr. Nguyen Quang Huy advised that, in the short term, investors should be cautious about “chasing” the peak of gold prices and refrain from investing at this time due to the abnormal volatility of gold prices.

Experts forecast a continued rise in gold prices next week. (Illustrative image)

“In particular, investors should avoid buying SJC gold if the buy-sell spread exceeds 2 million VND/tael. Over the medium term (6-12 months), investors can allocate capital to gold as it enters a long-term upward cycle,” Mr. Huy said.

Regarding whether investors should buy or sell at this point, expert Nguyen Tri Hieu stated that this is a difficult question as determining the right time to buy or sell depends on identifying the peak and bottom of the market.

“If gold prices continue to rise, investors should consider selling. However, the gold market is highly volatile, and I believe that at the current level, gold prices have not peaked. Therefore, in the near future, gold prices will continue to rise and set new records,” Dr. Hieu commented.

Dr. Hieu also emphasized that whether buying or selling at this point, investors need to adhere to financial discipline. Firstly, they must define their profit plan and determine the percentage return they aim to achieve from investing in gold, be it 20%, 30%, or 40%.

“Calculate from the time of purchasing gold to the time of selling it. If you reach your targeted profit margin, sell. Those considering investing in gold should also have a profit goal and base their decisions on forecasts to make informed choices about whether to invest. Following the herd mentality, buying gold when prices are rising, and seeing others buy it as well, may lead to hasty decisions. Thus, it’s essential to have a personal strategy rather than merely following the market,” Dr. Nguyen Tri Hieu advised.

Analysts attribute the surge in gold prices not only to trade tensions but also to a host of other macroeconomic uncertainties, including Moody’s downgrade of US government bond ratings, mounting budget pressures, and the less-than-positive outlook for international trade negotiations.

Kitco’s gold price forecast survey for the coming week also reflected a positive sentiment: 81% of experts expected gold prices to continue climbing, while over 63% of individual investors predicted an upward trend.

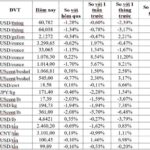

At the opening of the trading session on May 24th, Saigon Jewelry Company (SJC) listed the selling price of SJC gold bars at 121.5 million VND/tael, a rise of 1 million VND/tael compared to the previous day’s close.

However, less than half an hour later, SJC adjusted the gold price downward. The selling price of each SJC gold bar decreased by 500,000 VND to 121 million VND. The buying price of SJC gold bars was set at 119 million VND/tael. The buy-sell spread was 2 million VND/tael.

SJC also traded smooth gold rings at a selling price of 116 million VND/tael and a buying price of 113.5 million VND/tael.

Phu Nhuan Jewelry Company (PNJ) sold SJC gold bars at 121 million VND/tael and bought them at 119 million VND/tael.

During the past week, SJC gold bar prices fluctuated but generally maintained an upward trend. Compared to the beginning of the week, the selling price of each SJC gold bar increased by nearly 2 million VND, while the buying price rose by over 2 million VND/tael.

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

“Global Markets on May 22nd: Oil Prices Continue to Fall, Gold Reaches a One-Week High”

As of the market close on May 21st, oil, natural gas, and rubber prices took a dip, while precious metals shone brightly. Gold reached a one-week high, platinum soared to a year-long peak, and palladium climbed to its highest point in over six months.

The Market on May 23: Oil, Natural Gas, Gold, Copper, and Coffee Prices All Decline

As of May 24, 2025, the commodities market witnessed a broad decline with oil, natural gas, gold, and coffee prices all trending downward. The drop was significant enough to push the value of certain commodities to multi-week lows: copper hit its lowest point in three weeks, lead touched a two-week trough, and Indian rice futures plunged to their weakest level in nearly two years.