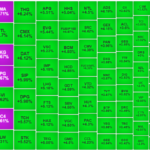

The market witnessed a massive swing of nearly 44 points in a single session. The breadth was impressive, with 253 advancing stocks against only 72 declining ones. No sector was left behind, with real estate continuing to take the lead as VHM surged by 6.83%, notably supported by the impressive recovery of industrial real estate stocks. SZC hit the upper limit, SIP rose by 5.99%, BCM advanced by 4.93%, and KBC gained 3.02%. VHM alone contributed 4.47 points to the overall index.

Sectors related to import and export, such as garment, seafood, and logistics, witnessed a strong recovery. The garment sector saw multiple stocks hitting the ceiling, including VGT, MSH, TCM, TNG, and GIL. The seafood industry was not far behind, with VHC, ANV, ASM, FMC, and IDI soaring high. Rubber stocks also shone, with PHR, DPR, and GVR turning purple.

The port and logistics sector rose by 2.68%, with GMD up by 4.5%, VSC by 5.23%, and SGP by 5.06%. Other sectors, including banking, securities, information technology, telecommunications, and construction, also showed positive momentum.

Investor sentiment was highly positive, as the market anticipated a more relaxed tariff rate from the US. However, as this expectation was based on unconfirmed information, it could lead to a sudden sell-off once the actual details are revealed. Therefore, it is advisable to refrain from chasing purchases until the tariff-related information is clarified.

The total matched transaction value on the three exchanges reached VND 25,000 billion, with net foreign selling at an insignificant level of VND 59.6 billion. Specifically, for matched transactions, they were net sellers at VND 2.2 billion. Foreign investors’ main net-buying by matched transactions focused on the real estate and chemicals sectors, including stocks such as VHM, VSC, DIG, IMP, VPB, KBC, GVR, NLG, VHC, and BVH. On the selling side, they net sold stocks in the financial services sector, mainly VIX, VCG, GEX, HPG, FPT, VRE, DXG, FRT, and STB.

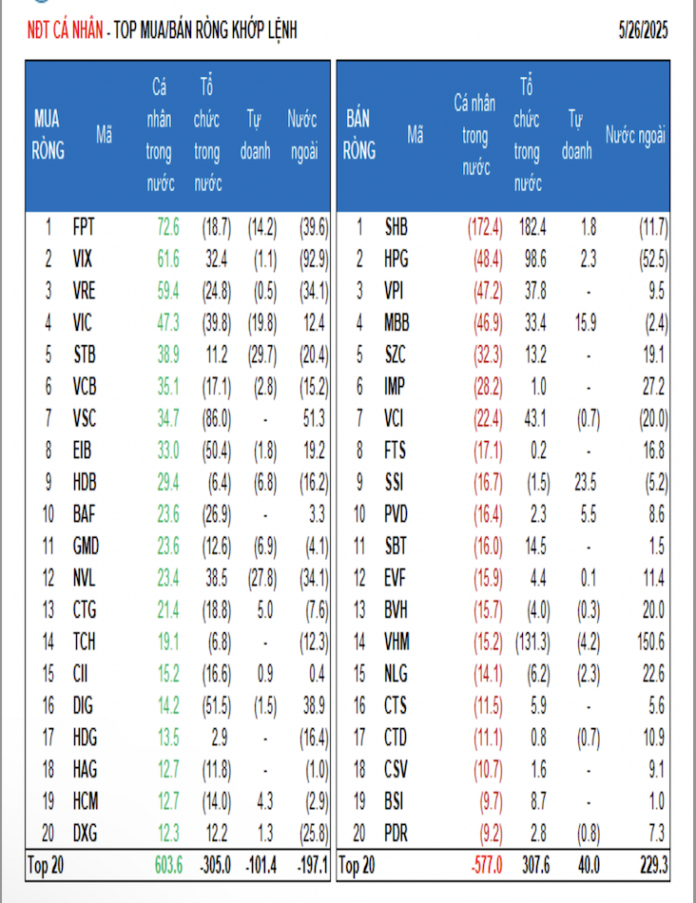

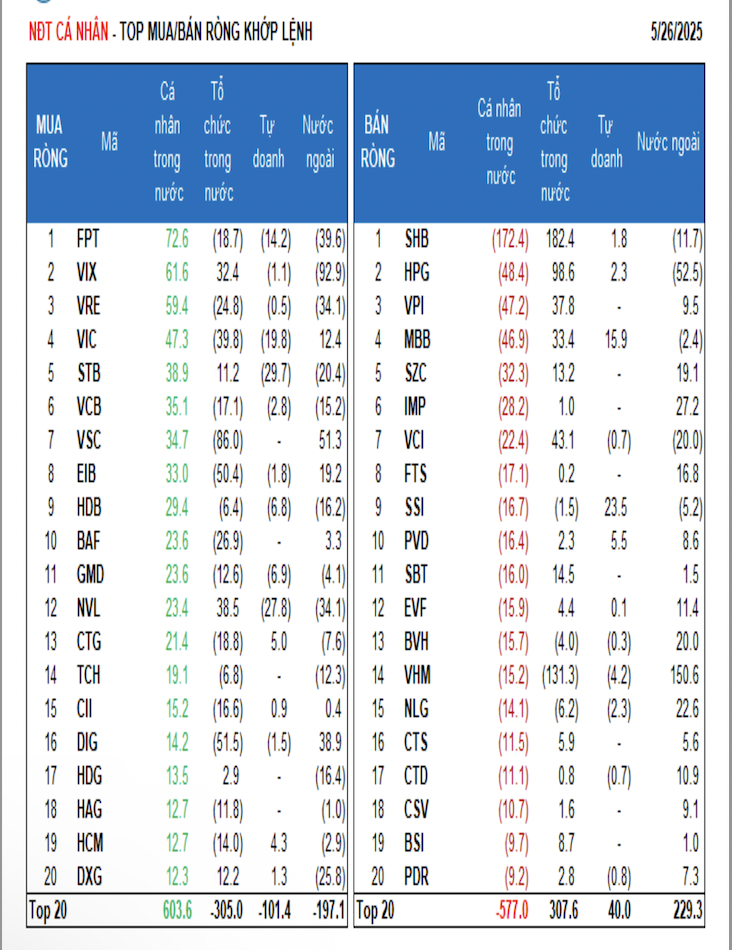

Individual investors net bought VND 123.2 billion, of which VND 99.5 billion was from matched transactions. For matched transactions, they net bought 9 out of 18 sectors, mainly in the Industrial Goods & Services sector. Their top net buys included FPT, VIX, VRE, VIC, STB, VCB, VSC, EIB, HDB, and BAF. On the net-selling side, they sold 9 out of 18 sectors, mainly focusing on the Basic Resources and Banking sectors. The top net sells were SHB, HPG, VPI, MBB, SZC, IMP, FTS, SSI, and PVD.

Proprietary trading net sold VND 231.0 billion, of which VND 82.2 billion was from matched transactions. For matched transactions, proprietary trading net bought 7 out of 18 sectors, with the highest value in the Financial Services, Construction & Materials, and Real Estate sectors. The top net buys by matched transactions were SSI, MBB, MSN, FUEVFVND, PVD, VCG, DPM, CTG, HCM, and PC1. The top net sells were in the Real Estate sector, including STB, NVL, VIC, FPT, VPB, PNJ, LPB, GMD, HDB, and GEX.

Domestic institutions net bought VND 142.8 billion, while they net sold VND 15.1 billion for matched transactions.

For matched transactions, domestic institutions net sold 11 out of 18 sectors, with the highest value in the Real Estate sector. The top net sells were VHM, VSC, DIG, EIB, VIC, GVR, BAF, VRE, VHC, and KBC. On the buying side, they net bought mainly in the Banking sector, including SHB, HPG, GEX, VCG, VCI, NVL, VPI, MBB, VIX, and FRT.

Today’s matched and negotiated transaction value reached VND 1,880.0 billion, down 14.6% from the previous session and contributing 7.5% of the total transaction value. Notably, there were large-value negotiated transactions between individual investors, with over 8.7 million MSN shares (worth VND 550.7 billion) and over 8.5 million TCB shares (worth VND 264.9 billion) changing hands.

The money flow allocation ratio increased in Real Estate, Banking, Construction, Steel, Warehouse, Logistics & Maintenance, Water Transport, Textile & Garment, Plastics, Rubber & Fibers, while it decreased in Securities, Chemicals, Food & Beverage, Retail, Electrical Equipment, Software & IT Services, Building Materials & Interiors, and Airlines.

For matched transactions, the money flow allocation ratio increased in the mid-cap VNMID and small-cap VNSML groups, while it decreased in the large-cap VN30 group.

“Empowering Excellence: Minister Nguyễn Văn Thắng Advocates for Autonomy in High-Performing Sectors”

The Ministry of Finance is actively seeking feedback on draft decrees and circulars aimed at decentralizing financial authority. With input from all 63 provinces and cities, specific proposals have been put forward to ensure effective and synchronized implementation.

Stock Market Blog: Flash Crash Stimulates Bottom-Fishing?

Today’s market movement was characterized by a swift crash that occurred within a 2-minute window around 9:30 am in the derivatives market. It took the underlying market a good 5 minutes to react strongly to this development. Over 11,200 contracts changed hands during this intense 2-minute period, marking a significant turning point in the day’s events.

“Market Movers: Navigating the Volatile Terrain”

The VN-Index staged a surprising turnaround, surging higher at the end of the trading session after a shaky start. This bullish sentiment was further validated by the trading volume, which surpassed the 20-day average, indicating a significant influx of capital.